Table of Contents

- What is Life Insurance?

- What is Term Insurance?

- Difference Between Term Insurance and Life Insurance

- Term Insurance vs Life Insurance: Who Should Choose What?

- Benefits of Choosing Term Insurance vs Life Insurance?

- Factors to Consider Before Buying Term Insurance vs Life Insurance

- Tax Benefits and Legal Implications of Term Insurance vs Life Insurance

- Common Misconceptions about Term and Life Insurance

- Conclusion

Today, in modern society, everyone understands the value of insurance, whether it is for your car, your home or your life. Insurance has become a crucial part of financial planning, offering peace of mind and protection against unexpected risks. But everyone is confused between two options: Term Insurance vs Life Insurance. Not knowing the real difference makes it worse.

Breaking it down simply, term insurance offers coverage for a specific time period with lower premiums, while life insurance provides lifelong coverage with some savings or investment benefits. But still, the question is, both have their own benefits, so which one is best for you, life insurance vs term insurance?

Well, do not worry. This blog will help you pick the best insurance policy for your unique goals. Stay tuned with this post to know the main difference between Term Insurance and Life Insurance, along with other factors that will help you make your best choice. So, let us dive in.

What is Life Insurance?

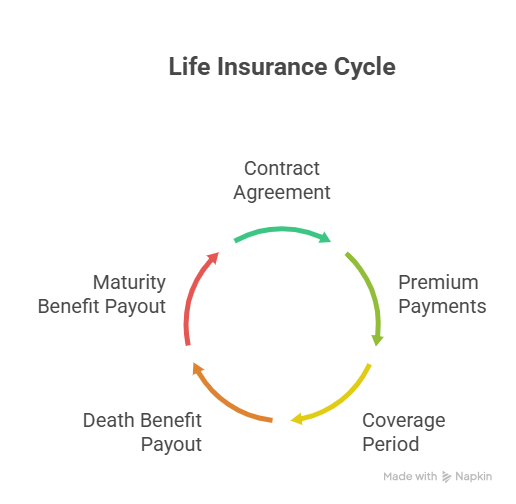

Life Insurance is a legal contract between an individual like you and an insurance provider that provides you with a financial safety net. The insurance is paid to your family or those who are dependent on you after your death. In simple words, an insurance company that you pay regular premiums (payments) to, guarantees a lump sum (death benefit) will be paid to your nominee.

Life Insurance is generally categorized into two types:

- Term Insurance-Provides life coverage for a specific period of time.

- Permanent Life Insurance-Provides lifelong coverage and includes a cash value feature.

How It Works

Firstly, you need to go to an insurance company and write a contract with them. You get to choose a coverage amount and the policy term. If you die within this term, the insurer pays the death benefit to your designated nominee. Some policies also pay a maturity benefit if you survive the term.

Now, let us learn about term insurance in detail in the next heading.

What is Term Insurance?

Term Insurance is basically a type of life insurance. They are specially designed to provide financial protection for a particular period of time, called the "term". This policy protects your family by giving them financial support if you pass away during the specified term. Your family or the nominee you choose gets paid by an insurer with a lump sum, known as the sum assured.

This policy is considered a pure protection plan as it only covers life risks and does not build any savings or investment value. It offers high coverage at a low premium.

The following are the main features of a term insurance-

- The insurance only covers you for a fixed duration of time.

- It has lower premiums than life insurance policies.

- Depending on the policy, a lump sum or periodic payments are paid to the nominee of the policyholder.

- If the holder lives longer than the specified time period, the coverage ends and no payout is made.

- You may be able to deduct the premiums you pay from your taxes under certain tax laws.

- Beneficiaries usually do not have to pay tax on the death benefit they receive.

How It Works

The policyholder needs to decide or choose the coverage duration and the death benefit amount. Then they need to pay regular premiums to the insurance company (monthly, quarterly, annually, etc). The family or nominee of the policyholder is financially protected for the selected time period. If the holder dies in this period, the insurer pays the amount to the nominee and if the holder lives longer than that period, the policy expires with no payout.

Let us differentiate term insurance vs life insurance in the next part.

Difference Between Term Insurance and Life Insurance

The following table shows the comparison of term insurance vs life insurance:

| Feature | Term Insurance | Life Insurance |

|---|---|---|

| Coverage Duration | Provides coverage for a specific term (5–35 years) | Covers the insured for the entire lifetime or a specific longer term |

| Premiums | Lower, affordable | Higher, includes risk coverage plus savings/investment components |

| Death Benefits | Paid only if death occurs during the policy term | Paid regardless of when death occurs, within policy terms |

| Maturity Benefits | No maturity benefit | May offer maturity benefits or surrender value |

| Cash Value | Does not accumulate cash value | Builds cash value that can be borrowed or withdrawn |

| Flexibility | Less flexible | More flexibility in terms and riders available |

| Investment Component | Pure risk coverage | Combines risk coverage with investment/savings |

| Bonuses | Generally not available | May include bonuses like loyalty or accrued bonuses |

| Policy Purpose | Pure protection | Protection + wealth creation |

| Loan Facility | Not generally available | A loan facility is usually available against the cash value |

Must Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

Now, let us answer your main concern: what option should you choose: Term Insurance or Life Insurance? Keep reading to know.

Term Insurance vs Life Insurance: Who Should Choose What?

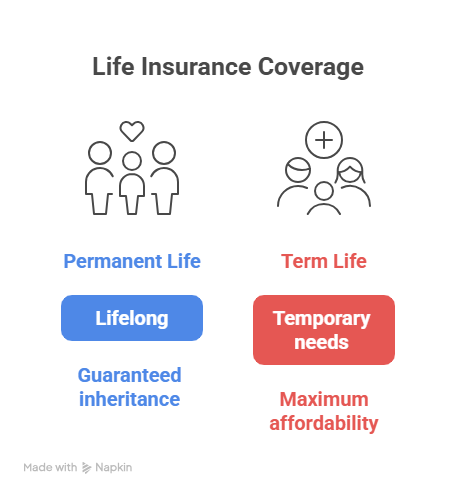

The individuals who want maximum affordability with temporary needs are recommended to choose term insurance, while those who want lifelong coverage and wealth accumulation should go for permanent life insurance. Here is the detailed description of who should choose what:

Who Should Choose Term Life Insurance?

- Young families and primary earners can replace their income for the family when children are being raised.

- People with short-term debts can go with it, for paying a mortgage or loan, so your family becomes debt-free if you pass away suddenly.

- Budget-conscious buyers can benefit from it as it offers the most coverage for those on a tight budget.

- Useful for covering specific financial obligations, such as covering your child's college education fees that have a set timeline.

Who Should Choose Permanent Life Insurance?

- It is useful for people who want to leave a guaranteed inheritance for their heir or those who want to cover estate taxes.

- The individuals who are supporters for those who will need care for their entire life, like a disabled child, can go for it.

- HNIs (High Net Worth Individuals) want to build wealth in a way that saves on taxes and allows them to diversify their investments.

- For Business Owners, these funds fund a buy-sell agreement if a business partner passes away.

Well, to decide on one between Life Insurance vs Term Insurance, you need to consider these two questions or factors:

- Do you need coverage for a specific number of years, or for your entire life?(Term vs. Permanent duration)

- Are you purely seeking a death benefit at the lowest cost, or do you want an investment/savings component?(Pure protection vs. protection + cash value)

Now, let us see what benefits you will get for choosing a term insurance or a life insurance.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Benefits of Choosing Term Insurance vs Life Insurance?

Here are the benefits provided by both policies: Term Insurance vs Life Insurance

Benefits of Choosing Term Insurance

- They offer lower premium rates than the permanent policies.

- Because of the low costs, it is affordable to purchase a high level of coverage.

- The policy is simple, you pay a premium for the insurance and if you die during the term, your nominee gets paid.

- You can choose a term (insurance duration) that matches your financial obligations.

- You can save money on lower premiums and instead invest it in comparatively higher-return vehicles like PPF, SIP or mutual funds.

Benefits of Choosing Life Insurance

- Unlike term insurance, it can provide you with lifetime coverage.

- A part of your premium goes into a cash value account that grows over time.

- The policy guarantees an available payout for your heirs that is tax-free.

- It is an effective tool for estate planning and allows you to leave a legacy for your loved ones.

- Some life policies may provide dividends, providing an additional source of income.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Let us know the factors to consider before anybody buys a term or life insurance.

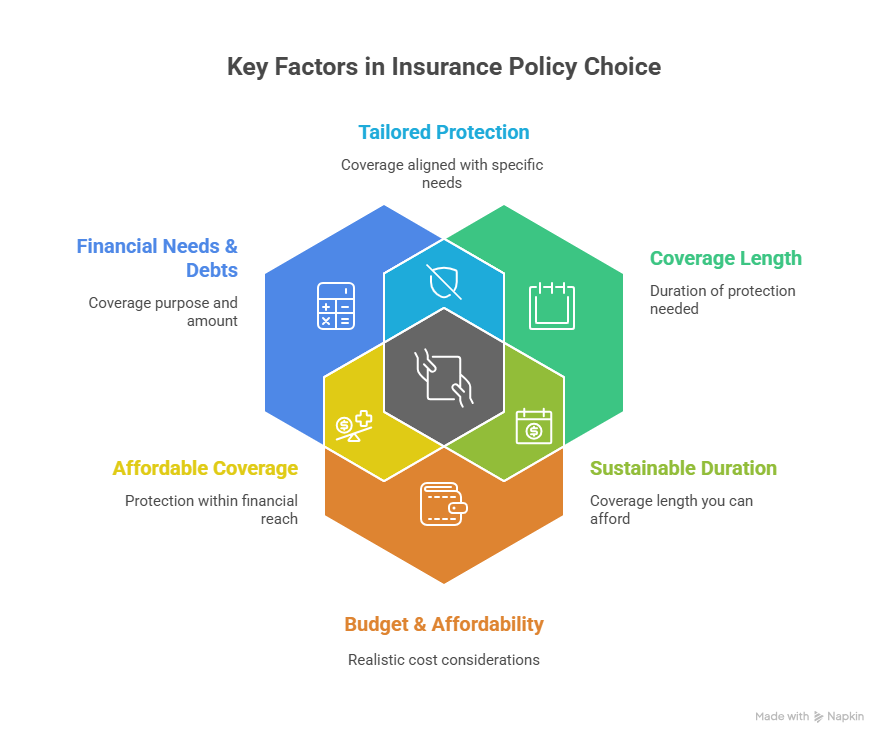

Factors to Consider Before Buying Term Insurance vs Life Insurance

The following are the crucial factors that should be kept in mind before you choose to buy any type of policy:

- List down all your financial needs and debts for which you are buying the insurance.

- Decide on the coverage length you want and match the insurance term with it.

- Calculate your current budget and be realistic about your needs and what you can afford.

- Consider going with the "Buy Term and Invest the Difference" Strategy, which is buying low-cost term insurance for pure protection and investing the money you saved by not choosing high-cost insurance in a separate place.

Let us explore the implications imposed on Term Insurance vs Life Insurance and also see what tax benefits they both provide.

Also Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Tax Benefits and Legal Implications of Term Insurance vs Life Insurance

Both insurance plans offer tax benefits and legal implications under the Income Tax Act, 1961 and the Insurance Act, 1938. The legal implications and tax benefits of life insurance vs term insurance include:

Legal Implications

- Based on the interpretation of Section 39 of the Insurance Act before 2015, the Indian law viewed a nominee as a trustee. This means that when the nominee receives money, they need to give it to the legal heirs.

- In 2015, the Insurance Act was revised to introduce the idea of a "beneficial nominee." If the nominee is an immediate family member, such as a spouse, parent or child, they have the right to receive the money as the beneficial owner.

- It is important to have a clear, registered will that matches your nominations to avoid confusion about who receives your money, especially if it is someone who is not a family member.

Tax Benefits

Both insurance plans offer huge tax benefits under the Income Tax Act, which are shown in the following table:

| Tax Provision | Description | Term Insurance | Permanent (Whole) Life Insurance |

|---|---|---|---|

| Section 80C | Premiums paid are eligible for a tax deduction up to Rs 1.5 lakh annually | Yes, premiums are deductible. | Yes, premiums are deductible. |

| Section 80D | Premiums for health-related riders can get additional deductions. | Yes, for eligible riders. | Yes, for eligible riders. |

| Section 10(10D) | The death or maturity benefit is tax-exempt in the hands of the recipient. | The death benefit is always tax-free. Maturity benefits are tax-free, subject to conditions. | Death and maturity benefits are tax-free, subject to conditions. |

Let us uncover the common misconceptions about term insurance and life insurance that you should avoid.

Common Misconceptions about Term and Life Insurance

The common myths about these insurance plans are:

General Life Insurance

- Life insurance is only for seniors, whereas the best time to buy life insurance is when you are young and healthy.

- Life insurance is too expensive, which is not true. While some policies can be costly, some offer high coverage at affordable premiums.

- You only need insurance if you have someone depending on you, single individuals also have financial obligations like loans, medical bills or funeral expenses.

- Employer-provided insurance is enough. This coverage is eliminated if you leave the job or retire, so go for a personal policy for consistency.

- Claim payouts are taxable or difficult to settle, but that is not true at all. In India, death benefits are generally tax-free.

Term Insurance

- It is a waste of money if you outlive the specified term, but what if you do not? Term insurance is a pure protection product, not an investment.

- You get your money back at the end of the term, not really. Traditional term plans offer no maturity benefits.

- The right coverage is just 20x your income. This formula does not work for everyone, the right coverage depends on your age, any debts, the number of dependents you have and your future expenses.

Permanent Life Insurance

- It is a better investment option than term insurance. It is better as it provides cash value that grows with the lifetime insurance, but the returns may be lower than those from separate investments like mutual funds.

- Only the breadwinner needs it, which is not at all true. Making sure everyone in the family has insurance helps maintain stability in case of a loss.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Smart Investments, Bigger Returns

Conclusion

To conclude the Term Insurance vs Life Insurance battle, the term insurance policy provides affordability with lower premiums and pure protection for a specified term, making it most suitable for individuals seeking maximum coverage at the lowest prices. Meanwhile, the life insurance policy gives protection with a growing cash value (savings and investment benefits), making it suitable for long-term wealth creation and estate planning.

But, choosing the best option between Term Insurance vs Life Insurance fully depends on your specific financial goals, coverage needs and budget.

Related Blogs:

1. Old vs New Tax Regime 2025: Key Differences & Best Choice

2. RBI Repo Rate Cut 2025: Impact on Loans, Deposits & Markets

3. Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

FAQs

-

Can I convert term insurance into life insurance?

Many insurers allow policy conversion from term to permanent life insurance without a medical exam, depending on the plan.

-

Do term insurance policies offer maturity benefits?

No, term insurance generally has no maturity benefit. Life insurance policies usually offer maturity payouts or cash value accumulation.

-

Are death benefits from term and life insurance taxable?

Death benefits under both policies are typically tax-free for nominees as per the income tax laws.

-

What factors should I consider when choosing between term and life insurance?

Consider your coverage duration, financial goals, budget, need for savings, and dependents’ future security.

-

Can I get riders on term and life insurance policies?

Yes, many riders like critical illness or accidental death benefits are available in both, enhancing coverage flexibility.

.webp&w=3840&q=75)

.webp&w=3840&q=75)