Table of Contents

- What are Public Sector Banks in India?

- List of Public Sector Banks in India 2025

- Top 10 Public Sector Banks in India by Market Capitalization

- Overview of the Top 10 Public Sector Banks in India

- Advantages of Public Sector Banks

- Financial Performance of Indian Public Sector Banks

- Criteria for Choosing the Best Public Sector Bank in India

- Conclusion

Did you know that Public Sector Banks (PSBs) hold 60% of India's total banking assets, serving more than 80% of the rural population? Yes, backed by the Government of India, PSBs provide more than 500 million Indians with reliable banking services.

This leaves you with a question: "Which is the largest public sector bank in India?"

Well, it is none other than the “State Bank of India (SBI)”, once again dominating the charts of the top 10 public sector banks in India, covering nearly 23% of India's total banking market share with over 22,500 branches globally.

So, let’s unmask the top 10 public sector banks in India, along with their market share and total revenue generated as per the latest records.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What are Public Sector Banks in India?

The Public Sector Banks in India are financial institutions or banks operated by the government and work according to their guidelines only. The government of India (either central or state) holds a majority of shares of these banks, that is, more than 50% of the total shares.

Public sector banks place the utmost importance on public welfare services and social objectives. In India, public sector banks (PSBs) are primarily owned and controlled by the Ministry of Finance, Government of India or State governments.

Public Sector Banks focus more on social services, unlike private sector banks, which are owned by individuals or corporations and primarily focus on the bank's profits.

Types of banks in India:

The Indian banking sector is primarily divided into the following categories:

- Public Sector Banks: Also known as government banks, as their major part is owned by the government. It has the widest branch network.

- Private Sector Banks: These banks are owned by private entities, that is, privately owned by an individual or a corporation.

- Foreign Banks: These are the global banks that are operating in India.

- Cooperative Banks: Community-based banks supporting small businesses and rural banking needs.

- Payment Banks: Give digital banking services, but can not give loans and credit cards.

- Small Finance Banks: Serve low-income individuals and small businesses.

Now that you know what a public sector bank is, the next thing you must want to know is how many public sector banks are there in India, right?

You will learn the answer in the next part.

List of Public Sector Banks in India 2025

There are 12 public sector banks operating in India as of July 2025. These PSBs are mainly owned by the government of India and work for the economic development of the country. The public sector banks in India are listed below:

| Bank Name | Headquarters | Establishment Year |

|---|---|---|

| Bank of Baroda Vadodara | Gujarat | 1908 |

| Bank of India | Mumbai, Maharashtra | 1906 |

| Bank of Maharashtra | Pune, Maharashtra | 1935 |

| Central Bank of India | Uttar Pradesh | 1911 |

| Canara Bank Bengaluru | Karnataka | 1906 |

| Indian Bank | Chennai, Tamil Nadu | 1907 |

| Indian Overseas Bank | Chennai, Tamil Nadu | 1937 |

| Punjab National Bank | New Delhi, Delhi | 1894 |

| Punjab and Sind Bank | New Delhi, Delhi | 1908 |

| State Bank of India | Mumbai, Maharashtra | 1955 |

| Union Bank of India | Mumbai, Maharashtra | 1919 |

| UCO Bank | Kolkata, West Bengal | 1943 |

After going through the list of the government banks that are operating in India, you must want to know," Which is the largest public sector bank of India? " Keep scrolling to know.

Best Mutual Funds for 2026 Backed by Expert Research

Top 10 Public Sector Banks in India by Market Capitalization

Public sector banks are considered more reliable and safer than private banks because they have the support of the government of India. PSBs are gaining more trust from the public.

For the year 2025, the State Bank of India (SBI) has secured its position as the largest public sector bank of India, over other banks.

Let us look at the list of the top 10 public sector banks in India, ranked according to their market capitalization:

| Rank | Bank | Market Capitalization |

|---|---|---|

| 1 | State Bank of India | Rs 7,49,526 Cr |

| 2 | Bank of Baroda | Rs 1,26,776 Cr |

| 3 | Punjab National Bank | Rs 1,25,733 Cr |

| 4 | Union Bank of India | Rs 1,05,420 Cr |

| 5 | Canara Bank | Rs 1,01,591 Cr |

| 6 | Indian Bank | Rs 85,195 Cr |

| 7 | Indian Overseas Bank | Rs 74,504 Cr |

| 8 | Bank of India | Rs 51,923 Cr |

| 9 | Central Bank of India | Rs 33,689 Cr |

| 10 | UCO Bank | Rs 38,384 Cr |

Let us explore the top 10 PSBs and their services in more detail in the next heading.

Overview of the Top 10 Public Sector Banks in India

The top 10 Public Sector Banks in India are described below:

1. SBI (State Bank of India)- The Largest Public Sector Bank of India

- Establishment Year: 1955

- Current Chairman: Shri Challa Sreenivasulu Setty

- Revenue of FY 2025: Rs 4,90,938

- Services: Personal, rural, international, SME, corporate, government banking and digital banking.

- Network: Over 22,500 branches, 63,580 ATMs and 82,900 BC outlets. Operates across 241 offices in 29 countries globally.

- Mutual Fund Services: SBI has its own AMC offering various mutual fundor SIP schemes in diverse sectors.

2. BOB (Bank of Baroda)- the 2nd largest public sector bank.

- Establishment Year: 1908

- Current Chairman: Dr. Hasmukh Adhia

- Revenue of FY 2025: Rs 1,27,945

- Services: Retail and corporate banking solutions such as savings accounts, loans, and credit cards, digital banking and an international network.

- Network: Over 9,693 branches and 10,033+ ATMs.

- Mutual Fund Services: These services are provided by the joint venture with BNP Paribas (Baroda BNP Paribas Mutual Fund).

3. PNB (Punjab National Bank)- the 3rd largest public sector bank.

- Establishment Year: 1894

- Current Chairman: K.G. Ananthakrishnan

- Revenue of FY 2025: Rs 1,24,010

- Services: Business loans, MSME banking, agriculture loans, personal banking and wealth management services.

- Network: Over 10,108 branches and 12,455 ATMs.

- Mutual Fund Services: Mutual fund services are offered through distribution agreements with various AMCs.

4. Union Bank of India

- Establishment Year: 1919

- Current Chairman: Srinivasan Varadarajan

- Revenue of FY 2025: Rs 1,08,417

- Services: Government schemes, retail banking, corporate banking, MSME loans, lending and public welfare schemes.

- Network: Over 8,500 branches and more than 10,000 ATMs.

- Mutual Fund Services: It has its mutual fundservice provider, Union Mutual Fund. It also includes SIP

5. Canara Bank

- Establishment Year: 1906

- Current Chairman: Shri Vijay Srirangan

- Revenue of FY 2025: Rs 1,21,601

- Services: MSME financing, agriculture, retail banking, project finance, personal loans, home loans, digital tools and SME banking.

- Network: Over 9,604 branches and 12,155 ATMs.

- Mutual Fund Services: These services are provided by the joint venture with Robeco, named Canara Robeco Mutual Fund.

6. Indian Bank

- Establishment Year: 1907

- Current Chairman: Binod Kumar

- Revenue of FY 2025: Rs 62,039

- Services: Loans, savings accounts, credit cards, digital banking services, Rural banking, personal loans and microfinance.

- Network: Over 9,693 branches and 10,033+ ATMs.

- Mutual Fund Services: Provides these services by associating with MF Utility.

7. IOB (Indian Overseas Bank)

- Establishment Year: 1937

- Current Chairman: Srinivasan Sridhar

- Revenue of FY 2025: Rs 28,131

- Services: Retail banking, international trade solutions, MSME lending, corporate finance, Personal banking, fixed deposits, rural banking and microloans.

- Network: Over 4,541 branches and 3,497 ATMs.

- Mutual Fund Services: Mutual fund services are provided through its network and a tie-up with MF Utility.

8. BOI (Bank of India)

- Establishment Year: 1906

- Current Chairman: M.R. Kumar

- Revenue of FY 2025: Rs 71,308

- Services: Corporate banking, retail banking, trade finance, investment banking, loan schemes and digital banking services.

- Network: Over 5,100 branches and 8,166 ATMs.

- Mutual Fund Services: Provides MF options through its subsidiary, which operates as Bank of India Mutual Fund.

9. Central Bank of India

- Establishment Year: 1911

- Current Chairman: Shri M. V. Rao

- Revenue of FY 2025: Rs 33,797

- Services: Personal banking, fixed deposits, rural banking, microloans, agricultural lending, MSME financing and government-sponsored schemes.

- Network: Over 4,500 branches and 3,644 ATMs.

- Mutual Fund Services: Provides mutual fund services through its role as an AMFI-registered mutual fund distributor.

10. UCO Bank

- Establishment Year: 1943

- Current Chairman: Aravamudan Krishna Kumar

- Revenue of FY 2025: Rs 25,067

- Services: MSME loans, forex banking, wealth management, personal loans, microfinance, retail banking services and corporate solutions.

- Network: Over 4,000 branches and 2,613 ATMs.

- Mutual Fund Services: Provides wealth management services, including mutual funds.

Moving on to the next heading that answers the most asked question, "What are the benefits of public sector banks for a common man?"

Keep reading to learn more.

Start Your SIP TodayLet your money work for you with the best SIP plans.

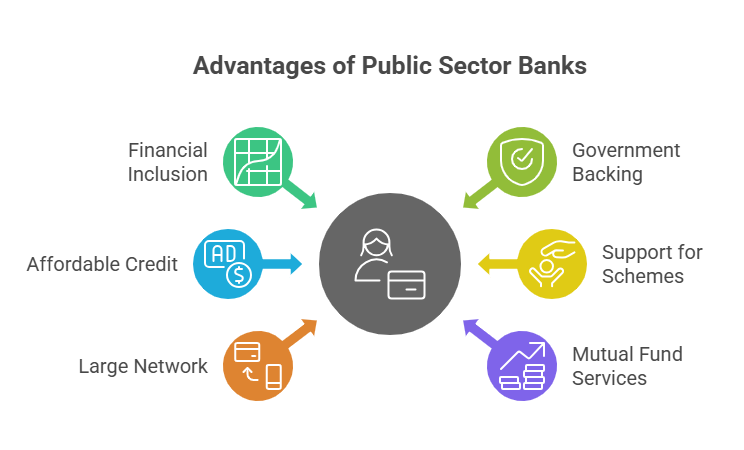

Advantages of Public Sector Banks

There are several benefits offered by the public sector banks in India. Some of them are described below:

-

Financial Inclusion

PSBs enable banking or financial services in rural and remote areas, also making them accessible to a broader population.

-

Government Backing and Stability

The deposited funds in the PSBs are considered safer than those in private banks due to strong government support.

-

Affordable Credit and Lower Loan Rates

PSBs give loans at low interest rates and on budget credit for priority sectors, supporting economic growth.

-

Support for Government Schemes

Public Sector Banks provide support to the government's social welfare schemes and social security services.

-

Large Network and Market Presence

PSBs have several branches and an ATM network, ruling both the urban and rural banking sectors.

-

Mutual Fund Services

Many PSBs in India provide mutual fund services either directly with their AMCs or by partnering with other AMCs. They also offer SIPs in mutual funds.

Pro Tip: Use a Mutual Fund Screener to compare funds and select the best one.

Also Read: Top Investment Banking Companies in India: Who To Trust?

Financial Performance of Indian Public Sector Banks

Public Sector Banks of India have shown a remarkable financial performance in recent years, displaying strong growth and stability. Government Banks have generated a net profit of Rs 1.78 lakh crores in the financial year 2025, which is the highest collection of PSBs ever achieved.

There has been a notable improvement in the asset quality, with the GNPA (Gross Non-performing Assets) ratio decreasing up to 0.52% in 2025 and CRAR (Capital to Risk Asset Ratio) exceeding the minimum requirement set by the RBI. The public sector banks showed a strong credit growth in the current year, with their total business reaching Rs 251 lakh crore in the retail, agriculture and MSME sectors.

The idea of merging significant capital into Public Sector Banks has a remarkable impact. This merger also involved the implementation of the EASE framework and structural reforms such as the 4R's strategy, that is

R: Recognizing

R: Resolving

R: Recapitalizing

R: Reforming

Public sector banks are also embracing technology and using digital solutions like UPI, mobile banking and digital banking.

Important Tip: Use a SWP calculator to plan and visualize how long your mutual fund corpus will last.

Now that it’s almost time to wrap this topic, let's end with learning about the criteria to pick the best public sector bank in India.

Keep reading to reach there.

Smart Investments, Bigger Returns

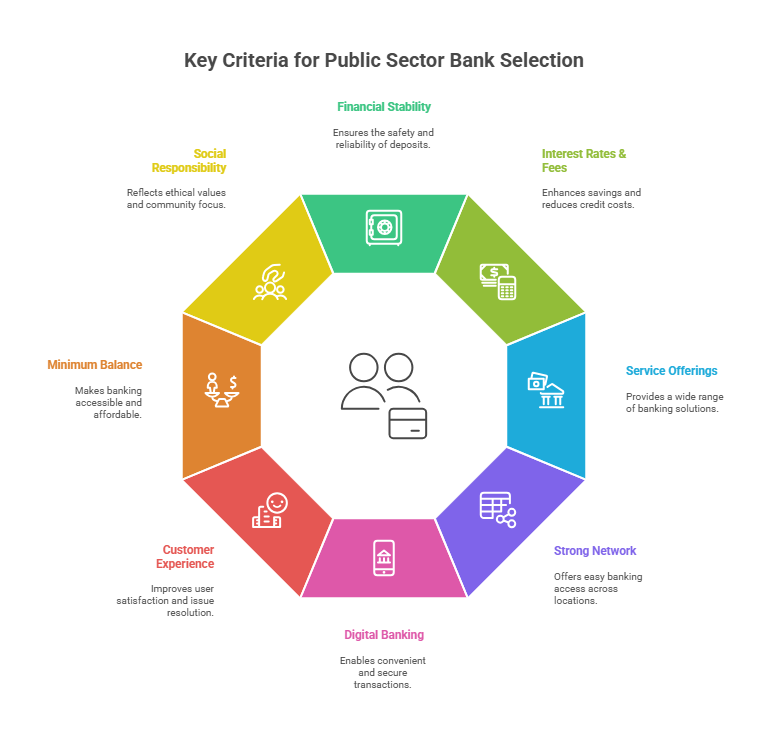

Criteria for Choosing the Best Public Sector Bank in India

The factors to consider when choosing a public sector bank in India to ensure that the bank aligns with your financial needs are:

- Financial stability & trust to protect deposits and ensure long-term reliability.

- Interest rates and fees to increase savings and reduce the cost of credit.

- Service offerings to ensure wide-ranging banking solutions.

- Strong network to provide easy banking everywhere.

- Digital banking and technology to enable convenient, fast and secure transactions.

- Customer experience and support to improve user experience and issue resolution.

- Minimum balance to make banking accessible and affordable.

- Social responsibility and reputation reflecting ethical values and community focus.

Conclusion

To conclude, public sector banks play a vital role in the nation's economic development by serving more than 500 million Indians with their daily banking services. In 2025, public sector banks of India remained the pillars of financial stability, economic development, and public trust.

With combined profits of more than Rs 1.7 lakh crore in 2025, public sector banks offer a strong mix of technology, government support and a huge service network.

FAQs

-

Which bank is best in India in 2025?

The State Bank of India (SBI), headquartered in Mumbai, is the best in India in 2025.

-

Which is the No. 1 national bank in India?

The State Bank of India (SBI) is the number one national bank in India. It has a broad network of branches and ATMs.

-

Is RBI a public sector bank?

The Reserve Bank of India was initially owned privately, but was nationalised in 1949. It is now owned by the Ministry of Finance and the Government of India (GoI).

-

What is the classification of public sector banks?

Public sector banks in India are classified into two categories: nationalized banks and the State Bank of India (SBI).

-

What is the number of public sector commercial banks operating in India?

There are twelve public sector commercial banks operating in India.

.webp&w=3840&q=75)