Table of Contents

- What is Digital Gold?

- How Does Digital Gold Work?

- Why Consider Investing in Digital Gold?

- Pros and Cons of Digital Gold Investment

- Comparing Digital Gold vs. Physical Gold vs. Gold ETFs

- Latest Trends and Regulatory Updates in Digital Gold

- Taxation and Charges: What Investors Should Know?

- How to Invest in Digital Gold? Different Ways to Invest and Best Platforms

- Best Platforms to Buy Digital Gold in India

- Safety, Risks and Regulatory Concerns of Digital Gold Investments

- Is Digital Gold Investment good or bad? Based on Returns and Performance Analysis

- Should You Invest in Digital Gold?

- Conclusion

In today's all-digital world, everything has gone online, even the basic operations of life. But have you ever imagined buying gold online on your phone instead of a visit to the jeweller? Sounds risky? Well, the truth is that with the evolution of the world, the traditional legacy of gold, too, has gone virtual in the form of digital gold in 2025.

Digital gold investments are changing the way Indians think about wealth creation. But that raises an important question many Indians are asking in 2025: Is digital gold investment good or bad? The answer is yes, digital gold investments can be beneficial if done wisely and they provide better returns with easy management.

But, this is not enough to know the answer, right? Well, this blog breaks it all down for you. Dive in to understand if digital gold is the right asset to add to your 2025 portfolio or not.

What is Digital Gold?

Digital gold is a way to purchase, sell and store pure physical gold using online platforms without physically owning it. Online investments in gold are known as digital gold investments. The same amount of physical gold backs every investment made in digital gold by you. For each digital unit purchased, an equal amount of actual 24 Karat physical gold (99.5% or 99.9% pure) is securely stored in vaults by independent providers or custodians.

These insured vaults offer flexibility, easy access and quick liquidity to investors. Digital gold investments allow you to buy gold in small amounts via apps or platforms with a minimum amount as low as you can afford, providing you with both physical gold ownership and digital convenience.

Now, let us see how digital gold investments work.

How Does Digital Gold Work?

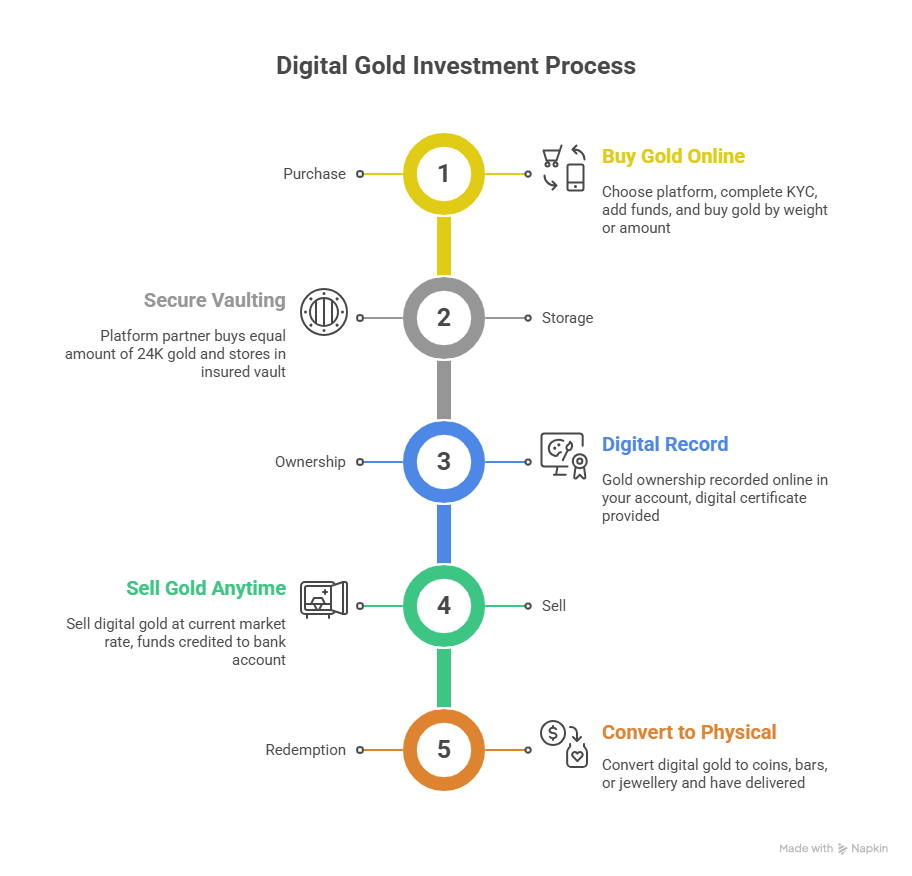

Digital gold works by letting you buy, hold and sell gold online without physical handling. The process is done by digital platforms and apps partnered with trusted vault providers. After choosing a trusted platform and completing KYC, you add funds and purchase gold. Here is how the digital gold investment process works:

Purchasing of the Digital Gold-

- You can buy gold through various platforms, like fintech apps, digital wallets (Paytm or Google Pay) or stockbroking platforms.

- You can buy gold by weight or by amount as low as Rs 1. The price of digital gold is based on real-time market rates.

Storing Digital Gold-

- After you complete the buying process and the transaction is made, he platform's partner (e.g., MMTC-PAMP, SafeGold or Augmont) purchases an equal amount of real gold.

- The equal amount of 24K real gold, which is 99.9% pure, is placed in highly secure and insured vaults.

Ownership of the Digital Gold-

- The gold ownership is recorded online in your account. Some platforms also provide a digital certificate as proof.

- This digital process provides you with ownership of gold without the risk of storing it yourself.

Selling Digital Gold-

- You are allowed to sell your digital gold whenever you want to. You will get the current market rate of your digital gold.

- The platform sells the corresponding physical gold for you and the money is credited to your bank account.

Redemption of Your Digital Gold-

- You are allowed to convert your digital gold into a physical asset in the form of coins, bars or jewellery. This feature is given to you by many platforms.

- This converted gold is delivered to your address, but some making charges may apply.

This is a simple and secure process of digital gold that offers easy access to pure gold without storage worries.

Further, let us answer your question: why you should consider digital gold investments.

Why Consider Investing in Digital Gold?

Several benefits make digital gold investment an attractive option for 2025, such as:

-

Convenience and Accessibility

You can manage your gold investments anytime, anywhere with your phone or computer.

-

Guaranteed Purity

Digital gold is pure 24K gold and is certified by vault partners like MMTC-PAMP and SafeGold.

-

Low Minimum Investment Amount

Allows investments with very low amounts, as low as Rs 1. It also provides mutual fund investments with SIPs.

-

Secure Storage

The purchased gold is placed in secure vaults by trusted custodians, eliminating the risk of theft, damage or loss.

-

High Liquidity

You have the option of converting your digital gold into physical coins or jewellery at live prices without hidden charges.

-

Inflation Hedge

Like physical gold, digital gold can help protect your wealth against inflation and market volatility.

-

Portfolio Diversification

By investing in gold mutual funds through SIPs, you can diversify and stabilise your portfolio.

-

Use as Collateral

You can use your digital gold holdings as collateral for your online loans, acting as an additional financial tool for emergencies.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Now, let us explore the pros & cons of digital gold investments.

Pros and Cons of Digital Gold Investment

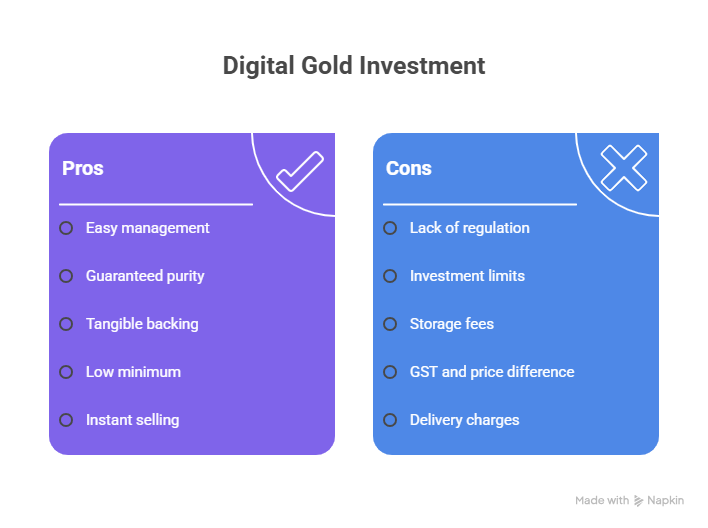

There are several benefits provided by digital gold to modern investors, but there are some drawbacks also that should be considered when investing. Here is the list of both:

Pros of Digital Gold Investments

- Easy management of gold through online platforms.

- Guaranteed pure gold (24K), ensuring authenticity.

- Backed by tangible gold stored in insured vaults.

- It has a minimum investment amount as low as Rs 1.

- You can sell digital gold instantly at live market rates.

- It has no extra making charges, making it more cost-efficient.

- It can be used as security for online loans in emergencies.

Cons of Digital Gold Investments

- It is not regulated by official government bodies like SEBI or RBI.

- May have a limit on investments (around Rs 2 lakhs).

- Some providers offer free storage for only a fixed period (like 5 years).

- Though it eliminates making charges, you may need to pay 3% GST and there might be a difference between buying and selling prices.

- Additional delivery charges could apply if you redeem your purchase.

- Unsatisfying for investors who value the tangible nature of gold, as you do not have direct access to the asset.

- It may become a target of cybersecurity risks, like hacking or other threats.

Let us see a comparison of digital gold investments with other investing options.

Comparing Digital Gold vs. Physical Gold vs. Gold ETFs

Prefer the table given below that displays the key differences between digital gold, physical gold and ETF investments.

| Feature | Digital Gold | Physical Gold | Gold ETFs |

|---|---|---|---|

| Ownership | Ownership of real gold held in vaults | Tangible gold you can touch and hold | Units representing gold holdings |

| Purchase | Online, instant, small amounts | Visit a jeweller or bank, larger buys | Through stock exchanges online |

| Storage | Stored securely by custodians, no hassle | Requires locker/security, risk of loss | Held in a demat account, no physical storage needed |

| Liquidity | Instant buying and selling | Requires physical sale - slower | Traded like stocks, highly liquid |

| Costs | Low premiums, no making charges | Making charges, storage, and purity checks | Brokerage, fund management fees |

| Taxation | Similar to physical gold for capital gains | Capital gains tax with indexation benefits | Taxed as equity or debt mutual funds |

| Convenience | Highly convenient, app-based | Less convenient, physical handling | Convenient, linked to stock accounts |

Must Read: Digital Gold vs Physical Gold: Which is better To Invest in 2025?

Now, let us look at the latest updates on the digital gold trends and regulations.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Latest Trends and Regulatory Updates in Digital Gold

Here are the latest trends and regulation updates on digital gold investments:

Regulatory Updates

- In 2021, SEBI stopped the sale of digital gold, saying that it is not secure and poses risks if the company fails.

- Now, SEBI regulates a new gold exchange, EGRs (Electronic Gold Receipts), which are treated as securities and traded on stock exchanges.

- In 2025, the RBI issued draft guidelines for gold loans, stating that digital gold can not be used as collateral.

- Now, the RBI has decided to stop the Medium and Long-Term Government Deposit parts of the GMS (Gold Monetisation Scheme) as of March 2025, indicating a review of gold investment policies.

Latest Trends (As of 2025)

- Recently, digital gold has become famous among millennials and Gen Z due to its convenience.

- Apps like UPI are making micro-investing and automated SIPs easy.

- In 2025, more investors invested in gold due to global tensions and market fluctuations.

- Some digital gold platforms are using blockchain for more security and permanent ownership records.

- Fintech platforms are offering quick digital gold loans online, however, this trend may be set back because of recent RBT rules.

- More investors are adopting a balanced approach of digital gold (short-term savings) and physical gold (long-term protection).

Let us understand the tax profile and charges of digital gold in the next heading.

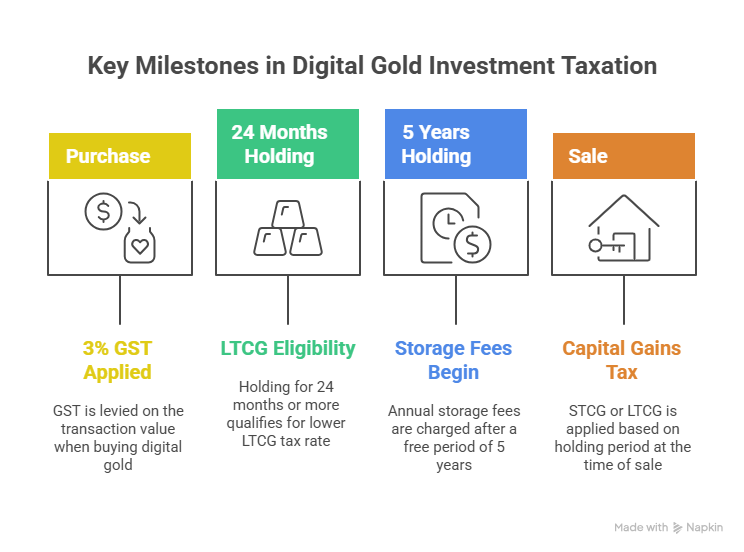

Taxation and Charges: What Investors Should Know?

When investing in digital gold, investors face two main types of costs: a GST (Goods and Services Tax) at purchase and Capital Gains Tax upon sale. Other than these charges, it also includes some additional expenses, such as a buy-sell spread (2%-3%), storage fees after a free period (annual charges after 5 years) and conversion charges for physical delivery (delivery fees, making charges and an additional 5% GST on the making charges), which can also impact net returns.

Taxation on Digital Gold Investments

You pay a 3% GST on the transaction value when buying digital gold. You cannot recover this tax when you sell the gold. Here are the capital gains tax on the sale of digital gold:

- STCG (Short-Term Capital Gains)-Taxed based on your income tax slab rates if sold within 24 months.

- LTCG (Long-Term Capital Gains)-Taxed at a flat rate of 122.5% if held for 24 months or more. The indexation benefits were removed in Budget 2024.

What Investors Should Know?

- Selling investments too soon can be expensive with all the charges.

- To benefit from a lower 12.5% LTCG tax rate, you need to hold digital gold for more than 24 months.

- When calculating their potential net return, you need to consider all charges and taxes.

- It is essential to check the details like fees, free storage periods and buy-sell spreads before choosing a platform.

Let us learn where and how you should place your digital gold investments in 2025.

Pro Tip: Use a Tax Calculator to estimate your tax liability on your investments.

How to Invest in Digital Gold? Different Ways to Invest and Best Platforms

In India, there are various ways to invest in digital gold, such as:

- Fintech and UPI Apps- Apps like Paytm, PhonePe and Google Pay allow users to buy gold as a micro-investment. The app handles the purchase and a vault partner holds the gold.

- Dedicated Gold Platforms- Platforms like SafeGold, MMTC-PAMP and Augmont offer direct investment opportunities. They also provide SIP and other options.

- Jewellery Brand Apps- Established jewellers like Tanishq offer digital gold through partnerships with vaulting partners like SafeGold.

- Brokerage Apps- The stockbrokers and investment platforms offer digital gold alongside other assets like stocks and mutual funds.

- Auto-Investing Apps- Apps like Jar automatically round up your daily digital transactions and invest the spare change into digital gold.

Here is how to invest in digital gold:

- Step 1: Select a reputable platform and ensure it partners with a reliable vault provider.

- Step 2: If the investment is above Rs 49,999, then you need to complete your KYC verification.

- Step 3: Add funds or money to your account using the payment options offered by the app.

- Step 4: Go to the digital gold investment section & place your buy order.

- Step 5: Confirm your order and pay using your preferred method.

- Step 6: You can monitor the value of your gold holdings and buy or sell more as needed.

Don’t Miss: How Much GST on Gold is Charged in India? 2025 Update

Let us learn about the best platforms to but digital gold.

Best Platforms to Buy Digital Gold in India

Here is the list of the best platforms and apps to buy digital gold in India:

| Platform | Minimum Investment | Key Features | Storage & Safety | Fees & Charges |

|---|---|---|---|---|

| Paytm Gold | ₹1 | Instant buy/sell, linked to Paytm Wallet | Bank-grade security, insured vaults | No purchase fees |

| PhonePe Gold | ₹1 | Buy from MMTC-PAMP & SafeGold, recurring purchases | Secured digital vaults | 0% fees on purchases |

| Google Pay | ₹1 | Integrated with UPI, real-time price updates | RBI-registered vaults | No fees |

| MMTC-PAMP | ₹100 | Trusted brand, option for physical delivery | Insured vault storage | Small handling fee for delivery |

| SafeGold | ₹1 | Partnered with many fintech apps & jewelers | Insured vaults | Nominal service charges |

| Groww | ₹1 | Integrated with investments platform | Vaulted storage via partners | No extra fees |

| Tanishq DigiGold | ₹100 | Redeem digital gold as jewelry in stores | Secure storage with SafeGold | No locker/storage fees |

| Jar | Variable | Auto-invest by rounding up expenses | Safe digital vaults | No explicit fees mentioned |

Now, let us look at the safety and risks associated with digital gold investments.

Safety, Risks and Regulatory Concerns of Digital Gold Investments

In India, digital gold is relatively secure due to its backing by physical gold stored securely. However, it includes some risks as the government does not regulate it.

Here is the safety and risk analysis of digital gold investments:

Digital gold is said to be a more secure investment than physical gold because it is backed by 24K real gold stored in secure vaults by trusted companies like MMTC-PAMP and SafeGold. This setup eliminates the risks like theft and damage while offering safety without the struggle of storage.

However, since these investments are not made directly under the RBI or SEBI, they may contain some risks related to the trustworthiness of the platforms and how clear their audits are. Apart from this, for digital investments, cybersecurity is also a concern.

Overall, digital gold offers a balance of convenience and security, but it is essential to invest through reliable platforms that have strong security measures for your investments.

The following are the regulatory concerns of digital gold:

Official government bodies do not regulate it and it exists in a regulatory grey area, making it a little less secure than Gold ETFs and Sovereign Gold Bonds. In 2021, SEBI informed brokers and investment advisors that they cannot offer digital gold, as it is not classified as a "security", thus separating regulated entities from the fintech-driven digital gold market.

As a result, SEBI introduced Electronic Gold Receipts, which are tradeable on stock exchanges under SEBI's supervision, offering a more regulated alternative.

Also Read: Gold BeES vs Gold ETFs: Expert Comparison to Invest in Gold

Now, let us jump to the main question: "Is digital gold investment good or bad in 2025?" Keep reading to know.

Is Digital Gold Investment good or bad? Based on Returns and Performance Analysis

In 2025, digital gold is a more intelligent and reliable investment option than physical gold if you are looking only at the returns and money matters. The main reason for this is that digital gold does not involve making charges and storage fees that come with physical gold.

Let us understand it with an example-

Assume you are buying gold jewellery in 2025. It means you need to pay an extra 10-25% making cost. This additional money you will never get back. On the other hand, if you buy digital gold, which hardly has any extra charges apart from a small GST and a low storage fee after a set period. You can save so much money.

Now, if you had invested in both physical and digital gold over the last five years, digital gold could have earned you a net return of about 36%, while physical gold might have only earned you 14% after deducting all those extra costs. That is a big difference, especially for long-term savers.

In simple terms, digital gold is a good investment if you are looking for cost-efficiency, easy access and want to avoid the stress of storing physical gold, but consider your investment horizon, costs and tax impact carefully before investing.

Let us know who should invest in digital gold.

Should You Invest in Digital Gold?

Here are the situations where digital gold is an ideal investment for you:

- If you want convenience, easy accessibility and micro-investing in gold.

- If you are looking for high liquidity.

- If you want to avoid the risks and costs associated with storing physical gold.

- If you are seeking short-term storage for future use.

- If you want to invest in pure gold only, with a guarantee of its pureness.

- If your goal is long-term wealth preservation.

Smart Investments, Bigger Returns

Conclusion

To conclude, if your goal is to profit from rising gold prices without struggling with its storage, digital gold is a great option. It is easy to buy and sell, secure and can offer better returns than physical gold.

However, it is less regulated by the government than Gold ETFs and SGBs (Sovereign Gold Bonds). Therefore, as long as you use a trusted platform, digital gold is a reliable and straightforward investment option.

Related Blogs:

1. Gold Mutual Funds vs. Gold ETF Which One is Best for You?

2. What will be the Expected Gold Rate in 2025 in India?

FAQs

-

What is the Digital Gold Price?

The price of digital gold is around Rs 12,300 per gram for 24K gold as of November 2025.

-

Is Digital Gold Safe?

It is backed by real gold in insured vaults but lacks direct regulation, so the safety is based on the platform choice.

-

What are the Risks of Digital Gold?

Risks of digital gold include counterparty risks, cybersecurity threats, platform dependency and additional fees.

-

Is Digital Gold Better Than FD?

Digital gold offers liquidity and market-linked returns while FDs give fixed, guaranteed interest.

-

Which is Better, SIP or Digital Gold?

SIPs offer diversification and compounding, while digital gold appeals to gold exposure and liquidity.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)