Did you ever feel like you were in an exam with multiple-choice questions like "large-cap, mid-cap or small-cap," pick one, when investing in mutual funds? If this is you, you have landed exactly where you need to be, introducing you to the UTI Flexi Cap Fund, a versatile equity fund launched by UTI Mutual Funds that lets you invest in a mix of large, mid and small cap stocks.

But is the UTI Flexi Cap Fund good for 2025? Yes, its long-term growth potential and flexible investment style make it a popular choice among other Equity Mutual Funds. Its 5-year return of 15.57% & AUM of Rs 25,509 crore make it suitable for long-term investors with a high risk appetite.

So, whether you are planning a long-term SIP in 2025 or weighing lump sum investments, this UTI Flexi Cap Fund Review will help you decide if this fund fits into your portfolio.

Overview of UTI Flexi Cap Fund

The UTI Flexi Cap Fund is an open ended multi-cap fund managed by the UTI Mutual Fund. It is one of the equity mutual funds that primarily invests in a mix of large, mid and small cap stocks for long term growth.

It invests in selected companies with high growth potential across market capitalizations. With an expense ratio of 0.1%, the mutual fund has delivered around 14.18% CAGR since inception and, as of September 2025, has Rs 25,509 crore of assets under management (AUM).

The fund has a high risk level and its performance is marked against the Nifty 500 TRI benchmark. It offers its best SIP plans starting at Rs 500 and lump sum investments from Rs 5000 onwards. The following are the top holdings of the UTI Flexi Cap Fund as of August 2025:

ICICI Bank

HDFC Bank

Bajaj Finance

Eternal

Avenue Supermarts

Also Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

Let us check out the UTI Flexi Cap Fund returns in detail.

Performance Analysis of UTI Flexi Cap Fund

As of 2025, the UTI Flexi Cap Fund has underperformed for short-term returns, whereas it has shown strong returns over time. Here is the detailed analysis:

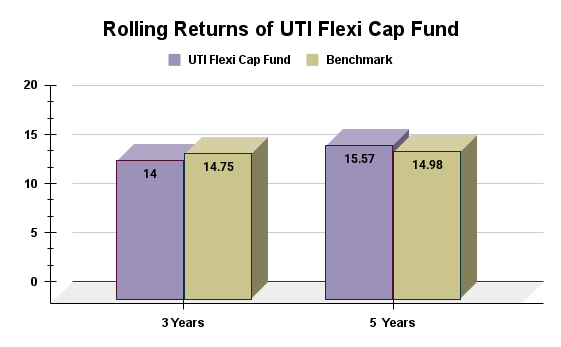

Rolling Returns

The UTI Flexi Cap Fund provides better and more consistent long-term growth. Its strong 15.57% 5 year returns, outperforming its benchmark of 14.98%, prove this. However, in the short term (3 years), the fund slightly underperformed with 14% returns against its benchmark at 14.75%, which indicates that it has a scope for improvement. Look at the graph below:

This shows that the fund is reliable for investors looking beyond index returns. It also balances growth with stability well.

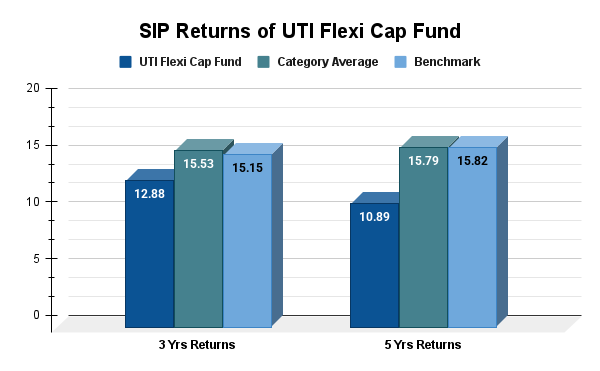

SIP Returns

The returns of the SIP investments in the UTI Flexi Cap Fund over the 3 and 5 years are 12.88% and 10.89%, respectively, slightly lower than the category average and benchmark. Investors need to consider the category and index returns when making decisions. Refer to the graph given below for a clear understanding:

The fund offers consistent but modest SIP gains compared to the benchmark and peers.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Let us explore the style and philosophy behind the fund's investments.

UTI Flexi Cap Fund Investment Strategy

The UTI Flexi Cap Fund adopts a buy-and-hold investment approach. It primarily invests in rising companies in secular growth sectors that can beat market timing and perform consistently with active management. The fund conducts a detailed research session to select companies with strong management and proven growth potential.

The mutual fund's core investment principle is based on the QGV framework, a flexible approach to long-term wealth creation across different market capitalisations. The QGV framework stands for:

| Value | Description |

|---|---|

| Quality | Selecting companies with high ROCE (Returns on Capital Employed), strong fundamentals and solid management. |

| Growth | Invest in companies with long-term growth potential (5-10 years) in secular growth industries less affected by market cycles. |

| Valuation | Invest in companies that generate consistent cash flow. However, it can be flexible on prices in a rising market. |

The fund uses a bottom-up analysis for cash flows, earnings visibility, ROE and management quality. It adopts a top-down overlay for sector trends like BFSI expansion, digital economy and energy transition.

Let us analyse the fund's portfolio composition in the next part.

Analysing Portfolio of the UTI Flexi Cap Fund

The diversification and composition of the fund's portfolio decide how well the fund will perform in the market. Here is the portfolio composition of the fund:

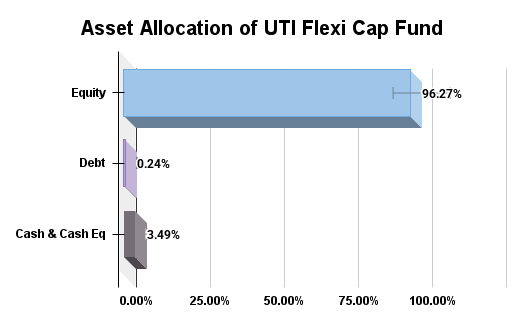

Asset Allocation

The UTI Flexi Cap Fund primarily invests in equities, with 96.27% aiming for growth over time. The fund also contributes a small portion in debt (0.24%) and cash equivalents (3).49%) for liquidity and stability. The flexi cap funds focus on stocks of various sizes to help increase the value of investments.

This aggressive investment strategy is best for investors who want growth and are comfortable taking more risks.

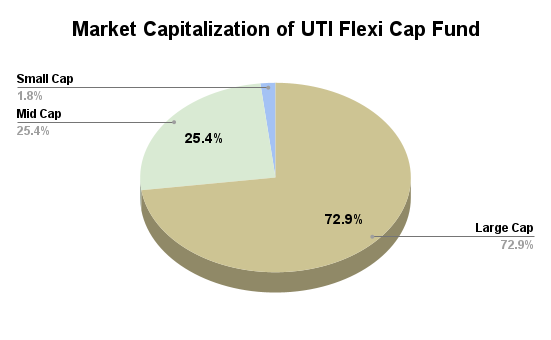

Market Cap Allocation

The UTI Flexi Cap Fund portfolio is mainly invested in large-cap stocks, which make up about 72.86% of it and provide stability and growth. Aiming for higher returns, the fund gives 25.35% of its portfolio to mid cap stocks. Lastly, to balance out risk & growth opportunities, the fund invests a small portion of 1.79% in small cap stocks.

This mix helps manage risk while pursuing growth, making it fitting for investors seeking stability and growth potential.

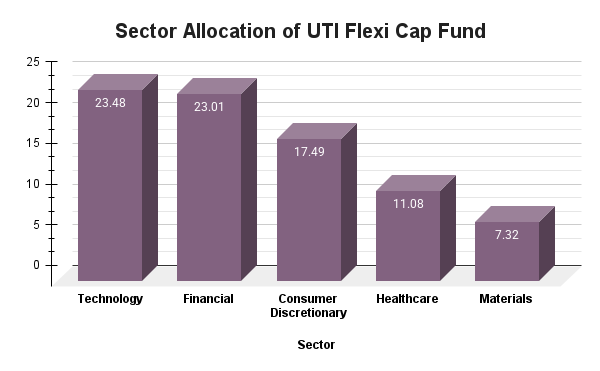

Sector Allocation

The UTI Flexi Cap Fund has a well-balanced sector allocation. The fund invests heavily in Technology (23.48%) to capture tech sector potential and Financials (23.01%) for stability. For long-term growth with sector leaders, it invests in Consumer Discretionary (17.49%) and Healthcare (11.08%). 7.32% in Materials ensures a broad sector coverage while managing risk effectively.

This mix of sector allocation makes the fund well-positioned for varied market conditions.

Now, the following heading will introduce you to the experts behind the fund's growth stories.

Fund Manager of the UTI Flexi Cap Fund

The UTI Flexi Cap Fund operates under the direction of its management team of three personalities. The names of these three characters are: Ajay Tyagi (since January 2016), Kamal Gada (since April 2025) and Ravi Gupta(since August 2024).

The most crucial persona of these three is Ajay Tyagi, the Fund Manager of the UTI Flexi Cap Fund and head of the equity division at UTI Mutual Funds. He joined UTI in 2000 and has over 25 years of experience in the equity market. He mainly focuses on quality, growth and long-term value.

Tyagi and his supportive team employ an investment strategy of holding stocks for years with minimal portfolio adjustments, ensuring steady fund performance and investor confidence. This disciplined approach helps the fund stand out and build wealth patiently.

Now, the main question: "Is the UTI Flexi Cap Fund a good investment for you in 2025?" Let us know in the next heading.

Is the UTI Flexi Cap Fund Good for 2025?

The UTI Flexi Cap Fund has a flexible strategy and solid long-term growth potential, but its recent underperformance and high risk profile are crucial factors to consider. Here are the factors that add to the fund's strength and make it a good option for 2025:

Adaptable Strategy: A flexi-cap fund's ability to shift its allocations across market caps is an advantage in 2025 market instability due to global factors like inflation and liquidity.

Long-Term Growth Potential: The fund's structured investment style and strong track record offer appealing benefits to investors with a long-term horizon (more than 5-7 years).

Lower Volatility: The fund can be a good option for investors seeking stability in their equity portfolio, as it has historically demonstrated lower volatility than its benchmark.

Active Management: The fund's experienced management team navigates dynamic market conditions and implements the fund's QGV (Quality, Growth and Valuation) growth strategy.

In short, the UTI Flexi Cap Fund is a good choice for 2025 if you want long-term growth. It posted a 15.57% return over 5 years, making it ideal for investors with a long-term growth perspective and good risk tolerance.

Must Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Now, let us explore the risk measures and the quality of stocks in the fund.

Risk and Stock Analysis of the UTI Flexi Cap Fund

The UTI Flexi Cap Fund's risk and stock analysis reveals a diversified portfolio & a flexible approach, but with some notable risks. Here is the analysis of the fund:

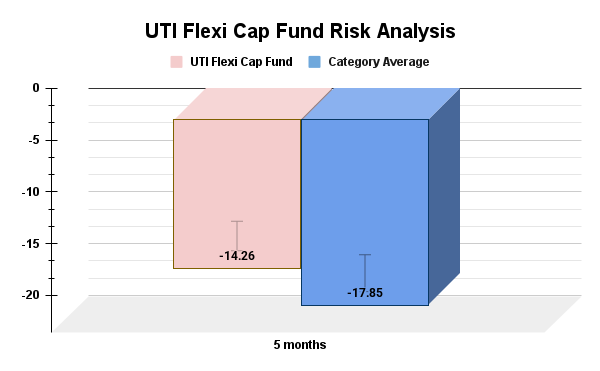

Risk Measures

The UTI Flexi Cap Fund has a standard deviation of 12.34%, below the category average of 13.37% and a beta of 0.82, showing lower volatility. However, its Sharpe ratio of 0.34 and alpha of -2.3 display underperformance against its benchmark. Refer to the graph below for a clear picture:

With a maximum drawdown of -14.26%, the fund shows moderate volatility but needs to improve in delivering excess returns.

Stock Quality

The UTI Flexi Cap Fund shows higher earnings (15.27), sales (18.74) and cash flow (20.02) growth than category averages, but with a high P/E (37.55). Its strong fundamentals display its efficient management, consistent growth potential and investor confidence. Look at the table below:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 18.74 |

| Earnings Growth | 15.27 |

| Cash Flow | 20.02 |

| PE- Valuations | 37.55 |

Despite being relatively expensive, the fund’s growth drivers make it an attractive option for long term wealth creation.

You must be curious about the fund's suitability for your unique portfolio, style, and goal. Right? Let us end your curiosity in the next part.

Who Should Invest in the UTI Flexi Cap Fund?

The UTI Flexi Cap Fund is ideal for long-term investors with a very high risk tolerance. Let us check out if you are the perfect investor for the fund:

- This fund is a solid pick to grow your money over 5 to 7 years or more.

- It is a brilliant mix of big and small companies that will give you a good return.

- It is best suited for those comfortable with market ups and downs, as the risks can be higher.

- This fund helps you build a well-rounded core equity portfolio without worrying about choosing between large, mid or small caps.

- You can rely on experienced fund managers who carefully pick quality businesses with strong growth potential.

- Its flexible approach adapts to market changes, giving your investment a better chance to grow steadily.

Pro Tip: Use a SWP Calculator for easy withdrawal of money from your investments.

Concluding the UTI Flexi Cap Fund Review

To conclude the UTI Flexi Cap Fund Review, the fund has shown strong performance over a longer period while offering diversification. But it has recently failed to beat its category and benchmark.

This mutual fund may be a good fit for investors who can handle a high level of risk and want to grow their money with equities. It offers professional management and has a strong track record.

Before investing, check the latest performance data and talk to an advisor to ensure it meets your financial goals.

Related Blogs:

1. Quant Flexi Cap Fund Review: Should You Invest In 2025?

2. HDFC Flexi Cap Fund Review: Should You Invest in 2025?

3. Is Parag Parikh Flexi Cap Fund Good For SIP? Complete Review

FAQs

-

What is the return of the UTI Flexi Cap Fund over the last 5 years?

The UTI Flexi Cap Fund’s 5-year return is approximately 15.59% CAGR (Compound Annual Growth Rate).

-

Is there any lock-in period in this mutual fund?

No, the UTI Flexi Cap Fund does not have a lock-in period. You can redeem your investment units whenever you need to.

-

How do I invest in the UTI Flexi Cap Fund?

You can invest online via the UTI Mutual Fund website or app. For offline investments, you can contact a distributor.

-

How can I redeem my investments in the UTI Flexi Cap Fund?

You can redeem your units anytime through the fund house website or investment platform.

-

What is the AUM or fund size of this mutual fund?

The current fund size (AUM) of the UTI Flexi Cap Fund is about Rs 25,509 crore.

.webp&w=3840&q=75)

.webp&w=3840&q=75)