Table of Contents

- What is Buy Now Pay Later?

- How Buy Now Pay Later (BNPL) Works?

- Top BNPL Companies in India for 2026

- Why Everyone is Using BNPL: The Benefits

- Risks of Using Buy Now Pay Later (BNPL)

- Buy Now Pay Later Fees and Charges

- Buy Now Pay Later (BNPL) Effect on CIBIL Score

- Should You Use Buy Now Pay Later?

- How to Use Buy Now Pay Later Smartly?

- Regulation of BNPL Companies in India

- Future of Buy Now Pay Later (BNPL) in India

- Conclusion

You want it. You click it. You pay... later? That is the magic of Buy Now Pay Later. Basically, it is a smart payment option to buy things now and pay later in installments or a single amount. It is quite interesting that without knowing, this smart payment option became a market boom and is about to hit an estimated business of massive $50 billion in 2026.

The credit goes to BNPL companies in India that have made it easier than ever to shop without paying the upfront amount. But before you hit that "Accept" button on Amazon Pay Later or Lazy Pay, you need to know what you are actually signing up for. Ready to see if this is a smart move for your wallet? Let us dive into how it actually works and how to avoid the "invisible debt" trap.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What is Buy Now Pay Later?

As the name suggests, buy now pay later (BNPL) is a short term credit facility that allows you to buy an item instantly and pay for it after a few weeks or months in installments or a single payment. You can imagine this as a digital version of your local grocer's "khata book".

Today, BNPL has become a global financial transaction system. In India alone, people are expected to use it for purchases worth around $50 billion this year.

Pro Tip: Loan against mutual funds lets you get quick cash without selling your investments, usually at lower interest than regular loans.

But you must be wondering how it became the center of payment options from the cornerstone. Let us see how it works to know why it became so popular.

How Buy Now Pay Later (BNPL) Works?

Whenever you purchase an item, you see a very attractive yet simple option of payment which helps you to checkout in seconds without disturbing your bank balance. Here is the step by step flow of how a typical transaction happens behind a simple click:

- You pick your items and move forward to the payment page. There you will find the Buy Now Pay Later button along with UPI and card options.

- If it is your first time then the app just take few seconds to check on your profile. After this verification, you are assigned a spending limit (say, Rs. 5,000 or Rs. 50,000) depends on your creditworthiness.

- The next step is followed by the selection of a plan where you choose to pay in equal installments or in a single amount.

- After this mutual understanding between you and the BNPL company, the company pays the store immediately on your behalf.

- The merchant confirms your order and the item is shipped to your address.

- Finally, you pay the BNPL company back the amount held due, depending on the plan you chose.

-works_696b585599cfb.png)

BNPL companies offer different repayment methods depending on the company and product:

- Interest-Free Periods: BNPL company facilitates paying within a specific time period (ex. 30-60 days) with no extra charges.

- EMIs: This option helps divide the due payment into several months with or without interest rates.

- Flexible Repayment Plans: Some companies let you choose the number of installments to suit your budget plan.

Pro Tip: Mutual funds are best used for long term goals by starting early, invest regularly and let your money grow with the power of compounding.

Best Mutual Funds for 2026 Backed by Expert Research

Now, let us know which are the companies offer these kinds of services in India.

Top BNPL Companies in India for 2026

You will be surprised to know that the BNPL market has grown into a giant fintech market worth over $35 billion in India. Some of the leading BNPL companies in India include:

- Amazon Pay Later: It facilitates users split payments on buying items on the Amazon platform with interest free options and flexible EMIs.

- Flipkart Pay Later: Similar to Amazon, it also allows users to buy now and pay later on Flipkart with easy repayment options and instant approvals.

- LazyPay: This BNPL is popular for online shopping and bill payments with flexible repayment plans.

- Simpl: This BNPL app is highly known for its smooth app experience and fast approvals.

- ZestMoney: This app mainly focuses on EMIs and higher value purchases like electronics and appliances.

- Slice: It is very popular among millennial which provides easy digital payments for lifestyle spending.

- Paytm Postpaid: Paytm has the immense advantage of integration with the Paytm wallet for all purchases.

Also Read: Equity vs Debt vs Hybrid Mutual Funds: What Should You Pick?

Buy now pay later is now a routine part of our daily life as it gives us a feel like a “khata book” at our local store. Let us check out the benefits of this digital khata.

Why Everyone is Using BNPL: The Benefits

The reason you see Buy Now Pay Later everywhere is not just because it is a cool feature. It actually solves real problems of both the buyers and sellers.

Why Shoppers Love It?

For you as a consumer, it is like a melody in the ears when buying things without disturbing your bank balance. Here is why millions of people prefer the BNPL facility over traditional credit cards:

- You do not need to imbalance your budget for large expenses for your present needs. You can split the payment into 3-6 interest free parts, which becomes a manageable amount per month.

- No more waiting for bank OTPs that arrive late or typing long card numbers. With the help of these apps, a single tap is enough to pay on your behalf.

- BNPL companies often approve your pay later request instantly just by looking at your digital behaviour as against to traditional banks that take days to clear the formalities.

- You get a safe environment by avoiding sharing your bank or card details on every random website. You only deal with a BNPL provider that keeps your account details safe and secure.

Why Merchants and Businesses Love It?

You must be thinking why every website from Zomato to Amazon is pushing you to buy now pay later method. It is because of the massive success of their business. Let us look at the benefits below:

- Data shows that when people tend to buy more using the BNPL payment method. Instead of buying just one item, they buy more knowing that the amount can be splitted in EMIs.

- We often fill the cart and close the app because the total looks too scary. Pay later removes that sticker shock, leading to more completed sales.

- The best part of the shop owner is the zero risk in selling as the consumer will pay later but the BNPL company pays the shopkeeper the full amount upfront.

However, as we have previously discussed in brief about the benefits and usefulness of the BNPL but we cannot deny the risk attached with it. Let us discuss them one by one.

Pro Tip: SIP calculator can show you how a Rs. 5,000 monthly investment could grow to over Rs. 10 lakh in 10 years.

Risks of Using Buy Now Pay Later (BNPL)

While buy now pay later feels simple and stress free but it has a darker side too. Because you do not need to pay currently so it is easy to forget that you have not clicked a button but you are signing a loan agreement. Here are the red flags you need to keep in mind:

- Since you are not paying right away, you tend to buy more than you actually need or can afford. Small installments may look harmless but multiple “pay later” purchases can quickly pile up.

- By 2026, data shows that BNPL users spend up to 20% more per transaction because the cost is divided into multiple installments.

- Most providers report your behaviour to credit bureaus which means a single missed payment of even Rs 500 can shake your CIBIL score.

- When you buy things using BNPL, you do not just pay with money but you also pay with data which is used as a tool to track your behavioral profile.

- There are chances that the data collected from you can be sold to third party advertisers.

- If you buy a defective product using pay later and if the merchant refuses to help then you are still legally required to keep paying the BNPL company while you fight for a refund.

- Since BNPL companies operate mainly online so we can not deny the chances of being hacked which can lead to financial loss to either the consumer or the merchant.

Also Read: SBI Focused Fund Review: Should You Invest in 2026?

Knowing these risks helps you stay in control of your money but you must also know the fees to avoid costly mistakes.

Start Your SIP TodayLet your money work for you with the best SIP plans.

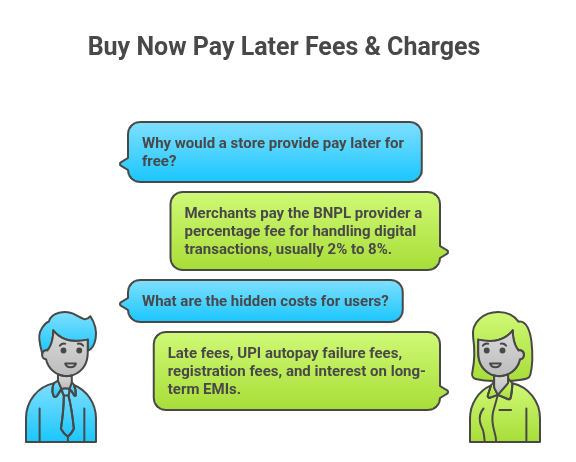

Buy Now Pay Later Fees and Charges

The marketing for buy now pay later always highlights the "0% Interest" part. But to keep business going, let us see how BNPL collects charges:

The Merchant's Side: How Shops Pay for Your Ease

You might wonder why a store would provide you with pay later for free. It is because merchants pay the BNPL provider a mutually agreed percentage fee for handling digital transactions. The merchant pays the fee for every transaction which can usually range from 2% to 8%. This helps the merchants because BNPL users tend to buy more items and complete their checkout 30% faster.

The User's Side: The Hidden Costs

At first, it looks interest might be zero but there are several other ways you could be charged more than the invoice value:

- The BNPL company makes money from users by collecting late fees. If you miss your payment due date then the company can charge fees ranging from Rs. 100 to Rs. 500 or a percentage of your total bill for per missed payment.

- Most of the BNPL apps use UPI autopay. If the auto debit fails for any reason then your bank might charge you a bounce fee and even the BNPL company adds its own late penalty.

- Some providers charge a small registration or account opening fee for the first time you use the service on every bill.

- If you convert a large purchase into a long term EMI (more than 3-6 months), the company can charge you an annual percentage rate of 18% to 36%, which is as high as a credit card.

The above risks are not only the major factors to consider but the effect on CIBIL is also important to take into consideration. Let us check the plus and minus on CIBIL below.

Buy Now Pay Later (BNPL) Effect on CIBIL Score

A common myth is that buy now pay later is "soft credit" that does not affect your financial goodwill. But the truth is BNPL companies in India are now required to report their transaction history to credit bureaus like CIBIL and Experian. Let us know how BNPL companies can affect your goodwill:

- If you are a young shopper and want to build a solid CIBIL score then pay later is a good option to pay your bills as many BNPL companies in India report to credit bureaus.

- Each BNPL account shows up on your report as a "Consumer Durable Loan" or "Personal Loan" which can make you look heavy credit borrower if you open too many accounts.

- Because of high frequency reporting, even a 24 hour delay in repaying a small bill of Rs. 200 can decrease your credit score.

Pro Tip: Mutual fund screener helps you quickly filter and find the best funds based on returns, risk, and investment goals, saving time and effort.

After looking at the risks and benefits, you must be thinking whether you should buy things using BNPL or it is not worthy enough for you. Let us find out the answer below.

Should You Use Buy Now Pay Later?

Today, BNPL is available at every checkout but this does not mean you should always click it. It is a powerful financial tool that can boost your goodwill if used wisely.

Who Should Consider BNPL?

- It is perfect if you have the cash but want to keep your bank balance intact for a few extra weeks while earning interest.

- It could work as a great entry point for students or freelancers to establish a solid CIBIL score without the hurdles of a traditional credit card.

Who Should Avoid It?

- BNPL will likely lead you into a debt trap if "One-Click Buy" makes you spend more than you planned.

- Avoid it if you already have multiple active installments; adding another "small" bill can quickly lead to a total monthly payment you cannot handle.

BNPL is a payment option that is not meant to trap you in debt but it teaches you a disciplined budgeting. Let us see how you can smartly use this for your needs.

Also Read: Difference Between Wages and Salary: Key Differences Explained

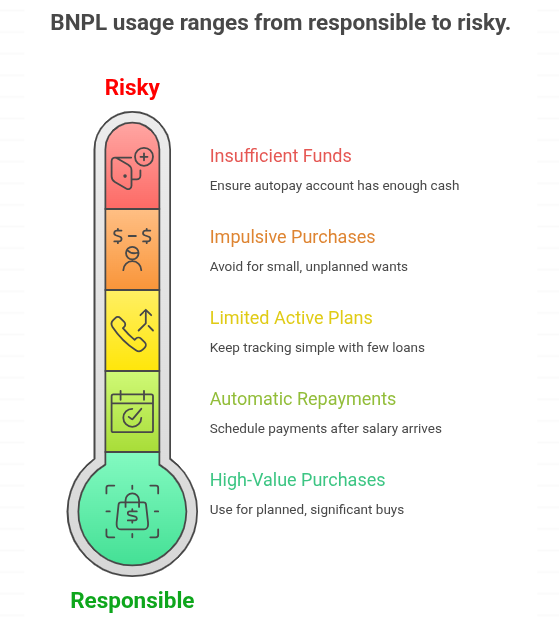

How to Use Buy Now Pay Later Smartly?

Buy now pay later can be genuinely useful when used carefully but it is risky when treated like "free money". Here is how you can use it smartly without falling into a debt trap:

- Remember that even if it is "interest free", you are still borrowing money that needs to be paid back on time.

- Use BNPL for high value purchases like a new work laptop rather than small, impulsive "want" purchases.

- Set up your repayment dates to automatically transfer right after your salary arrives so the transfer does not hit an empty account.

- Avoid taking multiple loans and try to keep only one or two active plans at a time to keep your tracking simple.

- Always take care that your autopay account has enough cash to avoid double penalties from both the app and your bank.

After all the discussion, we must know whether these companies are playing legally in India. Let us check out below.

Regulation of BNPL Companies in India

As of 2026, the "Wild West" era of instant, unregulated credit is officially over. The Reserve Bank of India (RBI) has integrated buy now pay later into the formal financial ecosystem. Let us check how the RBI keeps track of BNPL transactions:

- The RBI treats BNPL balances as regular loans like "personal loan" which has changed how BNPL companies in India operate.

- The RBI ban on transferring credit amount onto non bank prepaid payment instruments like digital wallets. This means BNPL funds will be directly disbursed into your bank account or paid directly to the merchant.

- It is mandatory for every BNPL fintech to partner with a Regulated Entity, usually a bank or a registered NBFC which means the company will have its own platform but money comes from a regulated entity.

- The RBI has set the limit of guarantee that BNPL's can provide to their partner banks at 5% to ensure that lenders do not take reckless risks just to grow their user base.

The regulations clearly indicate that BNPL is not only safe but has a bright future ahead. Have a look at the trends and factors that helps BNPL option to grow in India.

Also Read: Best Way to Save Money: Expert Tips to Grow Wealth Faster

Future of Buy Now Pay Later (BNPL) in India

Earlier, BNPL was mostly seen as a quick and easy way to pay later at checkout but with very few transactions. However, things have changed now, it is expected to be used for purchases worth around $50 billion this year. Let us see how various trends and factors decide the future of BNPL companies in India:

- Platforms are now looking beyond metros and Tier I cities to expand their operations in Tier II or Tier III cities where credit card usage is under 5%.

- BNPL is now a common way to pay for medical and healthcare services like dental work and wellness retreats with a projected growth rate of 25%.

- "Study Now, Pay Later" models are helping students manage tuition fees and enroll themselves in skillful without the burden of heavy interest personal loans.

- "Fly Now, Pay Later" has become a popular trend among Gen Z and millennial travelers which makes vacations more accessible through interest free EMIs.

Conclusion

Buy now pay later has changed the way many people shop and pay in India. It offers convenience, flexibility and quick access to short term credit. Of course it is helpful when used wisely but it also carries hidden risks. Missing payment dates, easy overspending can quietly turn into long term financial stress. While BNPL companies work under strict regulations but responsibility still lies with the user.

The smart way to use buy now pay later is to treat it like a "short term loan" and not as "free money". Before choosing BNPL as a payment option, always ask yourself one simple question: Can I repay this on time without stress? If the answer is yes, BNPL can be a useful tool and if no then skipping it today can save you from costly mistakes tomorrow.

Related Blogs:

- Smart SIP Strategy to Build a ₹2 Crore Wealth in 2026

- 2026 Finance Goals: 5 Key Personal Finance Rules for Better Money Management

Frequently Asked Questions

-

What is Buy Now Pay Later?

It is a way to buy what you want today and pay for it in small parts or a single bill later.

-

How is BNPL different from a Credit Card?

BNPL is much easier to join and usually doesn't have annual fees, making it perfect for smaller, everyday shopping.

-

Does using Buy Now Pay Later affect my CIBIL score?

Yes, most BNPL apps now report to credit bureaus. Paying on time builds your score, but a late payment will hurt it.

-

Is BNPL safe to use in India in 2026?

Yes, it is very safe because the RBI now strictly regulates all bnpl companies in India to protect your data and money.

-

Can I use BNPL through UPI?

Yes! In 2026, you can "Pay Later" by simply scanning any shop’s QR code using apps like Paytm or Mobikwik.

-

Are there any hidden charges in BNPL?

Not usually because the RBI mandates clear fee disclosures. However, always watch out for late fees if you miss a deadline.

-

Is BNPL really interest free?

It's usually 0% interest if you pay within 15–30 days, though longer EMI plans might carry a small interest charge.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)