Table of Contents

- What Is a Recession?

- What Does Depression Really Mean?

- Exploring the Main Differences in Recession vs Depression

- The Main Causes and Past Examples of Recession and Depression

- How Governments and Central Banks Respond?

- Can a Recession Turn Into a Depression?

- The Real Effects on Individuals and Businesses

- How to Prepare for Economic Downturns

- Are there Any Sign of Recession or Depression in 2026?

- Conclusion

If a recession is a magnitude 4.0 earthquake that shakes your windows, then a depression is a 9.0 level that can swing the entire city. So, simply comparing recession vs depression, recession is the slowdown of economic activities that lasts from 6 to 18 months. On the other hand a depression is a more severe version of a recession where GDP could fall by 10% or more and lasts for several years.

Most of us remember the “Great Recession” of 2008 as a period of extreme hardship where the US GDP dipped by 4.3% and unemployment hit an all time high of 10%. But look back at the “Great Depression” where GDP collapsed to 30% and unemployment to 25%. This was not a dip but a total structural failure. So how do you know whether the economy is just shaking or about to collapse? Please continue reading to know how recession and depression affect us all from personal finances to business decisions.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What Is a Recession?

A recession is commonly defined as a period of economic downfall for two consecutive quarters of negative GDP growth. In simple terms, the economy shrinks instead of growing for at least six months.

In the United States, the NBER (National Bureau of Economic Research) institution plays a major role in officially identifying a recession. The NBER identifies by looking at the broader set of indicators, including employment, income, industrial production and consumer spending. This helps them to decide when a recession starts and ends rather than just relying on GDP.

The clear signs of recession can be seen when a country’s total production drops, business stops hiring and lay off workers to save money.

With more people without work, everyone spends less, which forces factories to produce less as nobody is buying their goods. To make the condition worse, banks get nervous and stop lending money which slows down the overall economy.

Now, let us see what depression is for a broader understanding.

What Does Depression Really Mean?

The first thing to know is that there is no fixed technical definition for depression. Instead, it is a title to describe an economic disaster that lasts for several years rather than months. During such periods, economic activities fall dramatically, unemployment remains high for many years, consumers’ purchasing power is lost and recovery is slow and uneven.

The main features of depression show a more severe state of recession. The economy shrinks by at least 10% and stays down for years. The unemployment rate also increased to 25%. Even the strongest companies go bankrupt as people stop buying everything except the bare essentials.

The banking system can collapse during this time where people cannot access their savings, and businesses are unable to raise funds. The impact is so severe that people stop trusting banks and the market for years even after economic conditions start improving.

Now that we have understood what is recession and depression are, we can easily differentiate between the two.

Also read: Recession in India: Is India Heading Towards One in 2025?

Best Mutual Funds for 2026 Backed by Expert Research

Exploring the Main Differences in Recession vs Depression

To clearly understand recession vs depression, here is a simplified comparison that highlights the most important factors.

| Sr. No | Factor | Recession | Depression |

|---|---|---|---|

| 1 | Definition | A significant but relatively short dip in economic activity. | A severe and several years of collapse that paralyzes the economy. |

| 2 | Frequency | A normal and periodic part of the ‘boom and bust’ business cycle. | A rare and extraordinary event caused by systemic failures. |

| 3 | GDP Decline | Typically a mild drop (usually less than 10%). | A massive and sustained fall down (often 10% or more). |

| 4 | Duration | Generally lasts between 6 and 18 months. | Drags on for several years or even an entire decade. |

| 5 | Unemployment | Rates rise but are usually concentrated in specific sectors. | Rates skyrocket (20%+) across almost every industry. |

| 6 | Banking System | Mostly stable with only isolated cases of distress. | Widespread bank failures and a total loss of trust in finance. |

| 7 | Stock Market | Experience volatility and temporary price corrections. | Major crashes followed by years of "bear" (falling) markets. |

| 8 | Business Impact | Some companies struggle while others stay resilient. | Widespread bankruptcies of even the largest and oldest companies. |

| 9 | Recovery Speed | Recovery is relatively quick once the dip hits bottom. | Recovery is slow, painful and requires massive structural shifts. |

| 10 | Government Intervention | Managed with standard tools like small tax cuts or lower rates. | Requires emergency, "New Deal" style massive public works. |

| 11 | Global Reach | Often limited to one country or a specific region. | Almost always global, breaking international trade and relations. |

| 12 | Consumer Habits | People save more temporarily until things improve. | People develop a "scarcity mindset" that lasts for decades. |

One major difference that is usually overlooked is the long term mental impact. A recession is usually forgotten once the good times return but a depression creates a fearful mindset that lasts for generations.

Why this happens, will get clear by reading at the past downturns and their causes below. Let us go.

Pro Tip: Use SIP calculator to check how Rs 5,000/month can grow to Rs 12 lakh in 10 years at 12% returns.

Also read: Difference Between Wages and Salary: Key Differences Explained

The Main Causes and Past Examples of Recession and Depression

By looking back at past crashes and their causes, we can see exactly what causes the economy to shrink and just how bad it can actually get.

What Usually Causes a Recession?

Recession rarely happens automatically; instead, there are certain combinations of events that trigger, like:

- l When prices rise too fast that goods and services reach out of consumers' purchasing power, thus slowing the economy.

- l Central banks raise interest rates to fight inflation, which makes borrowing expensive and slows down business growth.

- l Major asset like housing or tech stocks crash can wipe out wealth immediately.

- l Unforeseen events like pandemics, wars or supply chain collapse are also a major cause that shakes the global economic system badly.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Looking Back at Major Recessions: Real World Examples

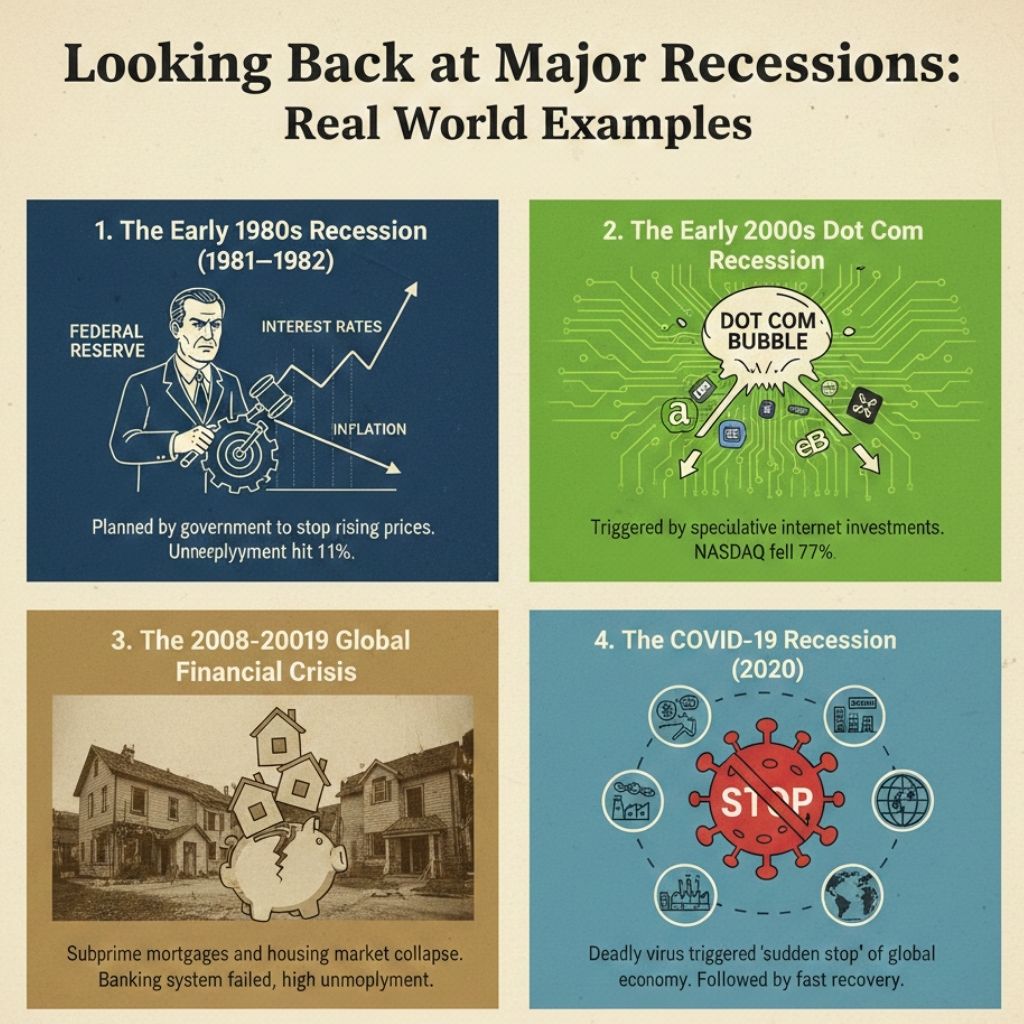

Below are four major recessions that affected modern economic thinking and policy.

1. The Early 1980s Recession (1981–1982)

This recession was planned by the government (Specifically the Federal Reserve) by intentionally raising interest rates to stop the high rising prices of the 70s.

The impact was painful as unemployment hit nearly 11% but it eventually succeeded in stabilizing prices for the next two decades.

2. The Early 2000s Dot Com Recession

This recession was mainly triggered by the explosion of the “Dot Com Bubble” in the late 1990s. Investors put massive capital into internet based businesses that were not actually profitable.

The market crashed with the NASDAQ falling 77% and even giant companies like Amazon and eBay share prices drop by 90% before recovering.

3. The 2008-2009 Global Financial Crisis (The Great Recession)

In 2007, the banks started distributing housing loans without taking care of the credibility of the borrower. People started purchasing houses, which eventually raised the prices and at last the housing market collapsed.

People could not pay back their mortgages and the impact was so severe that the entire banking system failed, leading to the highest unemployment rates since the 1930s.

4. The COVID-19 Recession (2020)

The spread of a deadly virus triggered the 2020 recession. The COVID-19 recession was unique because it was not caused by a financial imbalance or an asset bubble but by an intentional "sudden stop" of the global economy. Later, it was also followed by a very fast recovery.

Understanding the Root Causes of a Depression

In the recession vs depression debate, the causes of a depression are more severe than in a recession. Let us look at some common causes below:

- The rotation of money in the economy haltsas banks fail to serve the bare necessary services, unable to provide credit facilities and stop investments.

- The conditions get worse when governments or central banks raise taxes, increasing interest rates or disturbing global trade.

- A fuel in fire occurs where mass unemployment leads to zero purchasing power of people,causing more businesses to close for a longer duration.

- The crisis sets itsroots deeply by extreme wealth inequality or when over dependency increases on a single resource that makes quick recovery impossible.

Major Depressions That Shaped Economic History

When examining recession vs depression, history provides clear examples of how disastrous a true depression can be compared to a standard recession.

1. The Great Depression (1929-1939)

The most famous example is the gold standard for economic disasters. It started with the Wall Street crash in 1929. It became a depression over time because of the continuous reaction to failures.

The impact was devastating as unemployment in the US hit a record high of 25% and the economy fell by nearly 30%. It was not just an American problem; it caused political instability in Europe and Asia, leading to global trade falling by more than half.

2. The Long Depression (1873-1896)

This period was actually called the “Great Depression” before the 1930s. It was a period of nearly 20 years of slow growth and poor economic conditions. It all started with risky investments in railroads by the banking sector in Vienna and the U.S.

While not as severe as the 1930s crisis but it also led to decades of business failures and social unrest in Europe and North America.

3. The Greek Depression (2008-2017)

The Greek Depression was a massive collapse caused by the 2008 global financial crisis. This happened because the government took heavy loans that they could not afford to pay back.

The impact lasted nearly ten years, during which the economy fell by a record low of 25%. This lead to social unrest where half of all young people in the country were unable to find a job for a long time.

Now, you must have come to know about the history but you do not know how the government deals with such situations. Read further to know more.

Also read: 2026 Finance Goals: 5 Key Personal Finance Rules for Better Money Management

How Governments and Central Banks Respond?

Governments and central banks act as first responders to downturns. Their response depends on whether the situation is a typical recession or a full scale depression. Let us look at how they handle each scenario.

Policy Tools Used During Recessions

- Central banks work towards lowering the interest rates which makes loans cheaper,increasing the spending on goods and services.

- The government may release monetary aid or increase spending on small projects to put cash directly into the hands of consumers.

- This is the direct way of central banks to inject money into the financial system by buying government bonds and other assets.

- Temporary tax relief givespeople more take home money, while boosted unemployment benefits provide a safety net for those who lost their jobs.

Policy Tools Used During Depressions

When everything else fails and the private sector is not spending, then the government steps in with massive amounts of money to keep the entire economy from shutting down.

The government also intervenes to take over failing banks to guarantee all deposits, making sure that the public can access their funds when needed. A depression often leads to permanent changes like the creation of new jobs, new labour laws and improving industries so the economy can recover in the long run.

By looking at all the aspects, can you judge whether a recession turns into a depression? Let us know.

Can a Recession Turn Into a Depression?

Generally, economists look for warning signs that suggest a normal downturn is becoming something much more dangerous:

- Joblessness does not just explode, but it stays at extreme levels (20% or more) for several years, destroying the public’s spending powers.

- People lose faith in the financial system, which makes them run to banks to withdraw their money at once which causes banks to fail.

- The product and services lose their value as there is no demand.But in reality, it stops the economy as businesses stop producing goods and services.

- The crisis becomes more severe if the government accidentally makes things worse with its wrong policies.

In short, a recession can turn into a depression if problems go unaddressed. But even severe downturns can be controlled with timely intervention.

But does this really affect the common people and businesses or is it just a myth? Read below to know this.

The Real Effects on Individuals and Businesses

When we look at the recession vs depression comparison, the biggest difference is found in the lives of people and the survival of businesses. Here is how individuals and businesses experience economic stress.

Impact on Individuals

| Feature | Recession | Depression |

|---|---|---|

| Job Security | Worry about layoffs or hiring freezes. | Massive job loss (1 in 4 people unemployed). |

| Income & Savings | Wages stay flat, savings grow slowly. | Savings may be wiped out by bank failures. |

| Cost of Living | Prices usually stay stable or rise slightly. | Deflation occurs, prices drop but debt grows. |

| Psychology | People become cautious for a year or two. | "Generational Trauma" and permanent fear. |

Impact on Businesses

| Feature | Recession | Depression |

|---|---|---|

| Revenue | Sales drop, especially for luxury goods. | Zero sales even for basic necessities. |

| Staffing | Small, targeted staff reductions. | Massive layoffs just to keep the lights on. |

| Credit Access | Banks are "picky" about giving loans. | Credit freeze, no one can borrow money. |

| Business Survival | Weakest companies may close down. | Systemic bankruptcy across entire industries. |

In short, a recession causes discomfort and temporary hardship while a depression brings deep, long lasting economic & social strain. The good side is that we know what to do in such situations. Let us check it out.

Also read: Best Way to Save Money: Expert Tips to Grow Wealth Faster

How to Prepare for Economic Downturns

Economic downturns can be stressful, but if you have made the provisions, then there is a chance you will be impacted less. The strategy for planning for such scenarios is simple.

Personal Financial Preparation

- Always maintain savings for 3 to 6 months of essentialliving expenses. In a depression, it may take longer to get on the track so a 12 month provision is even safer.

- Always manage your debt and pay down high interest debt to have fewer monthly expenses,thus reducing the pressure if your income stops.

- Do not go for an all in one investment idea. A mix of stocks, mutual funds, bonds and cash helps protect you from a total loss if one specific sector crashes.

- If you have already invested your money in any assets, then do not panic selling when the market seems to be crashing.

- Be careful of investing in any assets and do not speculate that the market is low currently and then it will rise.

- Keep your skills updated or learn a recession proof skill to ensure you stay employed even when the job market has no opportunity.

How to prepare your Business?

- Monitor your daily expenses and try to make a provision of a cash reserve to cover wages, salaries, rent and other unavoidable expenses during months when sales are low.

- Identify non essential expenses that can be cut immediatelywithout hurting the main product or service.

- Always keep multiple strategies that work in different panic situations and help you to know what exactly to do.

- Always have multiple ways to make money by doing business in multiple products, ensuringthat if one part of the economy fails, then another might work for you.

The above precautions clearly show how to save whatever you have and wait for the recovery phase to begin. But are we really moving towards a recession in the near future? Find out next.

Are there Any Sign of Recession or Depression in 2026?

The economy in 2026 feels a bit like a "yes, but no" situation. On one hand, there are definitely some warning signs that show a recession could be there. If people stop spending and businesses stop hiring, then there is are chance that we might see some countries hit a rough patch. For example, the UK is struggling to get more houses built, Australians are being very careful with their money and investors in Europe are behaving nervous. If the problems get worse, those specific areas could see a real slowdown.

_69677ac942e06.jpg)

But here is the good news: there are no such signals of a mass level of worldwide depression going to happen. Even though some parts are weak but others are doing just fine. Until the big players are still growing at a steady pace, there are less chances of being hit by any recession in the upcoming year.

To summarize, 2026 is a year of "wait and see." If things like gas prices or interest rates jump too high then some countries might slip into a recession. But as long as the world's biggest businesses stay strong then we should be able to avoid a major fall down.

Smart Investments, Bigger Returns

Conclusion

In summary, understanding the core differences between a recession vs depression is about identifying the scale of the challenge. A recession is a temporary hurdle but a depression is a systemic collapse that leaves generational damage signs.

Ultimately, the best defence against any downturn is a combination of awareness, preparedness & flexibility.

While we cannot control the global market but we can control our preparations by building emergency savings and aligning our skills. Whether we are facing a mild recession or a more serious down fall, those who are prepared are the ones who not only survive but find new opportunities when the sun eventually comes back out.

Also read:

- Is SIP a Safe Investment in 2026? Truth Of Secure Investing

- What is SIP? How Does It Work to Grow Your Wealth?

Frequently Asked Questions

-

How often do recessions occur?

Recessions are a normal part of the business cycle, typically occurring every 7 to 10 years as the economy "resets" after a period of growth.

-

Who officially declares a recession?

In the U.S., the National Bureau of Economic Research (NBER) officially declares a recession.

-

Is the world at risk of another depression?

While possible, there are less chances today because modern central banks have "safety nets" and faster intervention tools that were non existent in the 1930s.

-

How long does recovery usually take?

A recession usually recovers within 6 to 18 months, whereas a depression involves a grueling recovery process that can last a decade or more.

-

Are depressions avoidable?

Yes, most economists believe that timely government intervention can stop a recession from become a depression.

-

Can you have a depression in just one country?

Yes, a "national depression" can occur, though most major depressions in history have been global.

-

What is the main indicator that a recession is becoming a depression?

The clearest signal is deflation combined with a banking crisis where prices fall and the financial machinery of the country stops working.

-

Why is understandingrecession vs depression important?

It helps individuals and businesses prepare better and respond more wisely during economic uncertainty.