Table of Contents

- Tata Digital India Fund Overview

- Performance Analysis of the Tata Digital India Fund

- What is the Investment Strategy of the Tata Digital India Funds

- Overview of the Tata Digital India Fund Portfolio Composition

- Top 10 Holdings of the Tata Digital India Fund

- Analysing the Stocks Quality and Risk Metrics of the Tata Digital India Funds

- Who Manages the Tata Digital India Fund?

- Does the Tata Digital India Fund Suit Your 2026 Portfolio?

- To Conclude Tata Digital India Fund

Introducing you to one of the best performers in the sectoral technology category, the Tata Digital India Fund, which has been around since 2015. Yet, in this short span, it has delivered 26.59% returns in the last 5 years.

But is investing in an IT sector fund good for the long term? Let's find out.

Did you know India is making long strides in the digital world? Yes, the IT sector is a major contributor to India's economy. Under the government of our honourable Prime Minister, Shri Narendra Modi, initiatives like "Digital Bharat" are helping new technologies reach every corner.

This reliability has made mutual funds that invest in top IT companies like Wipro and Tata Consultancy a hot pick to make high returns.

But, "How do you know which digital mutual fund is best for your portfolio?"

In this post, you will see whether it can be the best IT Sector Mutual Fund to be in your portfolio for 2026.

Tata Digital India Fund Overview

The Tata Digital India Fund is one of the sectoral Equity Mutual Funds that primarily invests in the IT and digital sector companies in India. Launched in December 2015, the fund aims to achieve long-term capital appreciation by allocating at least 80% assets to equity and equity-related instruments in the IT industry.

Tata Asset Management Private Limited manages the fund. It invests in software, consulting, fintech, e-commerce and IT services companies in India. It primarily focuses on leading IT stocks while also spreading its investments across 39 different companies as of late November 2025.

Here are the basic details of the Tata Digital India Fund:

| Factors | Value |

|---|---|

| AMC | Tata Mutual Fund |

| AUM | ₹12,084 Crore |

| Current NAV | ₹57 (as of December 19) |

| Benchmark | Nifty IT TRI |

| Risk Level | Very High |

| Expense Ratio | 0.43% |

| Exit Load | 0.25% if redeemed within 30 days |

| Returns Since Inception | 19.22% |

| Minimum SIP | ₹500 |

| Minimum Lump Sum | ₹5,000 |

Now, let us look at the performance analysis of the fund.

Performance Analysis of the Tata Digital India Fund

Here is the performance analysis of the Tata Digital India Fund based on the rolling returns and SIP returns to determine if it is a good option to invest in 2026:

-

Rolling Returns

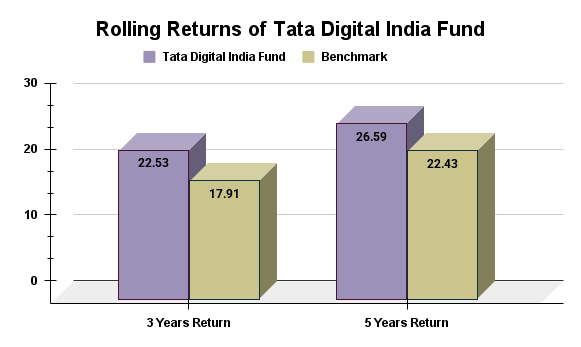

Based on the 3-year and 5-year periods, the fund has beaten its benchmark on both returns and consistency. Over a 3-year rolling period, the fund has delivered 22.53% returns, creating a gap of more than 4% points. The fund stands at 26.59% for the 5-year rolling returns, while the index is at 22.43%, showing meaningful outperformance. See the graph below for the comparison of rolling returns:

The above data shows that investors who stayed for a long time not only earned higher returns but also enjoyed a very high probability of crossing the 12% annualised mark -

SIP Returns

Check out the graph given below for a comparison of the fund, its benchmark and category average based on SIP returns over 3-year and 5-year periods:

The graph shows that the Tata Digital India Fund has outperformed its benchmark with better long-term outcomes, but it is a bit behind the category average.

Over 3 years, the fund has delivered 11.9% SIP returns, compared with 14.43% category average and over 5 years, it has delivered 11.99%, while the category average is higher at 13.8%.

This shows that the category has done slightly better than the fund in 3 years, but the investors who stayed with their SIP for 5 years still saw solid double-digit returns and outperformed the benchmark index, even though the fund lagged behind the average peer by a few percentage points.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, let us explore the investment style of the mutual fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

What is the Investment Strategy of the Tata Digital India Funds

The Tata Digital India Fund aims for long-term capital appreciation through the growth potential of the IT sector in India. This mutual fund invests at least 80% of its assets in equity and equity-related instruments of IT companies, focusing on digital economy leaders.

This fund uses a top-down approach to look at overall trends to find promising industries and with a bottom-up research process, the fund chooses companies based on their value, profitability, cash flow and strong financial health.

This fund, by Tata Mutual Fund, holds a moderately diversified portfolio of 38-40 stocks and a low turnover, which means it avoids frequent buying and selling of stocks and does not focus on quick trades or trends. The fund is ideal for investors bullish on the IT sector, leveraging secular trends like digitalisation, cloud computing and AI, but requires a high-risk tolerance.

Must Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

In the next heading, you will explore the portfolio of the fund, so stay tuned.

Overview of the Tata Digital India Fund Portfolio Composition

Here are the details of the portfolio allocations of the Tata Digital India Fund:

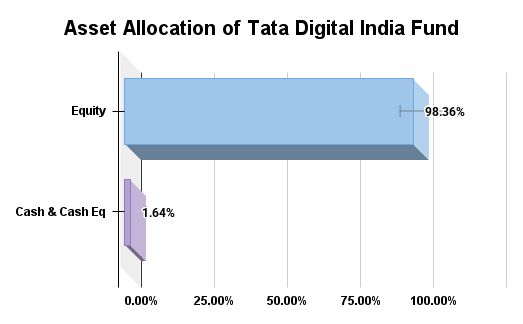

Asset Allocation

This fund has almost a fully invested equity portfolio, with 98.36% in equities of the IT sector companies. This shows that it firmly believes in the IT and digital industries, rather than trying to predict the market by holding large amounts of cash. The 1.64% in cash and cash equivalents mainly acts as a liquidity buffer for redemptions and tactical adjustments, not as a return driver.

This investment mix is suitable for investors who have a long-term investment plan, can handle the ups and downs of the stock market and believe in the growth potential of India’s IT and digital sector.

Allocation of Market Capitalisation

Tata Digital India Fund invests 76.87% in large caps, 14.81% in mid caps and 8.32% in small caps. With over three-fourths of the portfolio in large caps, the fund is focused on established, liquid companies that tend to be more stable during sharp market moves. Around 14.81% in mid-caps and 8.32% in small-caps adds a growth kicker, as these businesses can benefit significantly when their sector's growth.

This allocation makes it a reasonably balanced option within the sectoral IT space, provided investors have a long-term horizon and are comfortable with the volatility of the equity sector.

Sector Allocation

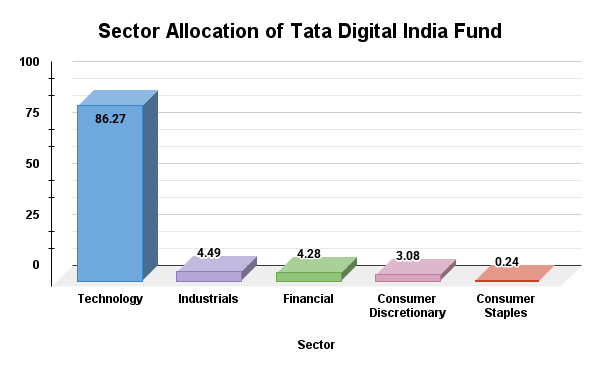

Let us review the distribution of assets by this fund across various sectors with the help of a graph:

The above graph clearly shows it is a sector-specific fund. Amongst the top 5 sector holdings, the major investment lies in the technology sector at 86.27%. This makes it quite a risky investment, which is why it must have quality stocks in its portfolio.

Let us look at the top holdings of the fund in the next part.

Top 10 Holdings of the Tata Digital India Fund

The following are the sectors in which the Tata Digital India Fund has its largest holdings:

| Rank | Stock Name | Sector | % of Total Holdings |

|---|---|---|---|

| 1 | Infosys Ltd. | Computers - software & consulting | 18.91% |

| 2 | Tata Consultancy Services Ltd. | Computers - software & consulting | 11.20% |

| 3 | Tech Mahindra Ltd. | Computers - software & consulting | 8.97% |

| 4 | Wipro Ltd. | Computers - software & consulting | 6.77% |

| 5 | HCL Technologies Limited | Computers - software & consulting | 6.70% |

| 6 | Eternal Ltd. | E-retail/ e-commerce | 5.45% |

| 7 | LTIMindtree Ltd. | Computers - software & consulting | 4.98% |

| 8 | PB Fintech Ltd. | Financial technology (fintech) | 4.02% |

| 9 | Persistent Systems Ltd. | Computers - software & consulting | 3.99% |

| 10 | Firstsource Solutions Ltd. | IT-enabled services | 2.90% |

You will go through the analysis of the risks involved and the stock quality of the fund in the next part.

Analysing the Stocks Quality and Risk Metrics of the Tata Digital India Funds

Here is a thorough analysis of the stock's quality and risk factors of the Tata Digital India Fund:

Risk Analysis

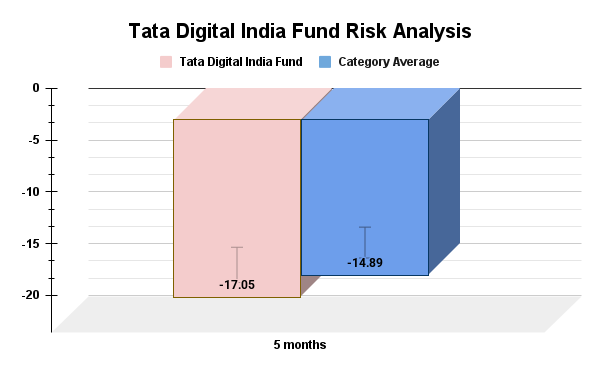

It offers slightly better risk–reward than its peers but with sharper falls. It has a standard deviation of 17.24, a bit lower than the category's 17.86, so its volatility is also comparatively low. Sharpe ratio at 0.5 versus 0.43 shows the fund has delivered more return per unit of risk. Look at the graph below:

However, its maximum fall is deeper at about -17.05% compared with -14.89% for the category and it took around 4 months to recover, which means investors must be ready for steeper short-term drawdowns.

Stocks Quality Analysis

It means investing in good quality companies and strong fundamentals, high growth margins, good cash flow and price-to-earnings (PE) ratios.

Coming back to Tata Digital India Fund, the current valuation stands very high at a 25.72% PE ratio.

Luckily, it has good growth earnings of 16.4%, proving that with high risk comes high rewards as well. Likewise, the sales growth at 10.94% and cash flow at 10.25% draw a healthy picture to make steady returns.

You will find the valuations in the table below:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 10.81% |

| Earnings Growth | 12.6% |

| Cash Flow Growth | 13.92% |

| P/E Ratio (Valuations) | 27.03 |

Also Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

Well, this leads you to question the expertise or who manages this fund. Let us answer that.

Who Manages the Tata Digital India Fund?

Meet Ms Meeta Shetty (Since November 2018), an intelligent and experienced mutual fund manager with over 15 years of experience in equity research and fund management. She follows a unique investment style called GARP. It stands for growth at a reasonable price.

Previously, she has also worked at Kotak Securities, HDFC Securities and others. Shetty's strong knowledge of the industry and Tata Mutual Fund's research help focus the fund on quality IT companies.

She is backed by Tata Mutual Fund’s investment team, which Chief Investment Officer Rahul Singh leads. With the support of her team, she focuses on intense research and careful risk management to achieve the success of the Tata Digital India Fund.

The following section will tell you if the Tata Digital India Fund suits your investment goals or not.

Does the Tata Digital India Fund Suit Your 2026 Portfolio?

It is clear that the fund plans on making high returns from the quickly making growth of the IT sectors. Let us see if it suits you:

- Now, if a high reward with a high-risk mindset suits your goals, this fund gives you the perfect opportunity.

- If diversification is what you seek, it will diversify your portfolio from regular equity funds to high-growth funds.

- Moreover, if you, too, had set your target for the long term, this fund totally supports it. The ideal investment duration for this fund is 5-7 years.

- Lastly, though this fund is volatile, meaning risky, the Tata Mutual Fundhas a reputation for handling market swings effectively.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

To Conclude Tata Digital India Fund

In short, this fund checks out every point that makes it a valuable addition to your portfolio. Nonetheless, investing via the SIP route is the best strategy to cancel out any major risk that may arise. Though it is a great opportunity, it also comes rarely, which is why it is necessary to know the right time for investment.

Luckily, this is your chance to take advantage of this growing IT Sector and make high returns with expert management every step of the way.

Related Blogs:

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

- Tax on Mutual Funds: Complete Guide with Smart Saving Plans

FAQs

-

Is Tata Digital India Fund a good investment in 2026?

In 2026, it can be a good choice for investors who want long-term growth of India’s IT and digital ecosystem and can tolerate high volatility.

-

Who should avoid the Tata Digital India Fund?

Conservative investors, retirees depending on regular withdrawals or anyone with a goal less than 5 years away should avoid this fund.

-

Is Tata Digital India Fund better than simply buying an IT index fund?

The fund has historically generated higher long-term returns than some IT indices, making it better than other index funds.

-

Is Tata Digital India Fund suitable for SIPs in 2026?

Yes, SIPs of at least 5–7 years can help average out volatility in this fund, especially because IT stocks often move in sharp cycles.

-

How is Tata Digital India Fund taxed?

Taxation is like any other equity fund: short-term capital gains are taxed at 20%, while long term at 12.5% tax rates if gains cross Rs 1.25 lakh.

.webp&w=3840&q=75)