Table of Contents

- What is Nifty 100?

- Which are the Top 5 Stocks in Nifty?

- The Structure Behind Nifty 100

- How to Invest in Nifty 100 Stocks?

- Is Nifty 100 a Good Investment?

- How is the Nifty 100 Calculated?

- Nifty 100 vs Other Major Indices

- Risk of Investing in Nifty 100 Stocks

- Factors to Consider When Investing in Nifty 100 Stocks

- Conclusion

Did you know Nifty 100 is not just a snapshot of the 100 largest companies, but it holds 77% market capitalization of NSE (National Stock Exchange) as of July 2025? Yes, you heard it right.

This means that Nifty 100 gives your investments an exposure to the majority of the equity markets of India and that too with a single investment. Additionally, it introduces you to the market leaders like Reliance Industries and Tata Consultancy Services, who are innovators in their respective fields.

So, are you ready to know what is nifty 100 and how its strong and new ideas can help your investments last? You will also come across the Nifty 100 stock list, so keep scrolling down to learn.

What is Nifty 100?

The Nifty 100 is an index or benchmark used in the stock market to measure the performance metrics of companies based on their market capitalization. It represents the top 100 companies listed under National Stock Exchange (NSE) from Nifty 500. Representing a major sector of the Indian economy, it is a broad-based index.

NSE Indices Limited owns and manages Nifty 100. The index is widely used by investors who want to check their portfolio against the benchmark, launch index Mutual Funds and understand market trends. This index provides a broader exposure as compared to Nifty 50 by adding mid-cap stocks.

The Nifty 100 Index fund is a mutual fund that tracks and replicates the performance of the index. Through this mutual fund, investors can access the large stocks with the most liquidity across various major sectors through one portfolio.

The Nifty 100 index is also used in the launch of index funds and exchange-traded funds (ETFs) by the asset management companies (AMCs). In other words, the Nifty 100 index acts as a tool that is used to analyse the overall market trends and investor sentiments.

Now that we understand the index, let us look at the top companies that drive its performance.

Which are the Top 5 Stocks in Nifty?

The Nifty 100 stock list consists of 100 companies that are listed under NSE and are included within Nifty 500. The top 5 stocks listed under Nifty 100 are listed below:

| Stocks | Market Cap (Rs) | 1 Year Return (%) | Return on Equity (%) |

|---|---|---|---|

| Reliance Industries Ltd | 19,11,867.73 | -5.86 | 7.94 |

| HDFC Bank Ltd | 15,39,023.52 | 22.19 | 14.05 |

| Tata Consultancy Services (TCS) Ltd | 11,43,170.93 | -26.30 | 51.90 |

| Bharti Airtel Ltd | 11,43,101.70 | 30.12 | 25.91 |

| ICICI Bank Ltd | 10,51,146.82 | 18.73 | 18.02 |

These stocks are part of a well-structured index, so let us explore how the structure of Nifty 100 is built.

Must Read: What Is Nifty? Here Is An Easy Way To Understand It

The Structure Behind Nifty 100

The Nifty 100 index is not just a random list of 100 companies. The construction of the Nifty 100 index involves a whole procedure. The structure of this index is designed to ensure huge market representation, stability and investment quality.

The Nifty 100 index is constructed by combining two indices:

- The Nifty 50 (includes top 50 companies)

- The Nifty Next 50 (includes companies ranked 51 to 100)

The Nifty 100 index company's eligibility criteria:

- Must Rank among the top 100 in Nifty 500.

- Must meet the requirements (liquidity, trading frequency and corporate governance).

- Show financial stability and justified business operations.

The Nifty 100 index sector allocation:

- Financial Services: 35-40% (banking, insurance, NBFCs).

- Information Technology: 15-20% (software services, IT consulting).

- Consumer Goods: 10-15% (FMCG, durables, retail).

- Energy: 8-12% (oil & gas, renewable energy).

- Healthcare: 6-10% (pharmaceuticals, hospitals).

- Materials: 5-8% (metals, chemicals, construction).

- Others: 10-15% (telecom, automobiles, utilities),

The index uses a free-float market capitalization weighting system, which means it does not consider the entire market value of the company; the index only involves the shares that are traded publicly.

Also Read: SIP Or Lump Sum: Which Is Better For You In 2025

Knowing how the index is structured is useful, but the question is,” How do you actually invest in Nifty 100?” You will know in the next part.

How to Invest in Nifty 100 Stocks?

You can only invest in Nifty 100 through an investment vehicle that tracks the index. There are two methods for investing in Nifty 100 stocks:

Direct or Manual Approach

In manual stock selection, you can manually buy all 100 stocks in the same proportion, which may not be possible for most investors due to the cost, complexity of execution and regular rebalancing.

Indirect Approach

In this, you can invest through index funds or ETFs that use Nifty 100 as a benchmark.

- In Index mutual funds, you can invest directly or start SIPand invest through a systematic approach.

- In ETFs, you can invest by exchanging stocks. It gives you flexibility of buying and selling stocks in real time.

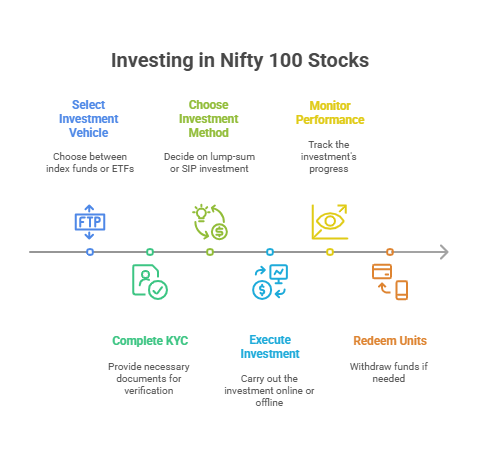

To invest in Nifty 100 through index mutual funds and ETFs, you can follow the described process:

- Step 1: Select a Nifty 100 index fund or ETF from a trusted AMC.

- Step 2: Complete your KYC and provide all the essential documents.

- Step 3: Select an investment method, lumpsum or SIP.

- Step 4: Execute your investment through an online (website or app) or offline (distributor) process, suitable for you.

- Step 5: Monitor your investment performance through an AMC portal.

- Step 6: If needed, you can redeem your units (online or offline) in part or fully with no exit loads for most of the funds.

Pro Tip: Use a SIP calculator to visualize your investment growth and set goals.

Now, let us see why Nifty 100 could be a smart investment for your long-term goals.

Is Nifty 100 a Good Investment?

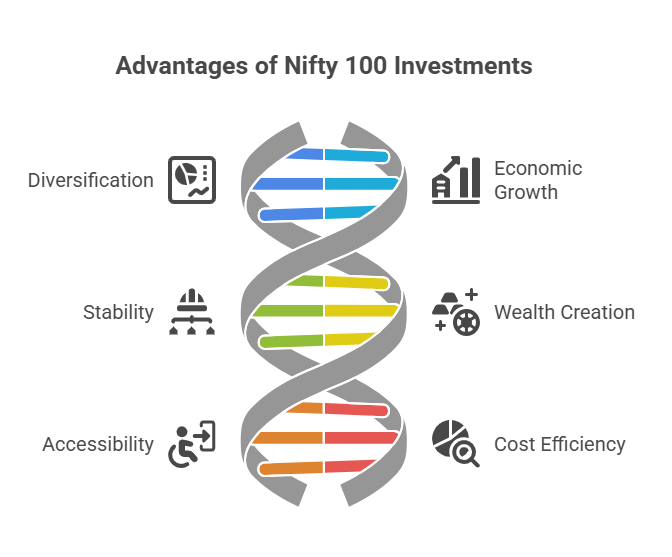

The Nifty 100 investments offer a wide range of advantages that make it a good investment opportunity, including:

-

Diversification

The Nifty 100 stock list provides investors access to multiple sectors and companies within the large-cap stocks of the Indian stock market.

-

Economic Growth

The Nifty 100 investments allow you to invest in the leading companies of India and increase their growth, which ultimately leads to the growth of the Indian economy.

-

Less Risky and Stable

The Niifty 100 generally invests in large-cap stocks, which generate stable returns with a lower risk level as compared to small and mid caps.

-

Long-term Wealth Creation

The funds under Nifty 100 are highly suitable for building long-term wealth. With a strong track record, they give long-term returns.

-

Accessibility and Transparency

By investing in the Nifty 100 index through index mutual funds and ETFs, it is easy to access index constituents and strategy, providing transparency in the investments.

-

Cost Efficiency

The Nifty 100 index funds and ETFs generally have a low expense ratio as compared to the other actively managed funds, maximizing long-term returns.

After getting a thorough understanding of the importance of Nifty 100, you will come to know how the index is calculated.

How is the Nifty 100 Calculated?

The Nifty 100 index is calculated by using the free-float market capitalization weighting method.

The free-float market capitalization is calculated by using the following formula:

Index Value = (Current Free-Float Market Capitalisation / Base Market Capitalisation) × Base Index Value

Where:

- Current Free-Float Market Capitalisation is the sum of the market values of all Nifty 100

- Base Market Capitalisation is the market value during the base period.

- Base Index Value is a standard number set when the index was created (usually 1,000).

Index Value: It represents the total fee-float market value of all stocks that are involved in the index related to the base market capitalization.

This calculation is done to make sure that the market value fluctuations are reflected in the changes of the Nifty 100 share list.

To gain more clarity on the Nifty 100 index, let us compare it with other major stock indices in India.

Nifty 100 vs Other Major Indices

Given below is a comparison of the Nifty 100 index with other major indices:

| Index | No. of Stocks | Market Cap Segment | Risk/Volatility | Diversification | Annual Returns |

|---|---|---|---|---|---|

| Nifty 100 | 100 | Large Cap (Top 100) | Moderate-Low | High—top 100 companies | 12.3% |

| Nifty 50 | 50 | Large Cap (Top 50) | Moderate | Moderate—top 50 companies | 12% |

| Nifty Next 50 | 50 | Large Cap (Ranks 51–100) | High | Moderate-high | 14.2% |

| Sensex (BSE 30) | 30 | Large Cap (Top 30, BSE) | Low-Moderate | Lower—top 30 only | 12–13% |

| Nifty 500 | 500 | Large, Mid & Small Cap | High | Max—entire market slice | Slightly higher in bull cycles |

| Nifty Midcap 100 | 100 | Mid Cap | High | Moderate | 30.5% (5Y CAGR) |

While it is useful, investing in Nifty 100 also comes with certain risks to be aware of. Let us see what we need to take care of.

Risk of Investing in Nifty 100 Stocks

The investments in the Nifty 100 stock list carry market risks and are liable to factors that impact the equity markets. The risks involved are:

- Market Volatility: As an equity investment, the investment values of Nifty 100 can fluctuate when the market changes.

- Market-cap Bias: The index performance is highly focused on large cap investments, which limits the diversification benefits.

- Distinct Sector Exposure: The index is mainly influenced by a certain sector, bringing investors closer to the sector-specific risks.

- Lack of Flexibility: The index funds tracking Nifty 100 only reflect it and may not be able to adjust according to the market conditions.

- External Factors: The Nifty 100 can be affected by changes in factors like interest rates, inflation, government policies and political events.

- Internal Factors: The issues related to the specific company within the Nifty 100 can also impact the index value.

Factors to Consider When Investing in Nifty 100 Stocks

Several factors are considered for an investor if they want to invest in the Nifty 100 stock list and these are:

-

Investment Goals

Align your investment goals and investment horizon with the stocks before investment.

-

Risk Profile

Compare your risk tolerance with the risk level associated with the stocks.

-

Economic Factors

Changes in economic factors like GDP growth, inflation and interest rates can affect investment growth.

-

Portfolio Diversification

Consider diversifying your portfolio across various sectors to mitigate risks associated with a single sector.

-

Market Research

Do time-to-time research and stay updated on market trends and changing conditions.

After comparing it with other key indices, you must get an understanding of why Nifty 100 could be a valuable addition to your investment strategy. So, let us wrap up the things.

Conclusion

In short, the Nifty 100 index lets you invest in the largest and most liquid companies of India in diverse sectors of the stock market. With its strategy of diversification, low risk profile and potential for long-term wealth creation, it offers compelling growth in your portfolios.

Nifty 100 gives a broad market coverage through its structured construction and involves both Nifty 50 and Nifty Next 50 indices. If you want to capitalize on India's economic growth, you can invest through Nifty 100 index funds and ETFs.

Related Blog: BSE or NSE: Which Is Better For Beginners?

FAQs

-

What is the NIFTY 100 Index?

The Nifty 100 is a stock market index that falls under NSE and tracks the top 100 large cap companies in India according to their market cap.

-

What is Nifty 100 Index fund?

It is an ETF or mutual fund that mimics the Nifty 100 index and offers diversification and exposure to the top 100 companies of India.

-

How do I invest in Nifty 100?

You can invest online or offline using Nifty 100 index mutual funds or ETFs through a lump sum or SIP investment.

-

Does Nifty 100 include Nifty 50?

Yes, the Nifty 100 is made up of the Nifty 50 stocks and includes the next 50 large companies (Nifty Next 50).

-

How many stocks are in Nifty Midcap 100?

There are precisely 100 mid cap stocks or companies that are included in the Nifty Midcap 100 index.

.webp&w=3840&q=75)