New Budget 2024 has made its great entrance into the financial industry by taking the headlines of every news channel. This new interim budget has sparked a lot of talk and speculation. It's shining a spotlight on economic development and the well-being of Indian society, it's essential to consider its potential impacts on various sectors, including Mutual Funds. Let's dive into this interim budget, see how it's making waves, and check out some important points.

What is interim budget?

The interim budget is a short-term financial plan created by the government in an election year until a new government takes over. It outlines the government's plans for spending money and generating revenue for a brief period. This budget provides a temporary overview of the government's financial decisions until the new government presents a detailed and complete budget. However, it covers government spending, income, fiscal deficit, and financial performance for a few months.

The Union Budget, on the other hand, is the government's annual financial plan that includes its planned costs and expenditures for the coming fiscal year.

Key highlights of budget 2024?

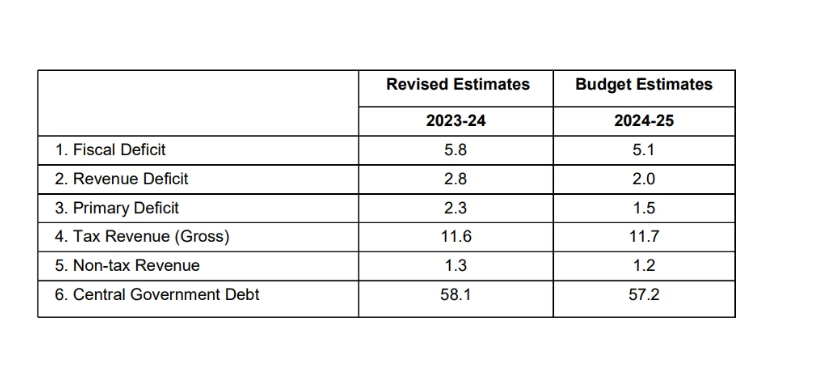

On February 1, the Union Finance Minister Nirmala Sitharaman presented the interim budget ahead of the general elections later this year. The budget focused on empowering youth and women while maintaining fiscal consolidation and continuing capital expenditure. The Finance Minister lowered the fiscal deficit target for FY25 to 5.1% of the GDP. No changes were made to the direct and indirect tax rates.

PM Kishan Sampardha Yojna: This scheme benefited 38 lakh farmers, providing them with profitable outcomes.

DBT Using PM Jan Dhan Accounts: Direct Benefit Transfer (DBT) of Rs. 34 lakh crore using PM Jan Dhan accounts resulted in significant savings for the government.

Fisheries Department: A separate department for fisheries was set up, leading to a doubling of seafood exports from 2013-2014.

Matsya Sampada – (PMMSY) PRADHAN MANTRI MATSYA SAMPADA YOJANA.: The Matsya Sampada-PMMSY initiative aims to enhance aquaculture productivity, targeting a double export to Rs.1 lakh crore.

Employment Opportunities: The budget aimed to generate 55 lakh employment opportunities.

Lakhpati DIDI: With 83 lakh Self-Help Groups (SHGs) and 9 crore women, the rural socio-economic landscape is transforming. The target for Lakhpati DIDI is increased from 2 to 3 crore.

Railway Projects: Projects identified under PM Gati Shakti aim to improve logistics efficiency and reduce costs.

Increase in Standard Deduction: Taxpayers are anticipating potential income tax relief, including a possible rise in the standard deduction.

HRA's Expansion: There is a demand to expand House Rent Allowance (HRA) to 50% for cities like Bangalore and Hyderabad, considering their high cost of living.

Caps on Home Loan Interest Deductions: The budget might propose an increase in the maximum amount of interest deductible from a buyer's mortgage.

Assistance for New Home Purchasers: The budget may introduce new incentives or enhance existing ones to facilitate first-time home purchasers.

GST Off on Building Supplies: Homebuyers and developers are hoping for a reduction in GST on building supplies, which could lower the overall cost of dwelling

What is the New Budget's impact on the economy and sectors?

The new budget of a country plays a significant role in the growth of the economy. It sets out the government's spending plans, which can boost the economy by investing in areas like infrastructure. The budget also determines the fiscal deficit, which is the difference between what the government spends and what it earns. A higher deficit may lead to more borrowing, potentially affecting interest rates and the overall stability of the economy.

The budget also allocates resources to different sectors such as healthcare and education, shaping the development of industries and creating job opportunities. Tax policies outlined in the budget also influence consumer spending and business investments. Changes in tax rates and structures can impact how much people spend and how much businesses invest in their operations.

Moreover, the budget's decisions on government spending, taxation, and borrowing can affect inflation levels and investor confidence. These factors, in turn, influence economic activity by shaping how much people and businesses are willing to spend and invest.

- The Indian economy has witnessed a profound transformation in the last 10 years.

- The budget will empower the four pillars of developed India, namely the young, poor, women, and farmers.

- This is a budget for creating India’s future and is a reflection of the aspirations of a young India

- Budget empowers the poor and middle class and will create countless employment opportunities for youth

- The “historic" budget has also offered rebates for start-ups.

- It has provisions for a huge capital expenditure of ₹11.11 lakh crore while keeping the fiscal deficit under control

What is the impact on the budget and market sector?

The budget can affect the stock market in several ways. When the government introduces new policies, it can impact specific industries and companies, causing their stock prices to go up or down.

The budget announcement also affects how investors feel – it can make them optimistic or uncertain, leading to changes in stock prices. Different parts of the economy may be affected differently by the budget, with some industries benefiting from good policies and others facing challenges.

The budget's impact on interest rates is also important because it can change how much it costs for companies to borrow money, which can affect their profits and stock prices. Lastly, if the budget introduces new rules for foreign investment, it can influence stock prices, especially in industries where a lot of foreign investors are involved.

The budget also allocates resources to different sectors, such as healthcare and education, which can shape industry development and employment opportunities. Tax policies in the budget can influence consumer spending and business investments by changing tax rates and structures.

Conclusion

The interim Budget 2024 has created a buzz in the financial world, putting the spotlight on economic development and societal well-being. With key highlights including initiatives like PM Kishan Sampardha Yojna and Matsya Sampada-PMMSY, the budget aims for inclusive growth and job creation.

Its impact on the economy involves strategic fiscal measures, setting the stage for growth by addressing sectors like healthcare and education. Changes in tax policies, interest rates, and foreign investments also add complexity to its influence on the stock market.

Investors, particularly in mutual funds, are keenly observing potential benefits, such as income tax relief and incentives for homebuyers. As we navigate this economic landscape, a Systematic Investment Plan (SIP) in mutual funds could offer a disciplined approach to wealth creation.

In essence, the interim Budget 2024 is not just making headlines; it's a pivotal discussion point with the potential to shape India's economic path.