Table of Contents

Have you ever thought about why some jobs pay employees wages while others pay salaries? At first, both may seem similar, but once you dive deeper, you realize that they are the two sides of the same coin. Now, the question is, what is the difference between wages and salary?

Well, wages are simply the amount paid based on the number of hours you work, whereas, salary is a fixed amount that you get paid regularly, no matter how many hours you work. Both offer different advantages depending on your work style and financial goals.

So, which one fits your career goals in 2026, fixed pay or flexible income? Keep reading to find out.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What is Wages According to Labour Laws?

Wages are basically the money a worker earns for the work they do. Whether the money is paid for per hour, day or task, it all counts as wages under the law. When we talk about wages according to laws, we are looking at the overall compensation more than money. It is about legal protections and rights set by the government for the workers.

Most countries have rules that says what counts as wages, how they should be paid and what rights a worker has in the workplace. These laws determined that workers are fairly paid for the hours they put in and employers must follow them strictly to avoid penalties.

What is Salary in the Context of Employment?

In simple words, a salary is a fixed amount of money that an employee earns for their work, usually paid monthly or annually. A salary does not change with the number of hours you have worked. Salary employees are often offered additional benefits like paid leaves, bonuses, health insurance and retirement contributions, making it a more stable form of income.

In a job, a salary not only represents the income earned but also reflects your role, responsibilities and career level.

Must Read: How to Save Money from Salary Monthly? Best Ways in India

Now, let us look at the difference between the salary and wages based on various features.

Difference between wages and salary in simple terms

If we want to know the difference between wages and salary, we have to look at how each payment works. Let us understand this by looking at a simple comparison chart of wages vs salary.

| Feature | Wages | Salary |

|---|---|---|

| Definition | Payment based on hours worked or tasks completed | Fixed payment over a period (monthly or yearly) |

| Payment Frequency | Daily, weekly, or hourly | Monthly or annually |

| Income Stability | Can vary depending on hours or workload | Fixed and predictable |

| Overtime | Usually eligible for extra pay | Often not eligible for extra pay |

| Common Jobs | Retail, manufacturing, freelance, part-time | Office jobs, professional roles, managerial positions |

| Benefits | Usually limited | Often includes bonuses, paid leave, and insurance |

| Calculation | Hours × Rate or Units × Rate | Pre-determined fixed amount |

As you can see a clear difference between salary and wages in the above table, how they are calculated, paid and what benefits come with them.

Pro Tip: SIP calculator is used to quickly see how much wealth can be built with monthly savings.

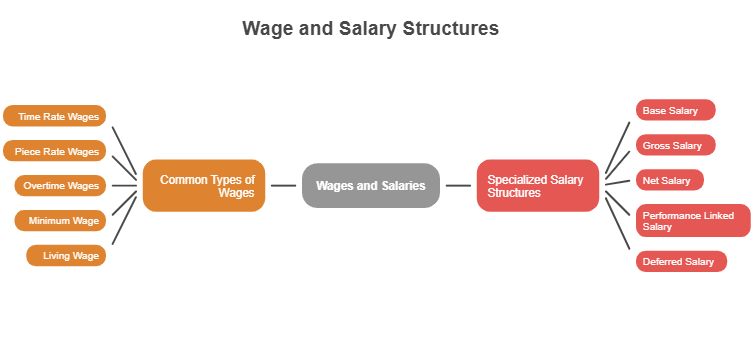

Now, let us look into the types of wages and salaries to see the different ways employees can be paid and what each type means.

Best Mutual Funds for 2026 Backed by Expert Research

Different Kinds of Wages and Salaries You Should Know About

Wages and salaries can be structured in many ways depending on the nature of the job, industry and payment cycle. Let us quickly go through the types of wages and salaries.

Common Types of Wages

Wages are variable payment types typically paid to employees based on the amount of time they work or the task completed. Let us look at some common wage types below:

-

Time rate Wages

It is the most common form in which employees are paid a set rate per hour. Income is calculated by multiplying the hourly rate by the number of hours worked.

-

Piece rate Wages

In this type of pay, the amount is paid strictly on the output of each unit of product. Employees are paid for each unit produced or task completed.

-

Overtime wages

Overtime wages are usually a higher rate of pay set for hours worked beyond the standard 40 hour work week.

-

Minimum wage

It is the lowest hourly rate an employer can legally pay as per the guidelines set by local, state or labour law.

-

Living wage

The lowest amount the law says a worker must receive to afford shelter, food & other necessities.

Specialized Salary Structures

Salaries are fixed amounts paid to employees on a monthly or annual basis, where the number of hours does not matter. Below are certain salary types mentioned with perks and other facilities.

-

Base salary

This is the core fixed amount agreed upon in an employment contract before any bonuses, commissions or deductions are applied.

-

Gross salary

It is calculated by adding all benefits, allowances and bonuses, but before deducting any taxes or contributions.

-

Net salary

This salary is the actual take home amount an employee receives in hand after adding all perks and deducting the taxes, insurance and other contributions.

-

Performance linked salary

In this salary structure, a portion of the fixed salary is assured as a reward if specific departmental goals are met.

-

Deferred salary

The amount in this salary type is earned in the present time, but it will be received at a later date, such as in retirement focused packages.

However, different types of salaries and wages are calculated differently. Let us look some general methods by which basic pay is calculated.

How Wages and Salaries are Calculated?

Have you ever noticed your paycheck and wondered how it was calculated? Understanding the math behind your earnings can help you see exactly what you are getting paid for.

Wages are usually calculated based on the amount of work done. The calculation method depends on the type of pay. The following are the formulas to calculate wages:

- Hourly wages

total pay = hourly rate × number of hours worked

- Daily wages

total pay = daily rate × number of days worked

- Piece rate wages

total pay = rate per unit × number of units produced

Wage calculations can also include overtime, bonuses or allowances depending on labour laws and company policies.

Salaries are generally fixed for a period & do not change with the number of hours worked. Employers calculate a monthly salary by dividing the annual salary by 12 months. Additional perks and benefits like performance bonuses, allowances or incentives may also be included in net payable salary.

Also Read: Tax Planning For Salaried Employees: Best Tax Saving Options

Next, we will look at the pros and cons of wages and salaries to help you decide which suits your career best.

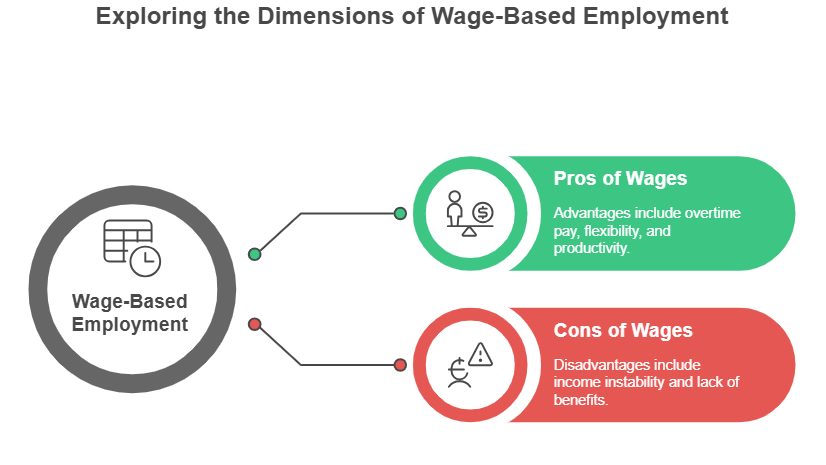

Pros and Cons of Wages

Wages are payments based on working hours and they have their own advantages and disadvantages. This will help you to decide if wage based job is suitable for you or not.

Pros of Wages

- Wage payments generally include paid overtime for working more than standard hours, which is directly connected to their increase in income.

- Wage based jobs usually provide a facility for workers to work part time, or as freelance workers, giving them ease in managing their schedules.

- The money is closely linked to the amount of work to do, which means more work earns more wages. This increases productivity for both the company and employee.

- Wages are often paid weekly or daily, providing faster access to money, which motivates the employee to work hard.

- Since many wage jobs have fewer requirements and are flexible, employees can take up multiple roles to increase their total income.

Cons of Wages

- Since the income is directly connected with hours worked, the income is not stable, making it harder to plan long term finances.

- Wage based jobs generally do not include paid leave, insurance, bonuses or retirement contributions; employees have to handle these benefits on their own.

- Many jobs are seasonal or dependent on market demand, which can result in periods where employees have little or no income.

In the next part, let us look at the pros and cons of the salaries.

Pros and Cons of Salaries

A salary means earning a fixed amount of money regularly, no matter how many hours you work in a day. Although it provides financial stability, it also comes with some limitations.

Pros of Salaries

- Salaried employees receive a consistent amount at regular periods, which makes their financial planning easier.

- Salaries have the added advantages of perks such as paid leave, health insurance, retirement benefits & bonuses.

- Employees are usually associated with long term positions that offer career growth & skill development.

- The amount they get is stable and does not change with daily or weekly working hours, providing peace of mind during low periods.

Cons of Salaries

- Fixed roles may require following strict schedules & extended working hours without overtime payments.

- Employees are often expected to meet targets & responsibilities regardless of workload.

- Salaries are usually increased at the time of the appraisal process over a certain period of time.

Smart Investments, Bigger Returns

Conclusion

So which one is better, salary or wage? The honest answer is - it depends on your work style, financial needs and career goals. If you prefer a steady income, long term job security and added benefits, then a salary may be the better choice.

On the other hand, if you prefer flexible working hours, getting paid for every hour worked or earning more through overtime, then wages might suit you better. In the end, understanding how each pay structure works helps you choose the option that best suits your lifestyle and career goals.

Related Blogs:

Frequently Asked Questions

-

Can a job switch from wage-based to salary-based?

Yes, many roles transition to salaried positions as responsibilities and experience increase.

-

Are interns usually paid wages or salaries?

Interns are most commonly paid hourly wages, especially for short-term roles.

-

Can a salaried employee negotiate pay increases?

Yes, salaries can be renegotiated during appraisals, promotions or role changes.

-

Do salaried jobs always require full time work?

Most do, but some part time or contract roles can also be salaried.

-

Can freelancers be salaried?

Most freelancers are paid per project or hourly, not salaried.

-

Can wage workers work multiple jobs efficiently?

Yes, hourly work often allows more flexibility to take on multiple roles.

-

Is salary better for loan approvals?

Lenders often prefer salaried income because it is consistent and predictable.

-

Are wages adjusted more frequently than salaries?

Wages may change with minimum wage laws, while salaries change through reviews.

.webp&w=3840&q=75)