Imagine having the power to influence an entire country's financial markets with your investments. That is precisely what Foreign Institutional Investors (FIIs) do in India. These big international players in India, including names like the Government of Singapore with 198,873.33 Crore portfolio value, the Government Pension Fund Global (148,212.3 Cr) and GQG Partners (68,955.15 Cr), bring in massive amounts of foreign money, driving the economic growth of India.

Want to know more, like who these investors are, how they impact the market and which sectors catch their eye in 2025? Well, you are in the right place. Dive into this post to know the top 10 foreign institutional investors in India in 2025 and understand why they are a crucial piece of India’s investment market and what it means for you as an investor.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What are FIIs? What is their role in India?

Foreign Institutional Investors (FIIs) in India are some large foreign financial organisations that are located in a country outside India but invest in the Indian financial markets, including stocks, bonds and ETFs. The examples of FIIs are mutual funds, pension funds, insurance companies, hedge funds or banks.

In India, FIIs are required to register with the SEBI (Securities & Exchange Board of India). They must follow the investment guidelines set by SEBI and RBI (Reserve Bank of India) to participate in the Indian stock markets. They are critical for shaping market sentiment and money flow because of the volume of their investments.

Role of Foreign Institutional Investors in India

- FIIs bring a large sum of foreign currency into India.

- They increase the liquidity of the stock markets.

- FIIs drive the direction of the Indian markets.

- FIIs help companies they invest in to align with international practices.

- FIIs contribute to economic growth and strengthen foreign exchange reserves.

- They connect the Indian financial markets with global economic trends and capital flows.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Now, let us understand the importance of FIIs for the Indian stock markets.

Best Mutual Funds for 2026 Backed by Expert Research

Importance of FIIs in India's Financial Markets

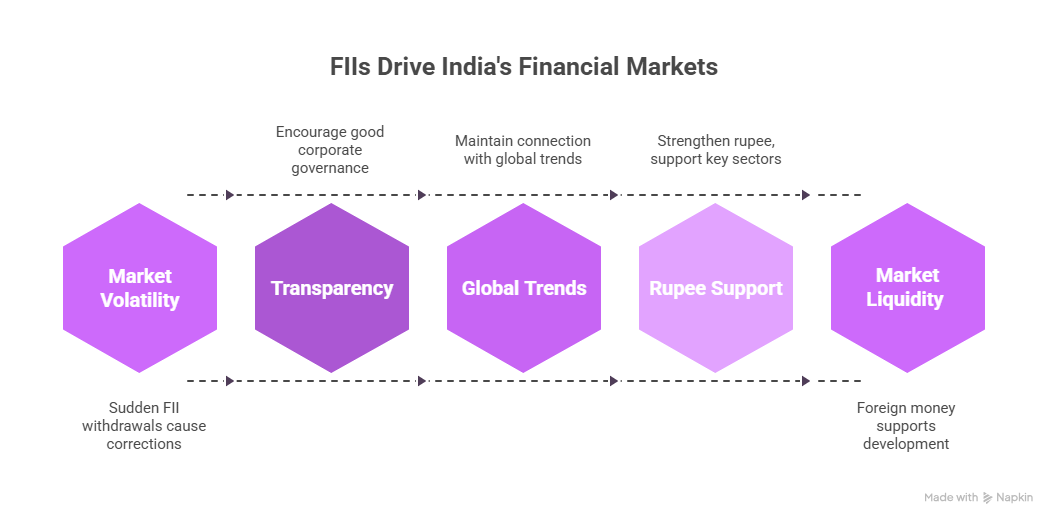

Foreign Institutional Investors play a big role as one of the key components that shape and drive India's financial markets. When they invest in shares, bonds and other Indian investment instruments, they bring in a large amount of foreign money into the country, which keeps the market more liquid and supports the overall development of the country.

When these investors put their valuable money in Indian markets, the stock prices of the markets tend to grow, which develops a sense of confidence in other investors also towards India's prospects. On the other hand, if FII investors suddenly withdraw their money, it can cause market volatility and strong market corrections.

FIIs encourage the companies they invest in to be transparent and maintain good corporate governance to meet international standards because global investors prefer to invest in organised firms.

FIIs help India to maintain a good connection with the global trends. The capital they bring also strengthens the Indian rupee and supports essential sectors, from tech to infrastructure.

Here is the most crucial question: "How are the top foreign institutional investors in India?" Keep reading to know.

List of Top 10 Foreign Institutional Investors in India: 2025 Edition

For the year 2025, winning the first position on the charts of the Top 10 Foreign Institutional Investors in India is none other than the Government of Singapore, with its impressive portfolio worth 198,873.33 Crore and handling 57 stocks.

Here is the list of all FIIs that invested the most in Indian financial markets in 2025 (As of 5 November 2025):

| Rank | Name of FII | Portfolio Value | No. of Stocks | Top Holdings |

|---|---|---|---|---|

| 1 | Government Of Singapore | 198,873.33 Cr | 57 | HDFC Bank, Bajaj Finance and Bharti Airtel |

| 2 | Government Pension Fund Global | 148,212.3 Cr | 101 | HDFC Bank, Bharti Airtel and ICICI Bank |

| 3 | GQG Partners | 68,955.15 Cr | 12 | ITC, Adani Ports and Adani Enterprises |

| 4 | Vanguard Fund | 65,895.15 Cr | 41 | HDFC Bank, Infosys and ICICI Bank |

| 5 | Smallcap World Fund Inc | 36,651.33 Cr | 36 | Max Healthcare, 360 One Wam and APL Apollo Tubes |

| 6 | Nalanda India Fund Limited | 31,356.46 Cr | 23 | Havells, AIA Engineering and MRF |

| 7 | New World Fund Inc | 26,363.73 Cr | 9 | Lodha Developers, Max Healthcare and Laurus Labs |

| 8 | Amansa Holdings Private Limited | 20,590.45 Cr | 26 | SRF, Eicher Motors and Trent |

| 9 | Goldman Sachs India Limited | 10,204.26 Cr | 49 | Navin Fluorine, Amber Enterprises and TD Power Systems |

| 10 | Pi Opportunities Fund I | 8,278.51 Cr | 30 | Aditya Birla Capital, Brainbees Solutions and Usha Martin |

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, let us explore the profiles of these investors in a bit of detail.

Profiles of the Top Foreign Institutional Investors

Here are the insights into the profiles of the top FII investors in India 2025:

1. Government of Singapore

The first FII on the top 10 charts, the Government of Singapore has an interest in Banking and Finance (45.14%), Automobiles & Auto Components (8.46%) and Telecom Services (8.13%) Sectors currently. The stocks that this foreign investor holds are diversified across various sectors, but the main ones are HDFC Bank (32,213.34 Cr), Bajaj Finance (16,426.89 Cr) and Bharti Airtel (16,175.61 Cr).

As of 5 November 2025, the FII has sold out its stocks in Entero Healthcare (1.59%), Astral (1.09%) and Data Patterns (0.83%), but has also bought 3.96% in Kalpataru, 1.68% in Aditya Infotech and 1.23% in Eicher Motors.

2. Government Pension Fund Global

Making its position at the top 2 in the top 10 FIIs in India, the Government Pension Fund Global has its top holdings in HDFC Bank (17,279.25 Cr), Bharti Airtel (13,882.95 Cr) and ICICI Bank (13,514.86 Cr). It has recently bought more stocks in the following sectors- Clean Science (2.38%), KPI Green Energy (1.7%) and Lemon Tree Hotels (1.36%).

The second-best FII in India prefer its stocks in Banking and Finance (43.62%), Telecom Services (9.91%) and Pharmaceuticals & Biotechnology (7.79%) sectors. But, as of November 2025, it has sold its stocks in Raymond Realty (1.58%), Cipla (0.35%) and Network18 (0.29%).

3. GQG Partners

The next in line, making the top 3, is none other than GQG Partners, whose recently bought stocks are Adani Energy (2.49%), Adani Green Energy (2.44%) and Adani Enterprises (2.15%). At the same time, the recently sold out stocks are Adani Power (0.23%) and Patanjali Foods (0.14%).

As of 2025, it invests most of its stocks in these top 3 holdings, including ITC (19,239.82 Cr), Adani Ports (10,864.64 Cr) and Adani Enterprises (10,803.32 Cr). The sectors this foreign investor prefers are Utilities (with 28.61% investment), Food, Beverages & Tobacco (27.9% investment) and Transportation (15.76% investment).

4. Vanguard Fund

The fourth in the list is the Vanguard Fund, which has recently sold 0.01% of Federal Bank and 0.01% of RBL Bank stocks. This FII has the following sector preference for investment- Banking and Finance (50.69%), Software & Services (26.71%) and Automobiles & Auto Components (7.81%).

The recently bought stocks of this fund are Zee Entertainment (3.59%), CarTrade Tech (1.45%) and Crompton Greaves (1.3%). The institutional investor has put most of its money in HDFC Bank (16,175.47 Cr), Infosys (14,323.39 Cr) and ICICI Bank (10,219.67 Cr).

5. Smallcap World Fund Inc

Following the top 4 FIIs, the next one is Smallcap World Fund Inc. The holdings of the FII are Max Healthcare (3,504.14 Cr), 360 One Wam (3,144.97 Cr) and APL Apollo Tubes (2,668.93 Cr). Its sector preference is as follows- Banking and Finance (40.43%), Healthcare (15.38%) and Pharmaceuticals & Biotechnology (11.16%).

The recently bought stocks of this foreign investor are Laurus Labs (4.25%), Tilaknagar Industries (3.15%) and IIFL Finance (2.15%) and the recently sold are Aster DM Healthcare (0.64%), Tube Investments (0.57%) and Max Healthcare (0.14%).

6. Nalanda India Fund Limited

This foreign institutional investor has recently invested in the following stocks: DB Corp (9.27%), Voltamp Transformers (6.08%) and Ahluwalia Contracts (5.49%), showing its trust in these sectors. It has also recently sold out its 0.01% of stocks in Vaibhav Global.

The top holdings of this FII in 2025 include Havells, AIA Engineering and MRF with the market caps of 3,837.91 Crore, 2,890.62 Crore and 2,763.64 Crore, respectively. In 2025, this FII scattered its 29.44% stocks in the General Industrials sector, 23.18% in Consumer Durables and 13.88% in Automobiles & Auto Components.

7. New World Fund Inc

The seventh top foreign institutional investor is New World Fund, with a sector preference in Realty (20.22%), Healthcare (19.83%) and Banking and Finance (17.11%).

The investor has its 2025 top holding in Lodha Developers with a 5,330.08 Crore market cap, followed by Max Healthcare and Laurus Labs with market caps of 5,228.36 Crore and 3,444.06 Crore, respectively. The recently sold stocks of this FII include Au SF Bank (0.63%), Max Healthcare (0.61%) and PB Fintech (0.04%).

8. Amansa Holdings Private Limited

The recent sales of this investor are Cyient (2.14%), Saregama (0.99%) and Sundram Fasteners (0.55%). The top holdings include SRF (2,697.81 Cr), Eicher Motors (2,471.78 Cr) and Trent (2,115.35 Cr).

The Amansa Holdings' recent purchase is 3.08% in Bluestone Jewellery, 1.0% in Star Health and 0.63% in Glenmark Pharma. The FII has the following sector preference- Automobiles & Auto Components (16.54%), Software & Services (15.68%) and Retailing (15.17%).

9. Goldman Sachs India Limited

Maybe the most well-known name in the list, the sector preference of Goldman Sachs India is Banking and Finance (16.91%), Consumer Durables (11.53%) and Software & Services (10.32%), with recently sold out stocks, Landmark Cars (1.02%), CarTrade Tech (0.5%) and SJS Enterprises (0.5%).

While the recent purchase of this FII is in GNG Electronic (1.9%), Bluestone Jewellery (1.23%) and Akzo Nobel (1.05%), the top holdings include Navin Fluorine (502.73 Cr), Amber Enterprises (457.26 Cr) and TD Power Systems (401.25 Cr).

10. Pi Opportunities Fund I

Last but not least, Pi Opportunities Fund I is the last one to make up to the top 10 list of foreign institutional investors in India, with the sector preference of Diversified (31.77%), Metals & Mining (11.44%) and Retailing (11.19%). The holdings of this FII include Aditya Birla Capital (2,630.07 Cr), Brainbees Solutions (923.09 Cr) and Usha Martin (758.78 Cr).

The recent purchase and sale of this investor is Mehul Colours (2.55%), Omnitex Industries (2.12%), Anondita Medicare (1.92%) and Dr Agarwals Health (0.83%), Praxis Home Retail (0.5%), Black Box (0.01%), respectively.

Must Read: Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

In the next part, you will explore the sectors of India that attract the foreign investors the most.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Key Sectors Attracting FII Investments in 2025

The following are the sectors that consistently attracted the interest of these FIIs, according to the recent trends and historical data:

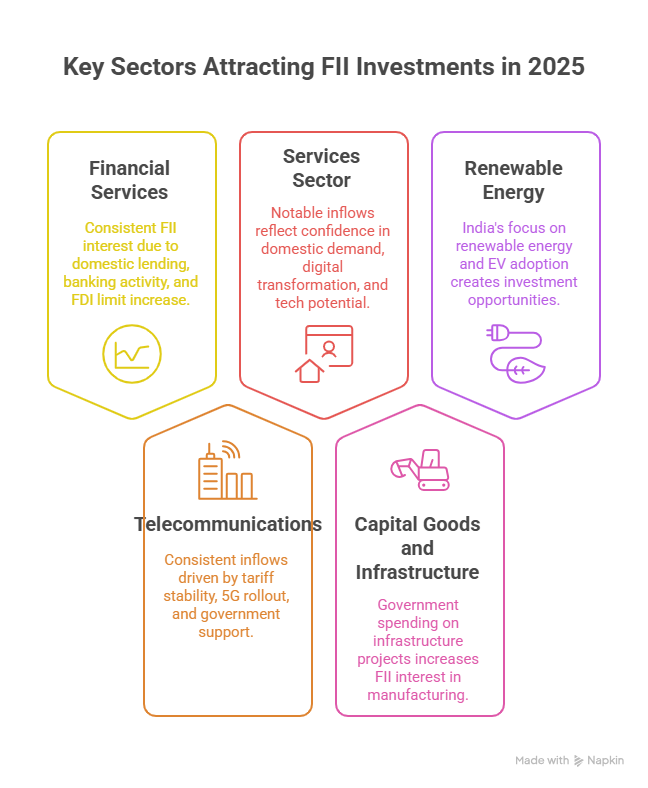

Financial Services (Including banking, BFSI, insurance, etc.)

FIIs have been net buyers for the last five straight months in this sector. They are positive about this sector, including growing domestic lending and increased banking activity due to consumer spending. Additionally, the government's move to raise the FDI limit in the insurance sector of India to 100% from 75% has increased investor confidence in that industry.

Telecommunications

This sector got consistent inflows throughout the year. The main factors that made this sector a top favourite include expected stability or an increase in tariffs that improve ARPU (Average Revenue Per User), ongoing momentum in 5G rollout and support from the government.

Services Sector (including IT & Digital)

This sector, with a broad range of services including professional services, e-commerce, and various digital services, has seen notable inflows. This inflow reflects FIIs' confidence in the country's growing domestic demand, digital transformation and potential in specific tech areas like AI, cloud computing and fintech.

Capital Goods and Infrastructure

The government of India is spending a lot on infrastructure projects (such as roads, railways & the Smart Cities Mission), increasing FIIs' interest in this manufacturing and infrastructure sector of India. This spending supports schemes like the 'Make in India' program and the related Production-Linked Incentive (PLI).

Renewable Energy and Green Energy

India is focusing on this sector by aiming to have 500 GW of renewable energy capacity by 2030. The country also wants to increase EV (Electric Vehicle) adoption in the near future. This commitment creates big investment opportunities. This is what attracts attention from funds and investors that care about environmental, social and governance (ESG) issues.

Let us understand the level of impact these FII investments have on the market trends and the economy of India.

Impact of FIIs on Indian Market Trends and Economy

Here is how the Foreign Institutional Investors impact the economy and market trends in India:

Impact on Market Trends

- FII flows indicate the world's confidence in India. When they make large investments, it boosts the markets. However, if they start selling heavily, it can cause market declines.

- FII investments make the Indian stock markets more liquid. This liquidity becomes a favourable move for other investors, making buying and selling easier at fair prices.

- When foreign investors buy or sell large amounts of stocks suddenly, it can cause stock prices to fluctuate quickly. This can lead to quick market changes in either direction.

- During these times of global uncertainty, the FII investments in the domestic sector have started balancing markets, reducing the impact of market fluctuations caused by global issues.

Impact on the Indian Economy

- FIIs provide Indian companies with important foreign currency. This funding helps the economic growth of the country by supporting infrastructure projects and creating jobs.

- Money coming into the country from foreign investors can help make the Indian rupee stronger. However, if a lot of money leaves the country, it can weaken the rupee and make imports more expensive.

- Foreign Institutional Investors support companies that are well-governed by promoting transparency and good practices to match the global standards.

- The presence of the FIIs connects India to global financial movements. This connection offers benefits but also exposes the country to overseas risks.

Also Read: Top 10 Investors in India 2025: Portfolios and Winning Strategies

Let us compare the FII investments with the DII investments in the next heading.

Comparing FII Investments vs DII Investments

The following table shows the main differences between the FII investments and the DII investments in India:

| Feature | Foreign Institutional Investors (FIIs) | Domestic Institutional Investors (DIIs) |

|---|---|---|

| Origin | Based outside India | Based within India |

| Source of Funds | Foreign capital | Domestic capital |

| Investment Horizon | Short to medium term | Primarily long-term |

| Regulatory Limits | Subject to caps on ownership in companies | Generally no such ownership caps |

| Impact on Market | Can cause volatility due to quick inflows/outflows | Provide market stability and domestic liquidity |

| Influence on Corporate Governance | Push for global standards | Influence aligned with local economic conditions |

| Examples | Pension funds, mutual funds, hedge funds abroad | Mutual funds, insurance companies, banks within India |

| Investment Scope | Primarily equities and some debt instruments | Equities, debt, and broader financial instruments |

| Decision Drivers | Global economic trends, geopolitical factors | Domestic policy, economic conditions |

Don’t Miss: Compare mutual funds and evaluate returns, risk, costs and objectives of two funds to choose wisely.

Now, let us explore the regulations and guidelines imposed on the FII investments in India.

Regulatory Framework Governing Foreign Institutional Investors in India

FIIs in India are primarily controlled by the SEBI and the RBI, operating under the Foreign Exchange Management Act (FEMA), 1999. This is what they regulate:

-

SEBI (Securities & Exchange Board of India)

It handles FPI (Foreign Portfolio Investors) registration, daily supervision and checks investment activities in stocks and debt markets.

-

RBI (Reserve Bank of India)

It manages all foreign exchange controls, sets sectoral investment limits and monitors overall capital flows under FEMA.

-

The Ministry of Finance

It sets overall policy direction, foreign investment caps and tax changes.

Here are the primary regulatory requirements for FIIs in India:

-

Registration and Classification

FPIs must register through a DDP (Designated Depository Participant) approved by SEBI. FPIs are sorted into three categories based on their risk profile and the regulations they follow in their home country: Category I (trusted government entities, top funds), Category II (highly regulated companies) and Category III (other unregulated entities).

-

Investment Limits and Restrictions

An individual FPI can invest up to a maximum of 10% in a single company. Collectively, the total FPI investment in any single company is up to 24%, which may be increased with shareholder approval. FPIs are allowed to invest in listed stocks, listed debt, government securities, mutual fund units and some derivatives, but not in unlisted companies or restricted sectors like real estate and agriculture.

-

Compliance and Reporting

FPIs must follow strict KYC and anti-money laundering rules and appoint local bank/custodian partners for handling finances and reporting. Tax applies to FPIs as per Indian laws, including capital gains tax and withholding tax.

These clear, strict rules help India attract global money while keeping the market safe and transparent for all stakeholders.

Important: Recession in India: Is India Heading Towards One in 2025?

Now, let us look at the recent market insights that are generated by the inflows and outflows of the FII investments.

Recent Market Insights of FIIs Inflows and Outflows

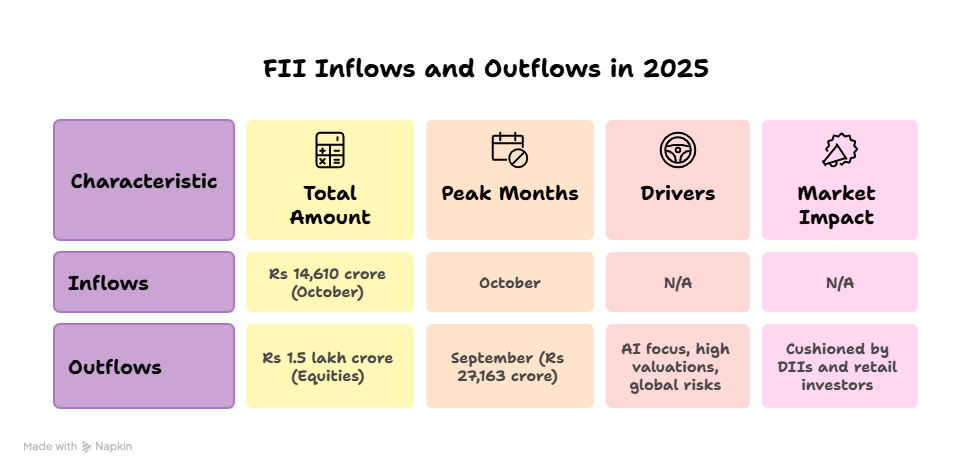

Foreign Institutional Investors have mostly been net sellers in India in 2025, continuing a trend from late 2024. The following are the recent market trends in India that are generated due to the inflows and outflows of the FII investments:

- In 2025, there has been a significant outflow of Foreign Institutional Investment. This selling pressure has resulted in total FII sales exceeding Rs 3 lakh crore over the last two years.

- The total outflow in 2025 has crossed Rs 5 lakh crorein equities alone, with steady outflows seen in July, August, September and resuming in November (Around Rs 12,569 crore in the first week).

- Outflows peaked in September (Rs 27,163 crore), August (Rs 34,990 crore) and July (Rs 17,700 crore). There was a brief buying pause in October with net inflows of around Rs 14,610 crore.

Key Drivers of Outflows

- The main reasons are FIIs shifting money to markets focused on AI (like the US, China, South Korea and Taiwan, viewing India as an "AI-underperformer"), concerns over high Indian valuations, global risks and slower earnings.

- The strong domestic investments from DIIs and retail investors have cushioned the market, with DIIs putting in over Rs 5 lakh crore in 2025, helping prevent major declines despite the FII selling.

- This year, Indian market trends are more influenced by local investors, making markets steadier even during global uncertainty.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

Conclusion

In short, the top 10 foreign institutional investors in India 2025 play a big role in the overall economic growth of the country. The inflows from these investors increase the global trust in India.

The top 10 FIIs in India include names like the Government of Singapore, Government Pension Fund Global, GQG Partners, Vanguard Fund, Smallcap World Fund Inc, Nalanda India Fund Limited, New World Fund Inc, Amansa Holdings Private Limited, Goldman Sachs India Limited and Pi Opportunities Fund I.

Related Blogs:

FAQs

-

Why are FIIs or Foreign Institutional Investors Exiting India?

FIIs are exiting India due to high valuations, better opportunities abroad, sluggish earnings and geopolitical risks.

-

Which are the top stocks recently bought by FIIs in India?

Top stocks recently bought by institutional investors include ITC, HDFC Bank, Reliance Industries, TCS and Infosys.

-

Should you make investment decisions according to the buying & selling activity of FIIs?

Buying or selling by FIIs is useful but should not be the sole basis for your investment decisions. Consider your goals and risk tolerance.

-

Can FIIs holding in a company be higher than promoter holding?

FII holdings cannot exceed promoter holdings in a company, as promoters retain majority control.

-

What is Section 115AD?

Section 115AD imposes tax on the income of FIIs from securities transactions in India.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)