Table of Contents

- Overview of SBI Energy Opportunities Fund

- Recent Returns of SBI Energy Opportunities Fund

- Who Leads SBI Energy Opportunities Fund and What is Their Investment Strategy?

- SBI Energy Opportunities Fund Portfolio Review 2026

- What is the Sector Allocation of the SBI Energy Opportunities Fund?

- Top Holdings of SBI Energy Opportunities Fund

- Analysing the Stock Quality of the SBI Energy Opportunities Fund

- Is SBI Energy Opportunities Fund Good or Bad for 2026?

- Who Should Invest in the SBI Energy Opportunities Fund in 2026?

- To Conclude SBI Energy Opportunities Fund Review 2026

- Future of Buy Now Pay Later (BNPL) in India

- Conclusion

Did you know that the highest energy demand in India is expected to hit 277 GW and is expected to rise to 366 GW by 2027? Yes, India's energy sector is indeed set for high growth in 2026 and in this changing energy scene, the SBI Energy Opportunities Fund offers a strong option for those seeking long-term growth.

Launched on February 5, 2024, by SBI Mutual Fund, this fund invests at least 80% of its assets in companies throughout India's booming energy sectors. But, "Is It Good for Your Portfolio in 2026?"

Let us know with this SBI Energy Opportunities Fund Review, which delves into its returns, portfolio, investment strategy and suitability for investors in 2026. Jump in to make long-term capital with India's energy transition.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of SBI Energy Opportunities Fund

The SBI Energy Opportunities Fund is an open-ended thematic scheme that falls under the category of equity mutual funds. It primarily invests in companies across the entire energy value chain in India to achieve long-term capital appreciation, focusing on both traditional sources like oil, gas and power, as well as new renewable energy sources like solar, wind and hydrogen.

Launched on February 5, 2024, this fund mandates at least 80% allocation to companies in the exploration, production, distribution and processing of energy sources in India.

Here are the basic details of the SBI Energy Opportunities Fund:

| SBI Energy Opportunities Fund – Key Details | |

|---|---|

| AMC | SBI Mutual Fund |

| AUM | Rs 9,129 Crore |

| Current NAV | Rs 10 (as of 14 January, 2026) |

| Benchmark | Nifty Energy TRI |

| Expense Ratio | 0.81% |

| Exit Load | 1% if redeemed within 30 days |

| Risk Level | Very High |

| Minimum SIP Amount | Rs 500 |

| Minimum Lump Sum Amount | Rs 5,000 |

Now, let us look at the returns of the fund and analyse its consistency.

Recent Returns of SBI Energy Opportunities Fund

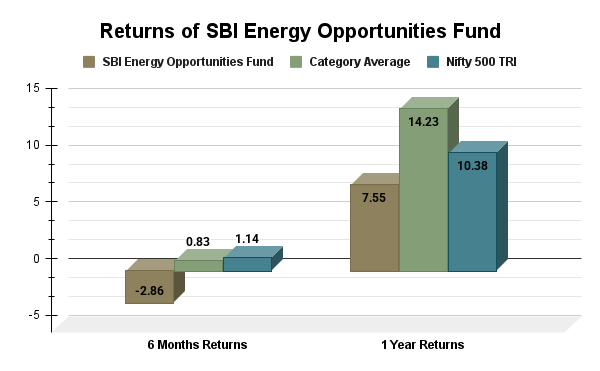

This mutual fund scheme by SBI Mutual Fund focuses over 80% on energy investments, making it very sensitive to these changes. Look at the graph below that shows the returns of the SBI Energy Opportunities Fund against its category average and the benchmark, Nifty 500 TRI (as of January 16, 2026).

The graph shows that the fund has underperformed for its 6-month returns of -2.86, while the benchmark was at 0.83% and the category average was 1.14%. Well, this drop is due to the energy sector uncertainties like oil price changes, fears of a global economic slowdown and delays in moving to green energy.

The 1-year return of 7.55% lags behind the Nifty 500's 10.38% and the category average of 14.23%. This may be due to SBI's focus on oil and gas, power and utilities, unlike other companies that diversify into technology or consumer sectors. Since its launch, the NAV (Net Asset Value) has steadily grown to about Rs 10.72, demonstrating stability amid market fluctuations.

However, the SBI Energy Opportunities Fund is only 23 months old, so it is not surprising that new themed funds often struggle before they succeed.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, let us understand the investment strategy of this fund and get to know the manager.

Best Mutual Funds for 2026 Backed by Expert Research

Who Leads SBI Energy Opportunities Fund and What is Their Investment Strategy?

Raj Gandhi manages the SBI Energy Opportunities Fund and has done so since it started. He is known for choosing quality companies and keeping them for a long time to earn compounding returns. His approach for this fund is called the Barbell Investment Strategy, which focuses on growth through themes.

In this strategy, he targets the companies engaged in both traditional and new energy sectors, such as oil & gas, utilities, power and green energy, for achieving long-term growth. He invests primarily in equity and equity-related instruments of these companies. Gandhi’s expertise in the energy sector and commodities helps him choose the right energy companies and shape the fund's focus on India’s growing energy market.

As for his track record, he has spent more than 20 years in financial markets. Previously, he has been involved in fund management and equity research at Sundaram Asset Management Company, Principal Mutual Fund, Deutsche Equities India, UTI Securities and Angel Broking.

Must Read: SBI PSU Fund Review 2026: Should You Invest or Avoid?

Moving on, let us understand the portfolio composition of this fund.

SBI Energy Opportunities Fund Portfolio Review 2026

The portfolio of the SBI Energy Opportunities Fund has the following allocations:

Asset Allocation

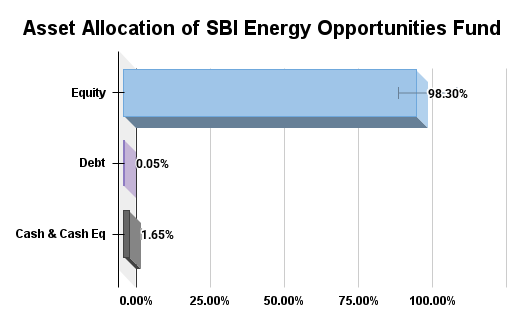

The fund's asset allocation strategy highlights its intentions of aggressive growth in the volatile energy market in 2026.

The large portion in equities (98.30%) serves as strong support for a fund designed to invest over 80% in energy sectors.

The small debt portion (0.05%) keeps the fund simple, avoiding interest costs when markets are strong. The 1.65% in cash acts as a safety net for downturns or new opportunities, like buying undervalued utilities after an oil price drop.

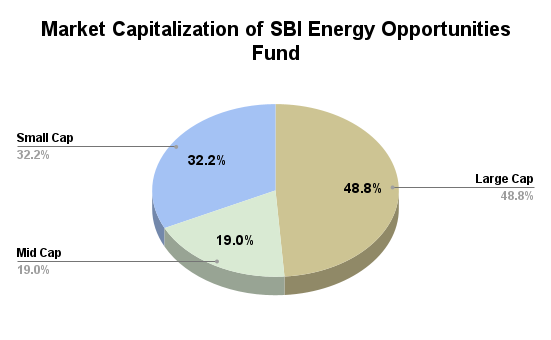

Market Cap Allocation

This fund has nearly half of its allocation in large caps (48.84%), which provide stability from oil companies and utilities that can handle market ups and downs. The interesting part is the 18.97% in mid-caps and 32.19% in small caps, which add growth potential.

This allocation is not random; it is a strategic choice for an energy-themed fund. Focusing on small and mid-cap stocks (over 50%) aims to capture high returns during investment cycles and reforms, while still maintaining some safety with large caps.

Unlike more diversified mutual funds that invest 20-30% in debt, SBI almost exclusively invests in stocks, making it a high-risk option for long-term investors. While this strategy can lead to significant gains of 20% or more when favourable policies arise, small-cap stocks may drop sharply during market downturns.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

In the next section, let us look at the sectors the fund allocates its investments into.

Start Your SIP TodayLet your money work for you with the best SIP plans.

What is the Sector Allocation of the SBI Energy Opportunities Fund?

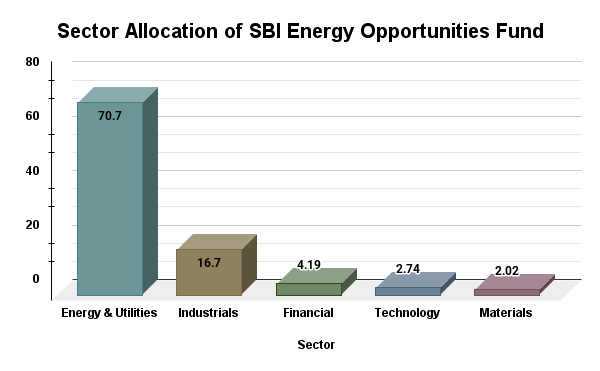

As one of the Energy Mutual Funds, this mutual fund also invests in India's booming energy sectors, which have a lot of potential (and some risks) as the country’s energy market is set to grow by 2026.

The fund's large shares in Energy & Utilities (70.7%) are not surprising since it includes oil and gas refining, power grids and utility companies that are the key players in India's energy sector. The 16.7% in Industrials helps with infrastructure, which is involved in building transmission lines for the Rs 12 lakh crore investment.

The Financials (4.19%) and Tech (2,74%) sectors provide some support through energy lenders and green technology, while the small Materials (2.02%) allocation keeps costs down. The top three sectors together account for about 92% of the fund, showing a strong focus.

Now, let us look at the top holdings of this mutual fund.

Top Holdings of SBI Energy Opportunities Fund

The following are the top 10 holdings of the SBI Energy Opportunities Fund, along with their allocations:

| Rank | Stock Name | Allocation (%) |

|---|---|---|

| 1 | Bharat Petroleum Corp Ltd | 9.12 – 9.73 |

| 2 | Reliance Industries Ltd | 8.83 – 10.16 |

| 3 | Indian Oil Corp Ltd | 8.26 – 9.44 |

| 4 | NTPC Ltd | 6.90 |

| 5 | Gujarat State Petronet Ltd | 5.43 |

| 6 | Kalpataru Power Trans Ltd | 4.58 |

| 7 | Thermax Ltd | 4.46 |

| 8 | Hitachi Energy India Ltd | 4.16 |

| 9 | HEG Ltd | 3.84 |

| 10 | Petronet LNG Ltd | 3.80 |

This fund also includes up to 35% allocation to international stocks to diversify and capture global energy trends.

Also Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

In the next part, you will go through the analysis of the quality of the fund's stocks. So, keep reading.

Analysing the Stock Quality of the SBI Energy Opportunities Fund

The fund manager of this fund invests in a focused group of about 30-35 stocks, out of a total of 90-95 options. This highlights his strong beliefs about which stocks will offer the best returns. Here is the table with the quality metrics:

| Fundamental Ratios | |

|---|---|

| Sales Growth | 9.2% |

| Earnings Growth | 8.85% |

| Cash Flow Growth | -12.33% |

| P/E Ratio (Valuations) | 13.15 |

The fund has a P/E ratio of 13.15, more than the category average of 12.76, which means the fund pays a little more for its earnings, which is reasonable for strong energy investments.

The earnings and sales growing around 9% shows that the fund is expanding, reflecting a rise in India's power demand and refinery activity. The cash flow drop of -12% is typical in sectors that spend heavily on infrastructure that takes time to generate cash, but should recover with support from policies.

The fund outperforms the category averages in all areas, which shows that the manager, Raj Gandhi, selects strong investments with real growth potential, rather than poor options. In this kind of focused fund, having quality investments helps reduce volatility compared to funds that chase trends.

Now, here comes the main question: Is this fund suitable for investments in 2026? Let us find out.

Is SBI Energy Opportunities Fund Good or Bad for 2026?

India's energy sector is changing fast. The country is aiming for 500 GW of non-fossil energy capacity by 2030 and plans to reach net-zero emissions by 2070. With these goals, the 2026 budget is set to provide major support for solar, wind, nuclear energy, green hydrogen and grid improvements. Peak energy demand is expected to reach 277 GW this year. It could rise to 366 GW by 2027. This situation will create new chances for the energy sectors.

The SBI Energy Opportunities Fund is designed to capitalise on these trends. It invests 70.7% in energy and utilities, 16.7% in industrials, with some funds in financials and tech sectors, all falls under these trends. Although the fund has faced a decline of 2.86% over the past six months due to oil price fluctuations and has a 7.55% return over the last year, compared to the benchmark's 10.38%.

If policies favour green energy, investors might see returns of 15-25% per year. Considering a SIP for over 5 years in 2026, you can still grow with this bet, even with the high risk level of the fund. This fund works well in a diversified portfolio, suggesting an allocation of 10-15%. It may not be suitable for risk-averse investors.

Lastly, let us look at who should invest in this fund in 2026.

Who Should Invest in the SBI Energy Opportunities Fund in 2026?

The following are the investors' profiles that are the most suitable for the SBI Energy Opportunities Fund investments in 2026:

- Investors with a very high risk tolerance.

- Those who can invest for at least 3-5 years or longer.

- Those who are looking to capitalise on the long-term growth potential of the energy sectors in India.

- This investment is suitable for people who want to make a tactical allocation to their equity portfolio.

- Investors who have confidence in India's energy market and its economic growth.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

To Conclude SBI Energy Opportunities Fund Review 2026

To wrap it up, investments in the SBI Energy Opportunities Fund are a good alternative that will shape a new direction for your current portfolio. By investing in this energy fund, you will get a lot of growth potential and scope for making high returns.

For 2026, invest in a SIP if you have a horizon of 5 years or more. This allows you to average out costs during market dips, aiming for a potential annual growth rate of 15-20% due to energy trends.

Related Blogs:

- Top Performing Equity Mutual Funds 2026: Highest Return Picks

- SBI Focused Fund Review: Should You Invest in 2026?

- SBI Contra Fund Review 2026: Should You Invest Now?

FAQs

-

What are the risks of the SBI Energy Opportunities Fund?

This fund has a very high risk level due to large price changes, delays in policy decisions, focus on specific themes and large small-cap exposure.

-

What is the impact of green hydrogen on the fund?

The Budget 2026 offers excellent opportunities for investments. If reforms are successful, there is potential for returns of 15-25%.

-

When to exit the SBI Energy Opportunities Fund?

Policy issues are holding back progress, with crude oil price changes; consider adjustments if your horizon is less than three years.

-

Is the SBI Energy Opportunities Fund suitable for beginners?

If you are a new investor, you can invest through SIPs and plan to invest for over five years. But note that it carries a high risk.

-

What is the suitable SIP amount and horizon for this fund?

You can invest Rs 1000 to Rs 5000 monthly for more than 5 to 7 years, minimum, for future gains.

Disclaimer: The views and opinions expressed in this blog are for informational purposes only and do not constitute financial, investment or legal advice. Mutual Fund investments are subject to market risks, always read the scheme documents carefully. It is advisable to consult a qualified financial advisor before making any investment or trading choices.

.webp&w=3840&q=75)

.webp&w=3840&q=75)