Table of Contents

Have you ever thought about how different types of bank accounts in India can help you manage your money better? If not, then you need to. Most of the people in India are unaware that there are many types of bank accounts for their different needs, from a savings and current account to FDs, RDs and demat accounts, catering to everyone's diverse needs.

But the question is, which type of bank account is best for which type of financial need? Or more importantly, which one should you choose in 2026? This post can clear your every doubt. You will see the features of all bank accounts and will learn which one might just be your 2026 game-changer. So, let us dive in.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Types of Bank Accounts in India: Importance and Features

A bank account can be defined as a financial tool for managing personal and business finances, maintained by a bank or other financial institution. A customer can deposit their money in a bank account to save it. They can also withdraw their money whenever they want, record financial transactions and manage their finances securely.

The banking system in India provides different type of accounts in various types of banks to meet various financial needs of everyone. The most common types include:

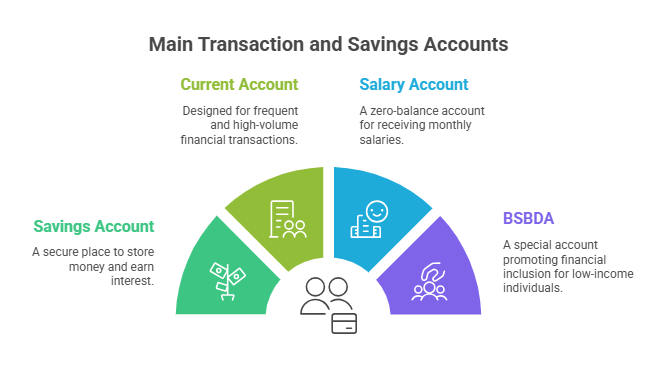

Main Transaction and Savings Accounts

1. Savings Account

It is a type of bank account in which individuals can securely store their money, save for the future and earn interest on their deposits. It lets you save the money and also provides easy access to your money when needed. The features of these accounts are:

- These accounts pay you interest on the money held in a savings account, ranging from 2.50 - 4% p.a. in public banks and up to 2.70-3.50% in private banks. For large balances, private bank pays 7% rates p.a.

- Here, your money is insured by deposit insurance schemes, like the DICGC in India.

- Allows easy withdrawals through various channels.

- You need to keep a minimum average monthly balance.

- These accounts have limited free transactions.

- It also provides access to other banking services like net banking, mobile banking, loan applications, FDs and RDs.

Importance of a Savings Account

A savings account creates financial discipline by separating long-term savings from daily spending. It is an ideal place to build an emergency fund. The interest earned helps your money grow over time, making it a foundation for good financial health. It offers a reliable and convenient way to conduct modern financial transactions.

2. Current Account

This bank account is designed to manage frequent and high-volume financial transactions. Businesses, entrepreneurs & professionals commonly use these accounts to manage everyday business activities. They provide high liquidity and flexibility. The following are the features of a current account:

- These accounts usually do not earn interest as savings accounts do.

- They allow an unlimited or very high number of daily transactions.

- They come with an overdraft option, allowing you take out money up to a set limit, even if you do not have that much in your account.

- They provide access to business services.

- You can manage banking across multiple locations and make bulk payments.

- They require a higher minimum average balance to be maintained.

Importance of a Current Account

A current account is a vital financial tool for businesses and professionals as it is a central hub for all financial activities, maintains cash flow management, enhances the company's credibility and professional image, simplifies financial tracking and control and provides access to credit.

Must Read: Best Way to Save Money: Expert Tips to Grow Wealth Faster

3. Salary Account

It is a type of savings account opened by an employer for their employees to receive their monthly pay. These accounts usually come from a deal between a company and a bank. They offer several benefits for salaried employees and typically do not require a minimum balance. Here are its main features:

- It is a zero minimum balance (ZMB) account.

- These are used for direct, automatic credit of salaries every month by the employer.

- These accounts often include helpful services like free personal accident insurance, lower interest rates on personal and home loans, etc.

- Holders receive standard banking facilities from these accounts.

Importance of a Salary Account

A salary account simplifies the financial connection between an employee and their employer. It also offers benefits that regular savings accounts may not provide, like simple payroll management, financial convenience, cost savings, building regular credit history and other helpful services.

Best Mutual Funds for 2026 Backed by Expert Research

4. Basic Savings Bank Deposit Account (BSBDA)

It is a special savings account mandated by the RBI (Reserve Bank of India) to promote financial inclusion in the country. This service offers simple banking options for everyone, especially for people with low incomes. Key features of these accounts are:

- It does not require a minimum balance or complicated paperwork.

- All BSBDA holders are provided with essential banking services for free.

- Deposits are generally free in these accounts, but withdrawals are charged after a set limit.

- You can open this account using simplified KYC documents, even if you do not have all the official paperwork.

- An individual cannot hold any other savings account in the same bank where they hold a BSBDA.

Importance of a BSBDA

The BSBDA is very important for the social and economic structure of a country like India, as it provides financial inclusion for economic growth. It offers a secure savings option for low-income individuals and offers Direct Benefit Transfers (DBT) from government programs.

Investment and Special Purpose Accounts

1. Fixed Deposit Account

An FD is one of the most popular and safest investment options available in India. Banks and financial institutions offer it. It is a type of term deposit, in which you put a lump sum of money in the bank for a set period. In return, the bank pays you interest at a guaranteed rate. Here are some features of FDs:

- The interest rate is fixed at the time of opening the account and remains unchanged.

- FDs offer assured returns and you can choose a deposit tenure that suits your goals.

- Interest payments can be paid out regularly (like monthly) or you can have them added to your principal and paid out all at once at maturity.

- Account holders can take loans against their FDs.

Importance of a Fixed Deposit Account

The fixed deposit is a vital component of personal financial planning. It is highly suitable for retirees or individuals who need a steady, predictable source of income and it gives higher returns than savings accounts.

2.Recurring Deposit Account

An RD account allows people to deposit a fixed amount every month for a set period, similar to SIP investments in mutual funds. It combines features of a savings account, where you make regular contributions and an FD, which has a fixed term and interest rate. The key features are:

- The interest rate on an RD is usually the same as that of an FD.

- RDs have a flexible tenure, based on holder’s goals.

- At the end of the chosen tenure, the returns are guaranteed.

- They have a low minimum investment amount.

- Similar to FDs, you can sometimes take a loan against your RD.

Importance of a Recurring Deposit Account

A Recurring Deposit account is a valuable tool for managing personal finances because it helps you save money in a disciplined way. They are very safe and offer guaranteed returns. It does not require a lump sum and can be opened with small monthly contributions.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

3. NRI Accounts

These accounts allow NRIs (Non-Resident Indians) to manage their money, investments and money transfers to India while they live abroad. To comply with Indian banking laws under the Foreign Exchange Management Act (FEMA), you need to open specific types of accounts and each one has a different purpose. The following are the types of NRI accounts and their features:

| Features | NRE (Non-Resident External) Account | NRO (Non-Resident Ordinary) Account | FCNR (Foreign Currency Non-Resident) Account |

|---|---|---|---|

| Purpose | To manage foreign earnings in India. | To manage income earned in India (rent, dividends, etc.). | To hold deposits in foreign currency. |

| Currency | Maintained in Indian Rupees (INR). | Maintained in Indian Rupees (INR). | Maintained in a major foreign currency (USD, GBP, EUR, etc.). |

| Taxability in India | Tax-free (both principal and interest). | Taxable (interest is subject to TDS). | Tax-free (both principal and interest). |

| Repatriability | Fully and freely repatriable. | Limited (up to USD 1 million per financial year for the principal, after tax). | Fully and freely repatriable. |

| Joint Holder | Only with another NRI or a resident relative on a "former or survivor" basis. | With an NRI or a resident Indian (close relative). | With another NRI or a resident relative on a "former or survivor" basis. |

Importance of an NRI Account

NRI accounts are essential for Indians living abroad, as they become NRIs. They also allow for smart investments in mutual funds, stocks through the Portfolio Investment Scheme (PIS) or real estate. NRI accounts are simple, secure and smart options for NRIs.

4. Demat (Dematerialised) Account

It is a secure electronic account that holds financial securities like shares, bonds, government securities, mutual fund units and ETFs (Exchange-Traded Funds). In India, if you want to trade or invest in shares on exchanges like the NSE and BSE, you must have a Demat account. The following are the features of a demat account:

- It changes physical share certificates into an electronic format.

- It is mandatory for trading on the Indian stock exchanges.

- A single Demat account can hold various types of securities, like shares, Mutual Funds, etc.

- Corporate actions such as bonus issues, stock splits, dividends and rights issues are automatically added to the balance of a Demat account holder.

- You can take a loan against the securities held in this account, for instance, a loan against mutual fund.

- Shares can be easily transferred between different Demat accounts.

Importance of a Demat Account

It eliminates the physical risks like delays in transfers, theft, fraud, etc. It offers real-time trading with minimal fuss and reduced transaction costs. It serves as the central hub for nearly all types of capital market investments.

Now, let us know which bank account will be perfect for you for managing your finances in 2026 in the next heading.

Also Read: Buy Now Pay Later Explained (2026) – Benefits & Hidden Risks

Start Your SIP TodayLet your money work for you with the best SIP plans.

Which Bank Account in India is Right for You?

Choosing the right bank account in India depends entirely on your specific financial needs, lifestyle and goals. But, you can take the below given advices to select the best one in 2026:

-

For Daily Banking and Savings

For this purpose, a savings account is the ideal choice, as it is the standard account for personal use. If you are a low-income individual or a student, you can also go for a BSBDA.

-

For Salaried Professionals

If you have a regular monthly income, you can choose a salary account. These accounts are like regular savings accounts but come with extra benefits and offer better rates on types of loans.

-

For Businesses and High Transactions

If you deal with many daily transactions, a current account would be best for you, as this account allows unlimited transactions and has higher withdrawal limits.

-

For Long-Term Investment and Guaranteed Returns

If your goal is to grow your savings for a future goal with guaranteed returns and low risk, go with an FD or RD account. Both of these options give better rates than a savings account.

-

For Investing in the Stock Market

If you plan to buy shares, bonds or mutual funds, you need a specific type of account to hold those digital assets. The account is a demat account, which is a digital locker for your investments.

-

For Non-Resident Indians (NRIs)

If you live abroad but need to manage finances in India, your option is an NRI account, like NRE, NRO or FCNR Account.

Smart Investments, Bigger Returns

Conclusion

Wrapping up, different types of bank accounts serve the different financial needs of various people in India. Choosing the right bank account in India, whether in public banks' savings accounts or private banks' salary accounts, depends on your specific needs.

As rules become stricter and UPI makes payments easier, it is essential to choose a suitable account for managing your money. Look at interest rates and pick the one that matches your goals.

Related Blogs:

- Top Credit Rating Agencies in India: Why They Matter?

- Top 10 Foreign Institutional Investors in India You Must Know

FAQs

-

Which bank account earns the highest interest?

Fixed Deposits (FDs) and Recurring Deposits (RDs) earn you the highest interest at 6-9% per annum, way above savings accounts' 3-7%.

-

Can I open a savings account online in 2026?

You can complete video KYC using bank apps like SBI YONO, HDFC and ICICI. You will need your Aadhaar number and PAN card.

-

Can NRIs open FD or Demat accounts?

NRIs use NRE and NRO accounts for fixed deposits to earn higher interest rates. They also use PIS-linked Demat accounts for investing in stocks.

-

Can I have multiple savings accounts?

Yes, you can have multiple savings accounts across various banks. But only one BSBDA per bank.

-

FD vs RD: Which is better for saving ₹10k/month?

RDs work well for regular deposits, like SIPs, while FDs are better for lump sums. Both options are safe and offer guaranteed returns.

.webp&w=3840&q=75)