Table of Contents

- What is AIS in Income Tax?

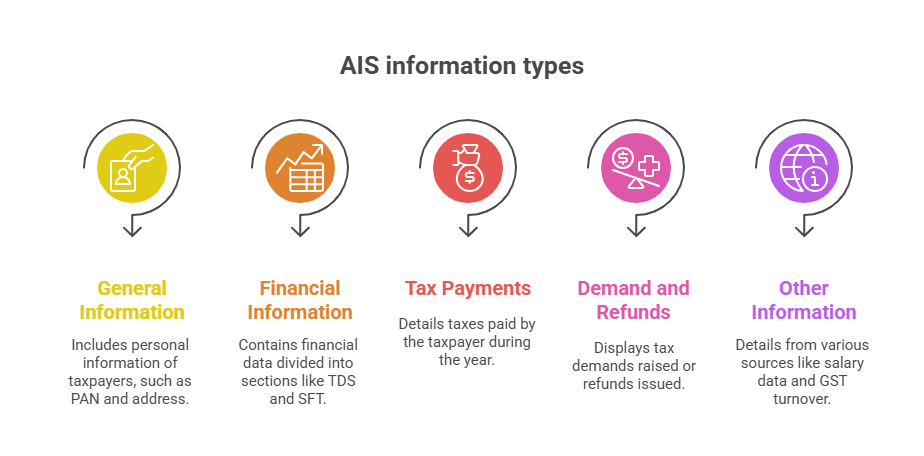

- Which Types of Information Does AIS Cover?

- How to Check Your AIS on the Income Tax Portal?

- How to Download AIS?

- How to Rectify Errors in AIS?

- Steps to Submit Feedback in AIS

- How to Check Your AIS Correction Status?

- AIS During Return Filing

- What Does the Taxpayer Information Summary (TIS) Contain Under AIS?

- Difference Between AIS and Form 26AS

- Conclusion

Are you someone who is struggling to organize your financial statements? Let AIS (Annual Information Statement) do the heavy lifting for you, bringing all your financial transactions together in a simple yet organized format.

Introduced by the Income Tax Department, AIS gives you a 360-degree view of your yearly transactions. AIS in Income Tax collects your financial data, such as total income, investments, taxes paid and even high-value purchases in one place.

But do you know what is even better? AIS is not just a static report. You can review, give feedback and even request corrections directly for your tax records with AIS.

So, are you ready to take charge of your financial story this tax season? Let us dive into what is AIS in income tax and how it can make tax time easier for taxpayers like you.

What is AIS in Income Tax?

The AIS stands for Annual Information Statement, which is a statement by the Income Tax Department containing detailed information about a taxpayer's transactions in a financial year. It is a compounded & detailed review of the financial data of an individual used for filing ITRs (Income Tax Returns) in a specific year.

AIS is simply a large version of Form 26AS and contains some extra details beyond Form 26AS, offering a wide range of financial information for tax filing. AIS in income tax includes the total earnings, overall tax liability & investments made by the taxpayer. This information helps to ensure accurate tax filing.

Primary features of AIS include:

- Display a taxpayer's complete financial information for efficient ITR filing.

- An online mechanism to capture data based on a taxpayer's feedback.

- Encourage taxpayers to report their income and transactions accurately.

- Enable pre-filing of ITRs more accurately for a smoother filing process.

- Discourage any non-compliance with taxes or reporting incorrect income.

Which Types of Information Does AIS Cover?

The information that AIS covers is divided into two parts-

Part 1: General Information

This part of the Annual Information Statement includes the personal information of the taxpayers, including:

- Permanent Account Number (PAN)

- Masked Aadhaar Number

- Name of the Taxpayer

- Date of Birth/Incorporation/Formation

- Mobile Number

- Email Address

- Address of the Taxpayer

Part 2: Financial Information

This part of AIS includes the financial data of a taxpayer divided into sections, including:

TDS or TCS Information: This part shows the information about taxes deducted or collected at source on various income, such as salary, interest, dividend, rent received, professional fees, winnings from lottery or online games and receipts from life insurance policies.

SFT (Statement of Financial Transaction) Information: This includes the information of specified high-value transactions provided by reporting entities like banks, Mutual Funds, Companies, etc. The transaction's information includes:

- Purchase and sale of immovable property

- Mutual fund (SIP)transactions (purchase and sale)

- Share transactions (purchase & sale)

- Cash deposits & withdrawals (high-value)

- Foreign remittances

- Credit card payments

- Purchase of time deposits

Tax Payments: This includes the details of the taxes paid by the taxpayer during the financial year, including:

- Advance Tax

- Self-Assessment Tax

- Other Tax Payments Made

Demand and Refunds: This section of AIS displays information on any tax demand raised or refund issued by the income tax department during the financial year.

Other Information: Various details received from different sources, like:

- Information from Annexure II salary data

- Interest on refunds

- Foreign Transactions/purchase of foreign currency

- GST turnover (reported under information code EXC-GSTR3B)

- Details of pending and completed proceedings

- Information received from any other person

Pro Tip: Use a SIP calculator to track your SIP investment returns quickly.

Now, let us learn how to check AIS on the e-filing portal of the Income Tax Department.

How to Check Your AIS on the Income Tax Portal?

You can check your AIS (Annual Information Statement) on the e-filing portal of the Income Tax Department. Here are the steps to access AIS:

- Step 1:Log in to the e-filing portal at www.incometax.gov.in using your ID(PAN or Aadhar) and password.

- Step 2:Go to the dashboard, on the 'Services' tab and select 'AIS'.

- Step 3:Click "Proceed" to go to the compliance portal.

- Step 4:You can click on the titles Taxpayer Information Summary (TIS) or the Annual Information Statement (AIS) to view the details.

- Step 5:Select the financial year you want to view from the dropdown menu.

- Step 6:Click on the AIS option to see detailed information in Part A (General Information) and Part B (Detailed Financial Information).

- Step 7:Download the AIS in PDF or JSON formats.

Now, the doubt is how to download the AIS. Let us dive into it.

Must Read: What is Tax Planning: Objectives, Types & Importance

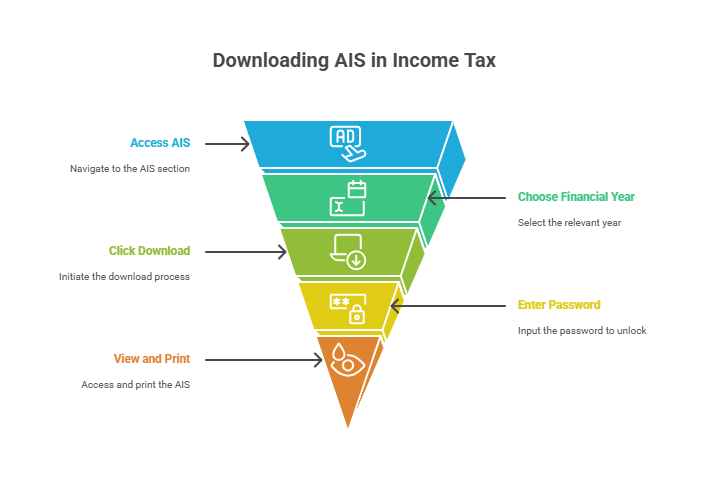

How to Download AIS?

Follow the above-described steps to access an AIS in income tax, that is, start from logging in or registering, then go to AIS, then choose the relevant financial year and then click on download.

The AIS can be downloaded in your preferred format- PDF, JSON or CSV.

The downloaded AIS is password-protected. The password is your PAN (lowercase) followed by your date of birth (DDMMYYYY) without spaces.

After entering the correct password, you can view and print your AIS.

You must be thinking," What if something goes wrong in AIS?" Your concern is right, let us learn how to fix it in the next part.

How to Rectify Errors in AIS?

Rectifying errors in your AIS is crucial, as ignoring them can lead to penalties. If you discover any errors in your AIS and want to correct them, then you can request an Income Tax Department correction through the mechanism provided by them.

The Income Tax Department has designed a mechanism for you to submit your feedback and request corrections. You can access this mechanism through their e-filing portal.

You need to give your feedback over there, which is then forwarded to the reporting source institution for verification. Your feedback's status is updated on the portal, and you can check it there.

If the issue of your Annual Information Statement is still not solved after using the feedback mechanism, then directly contact the reporting institution and check if the data provided from the source was correct.

Keep reading to know how to submit the feedback in the Income Tax Portal.

Steps to Submit Feedback in AIS

Follow the steps given below for submitting feedback in AIS on the e-filing portal of the Income Tax Department:

Step 1: Log in to the official e-filing portal of the Income Tax Department.

Step 2: Navigate to the Annual Information Statement (AIS) option.

Step 3: Select the relevant financial year and review your AIS.

Step 4: Find and select the incorrect information in the AIS.

Step 5: Select the 'Add Feedback' option to start the feedback submission process.

Step 6: Select the relevant feedback type from the window that appeared. Common options are:

| Common Options |

|---|

| Information is correct. |

| The information is not fully correct. |

| Information relates to other PAN/year. |

| Information is duplicate/included in other information |

| Information is denied. |

| Income is not taxable. |

| According to Rajput Jain & Associates, a receipt is not taxable. |

Step 7: Provide details if required for the feedback type.

Step 8: Submit your feedback.

After the submission of the feedback, you will receive confirmation via email and SMS about the submission. An Acknowledgement Receipt will be available for download in the activity history tab.

After submitting feedback, the concern is, what is the status of the error and how to check it. Let us explore it in the next heading.

How to Check Your AIS Correction Status?

Here is how to check your AIS Correction Status after submitting the feedback:

Accessing the AIS Section

Log in to the Income Tax portal, go to the "Services" tab and choose "Annual Information Statement (AIS)". Click on "Proceed" to go to the compliance portal.

Checking Feedback Status

You can see the status of your feedback in the AIS section within the compliance portal. It states if it has been partially accepted, fully accepted or rejected. The attributes of feedback status are:

- If it was shared for confirmation with the Reporting Source

- The date it was shared

- The date of the Source's response

- The nature of that response.

Action after Confirmation

If feedback is partially or fully accepted, the source needs to correct the information by filing a correction statement.

Checking your AIS correction status helps ensure your tax records are accurate.

It's time for the main question now: " What is the importance of AIS in filing ITR?" Keep scrolling to know.

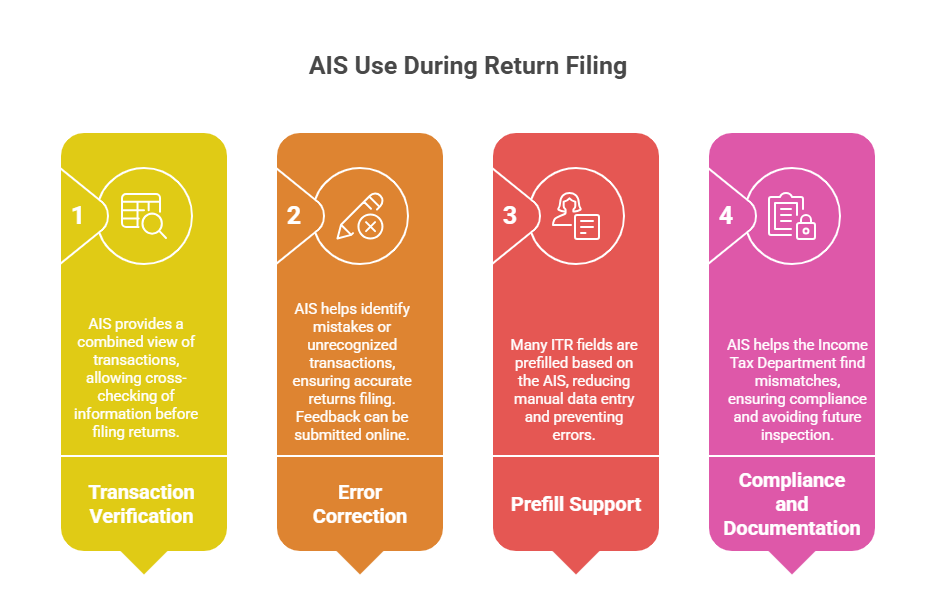

AIS During Return Filing

The AIS (Annual Information Statement) is presented as a main document during the process of filing your income tax return (ITR) in India. The use of AIS during the filing of returns is:

Transaction Verification

AIS allows you to review your information (like TDS or TCS, etc) by giving you an overview of your transactions made from different sources (such as salary, interest, mutual fund, etc) in a year.

Error Correction

AIS helps you identify mistakes or unrecognized transactions present to ensure accurate returns filing. You can submit feedback online on the portal to solve issues like these.

Prefill Support

Many fields in your ITR are prefilled based on the AIS. The TIS (Taxpayer Information Summary) is also made based on the AIS, reducing manual data entry and helping prevent errors.

Compliance and Documentation

The Income Tax Department uses AIS to find mismatches between your declared income and what third parties report. This helps to stay compliant and avoid any future inspection.

Pro Tip: Use a Tax Calculator to estimate your taxes and avoid surprises during filing.

Now, you will explore what TIS contains under AIS.

What Does the Taxpayer Information Summary (TIS) Contain Under AIS?

The TIS (Taxpayer Information Summary) is a categorized summary of a taxpayer's financial transactions. It collects and duplicates the data reported from various sources, processes it and forms a summary used for ITR prefilling. Contents of TIS include:

- Information Categories:Grouping transactions into categories such as Salary, Interest, Dividend, Mutual Funds (SIP), Capital Gains, Rent, etc.

- Processed Value:Value generated after processing and duplicating the reported transactions according to the predefined rules.

- Derived Value:Value accepted by reporting sources after considering the feedback. It is used for prefilling the ITR.

Under each category, TIS shows additional details like:

- The part of AISfrom which information was received,

- Description of the information,

- Source of the information,

- Reported, processed, and derived amounts.

Let us clear the clouds by differentiating AIS and Form 26AS in the next heading.

Also Read: Top 10 Highest Taxpayers In India 2025: Who Pays The Most?

Difference Between AIS and Form 26AS

Given below is a comparison between AIS and Form 26AS to differentiate them accurately:

| Aspect | AIS | Form 26AS |

|---|---|---|

| Purpose | Shows detailed financial transactions beyond tax deductions. | Shows tax deducted/collected details (TDS, TCS) |

| Scope | Includes Form 26AS data plus bank interest, dividends, rent, securities, GST, and foreign remittances. | Tax credits, advance tax, and high-value transactions. |

| Feedback | Taxpayers can give feedback and request corrections. | No feedback mechanism. |

| Access | Via the Income Tax portal with more formats and details. | Via TRACES or the Income Tax portal. |

| Status | A newer, more comprehensive system is replacing Form 26AS gradually. | Currently used, will be replaced. |

This comparison highlights how AIS provides a comprehensive and interactive financial overview, underscoring its importance for accurate tax filing.

Conclusion

To conclude the Annual Information Statement, it is essential for the taxpayers who want effortless and accurate Income Tax filing. AIS combines all your financial transactions to make the review process easy for you.

AIS allows you to control your tax records or statements by reviewing regularly and providing feedback on the basis of the review (if needed). This review process enables you to avoid the penalties for providing wrong information in the filing process.

So, go to the Income Tax e-filing portal today and start exploring your AIS and experience seamless tax compliance like never before.

Related Blogs:

1. What Is the Assessment Year in Income Tax?

2. What is Surcharge in Income Tax: Purpose, Slabs & Relief

H2: FAQs

-

What is an Annual Information Statement, AIS?

AIS is a detailed review of a taxpayer's transactions for a financial year by the Income Tax Department.

-

Is Form 26AS and AIS the same?

They are not the same. AIS is a detailed and enhanced version of Form 26AS with added data and feedback options.

-

Which Form Should a Taxpayer Refer to at The Time of Filing of ITR?

Taxpayers should primarily refer to AIS for a complete overview of their finances when filing ITR.

-

Is AIS mandatory for income tax returns?

AIS is not mandatory, but it is suggested for efficient and accurate ITR filing as it provides complete transaction details.

-

Is Form 16 and AIS the same?

Form 16 is an employer-issued TDS certificate for salary income and AIS is a broad financial transaction statement.

.png&w=3840&q=75)